Impact of Coronavirus on eCommerce: Online Engagement Still High As Many Sectors Record small decline of Traffic and Transactions (Update 15)

Our team has been computing billions of user sessions over the past 16 weeks to share insights into how the unfolding Coronavirus crisis is impacting consumer behaviors across industries. Every week we look at traffic, transactions, and engagement data and compare the numbers with averages from the period immediately preceding the beginning of social distancing and quarantine in the West (or, the first 6 weeks of the year, which we call the reference period).

Here are some of the insights we surfaced this week:

Traffic And Transactions Go a bit Down But Online Engagement Remains Strong

After a stable first week of June, eCommerce traffic and transactions dropped slightly this past week, with -4% fewer visits and a -3% decrease in transactions from the previous week. As stores reopen their doors to customers around the globe, digital customer engagement appears to be slowing down. Despite this, online consumer activity is still much, much higher than before the onset of the crisis, prompting many businesses to invest heavily in their digital operations.

The greatest increase in the volume of digital transactions is observed in the UK, where businesses are bringing in on average +67% more online sales than pre-Covid. In the US, this figure is +27%.

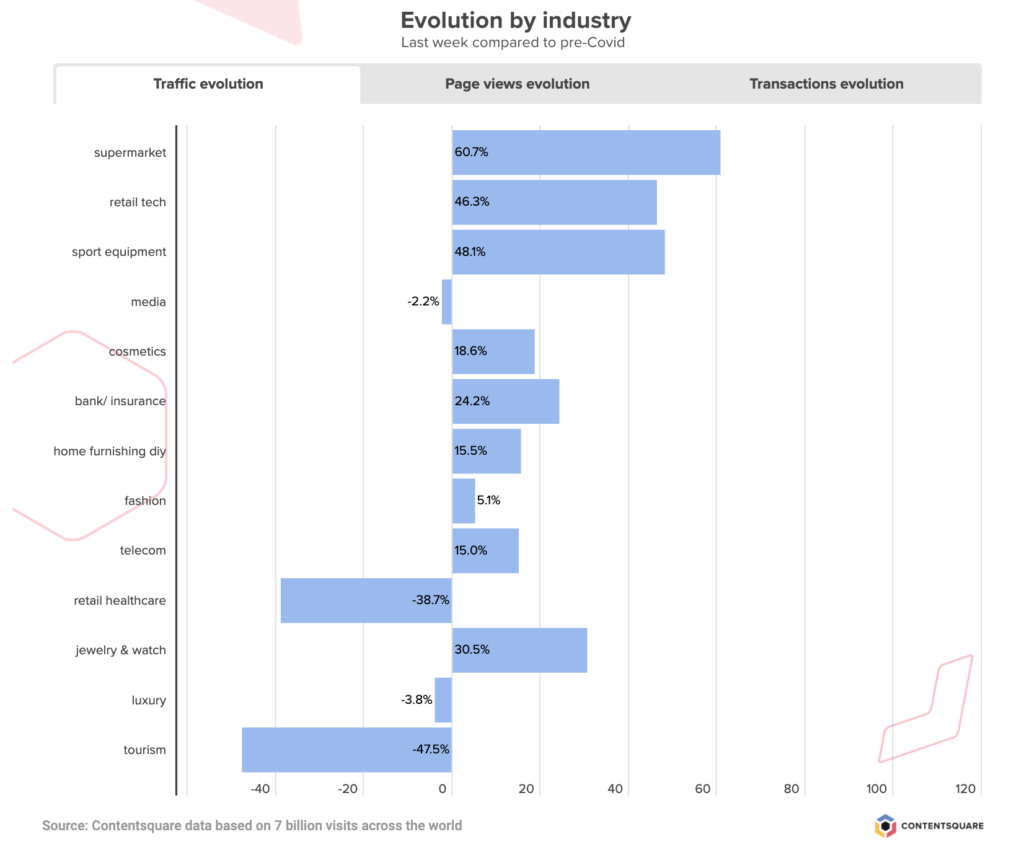

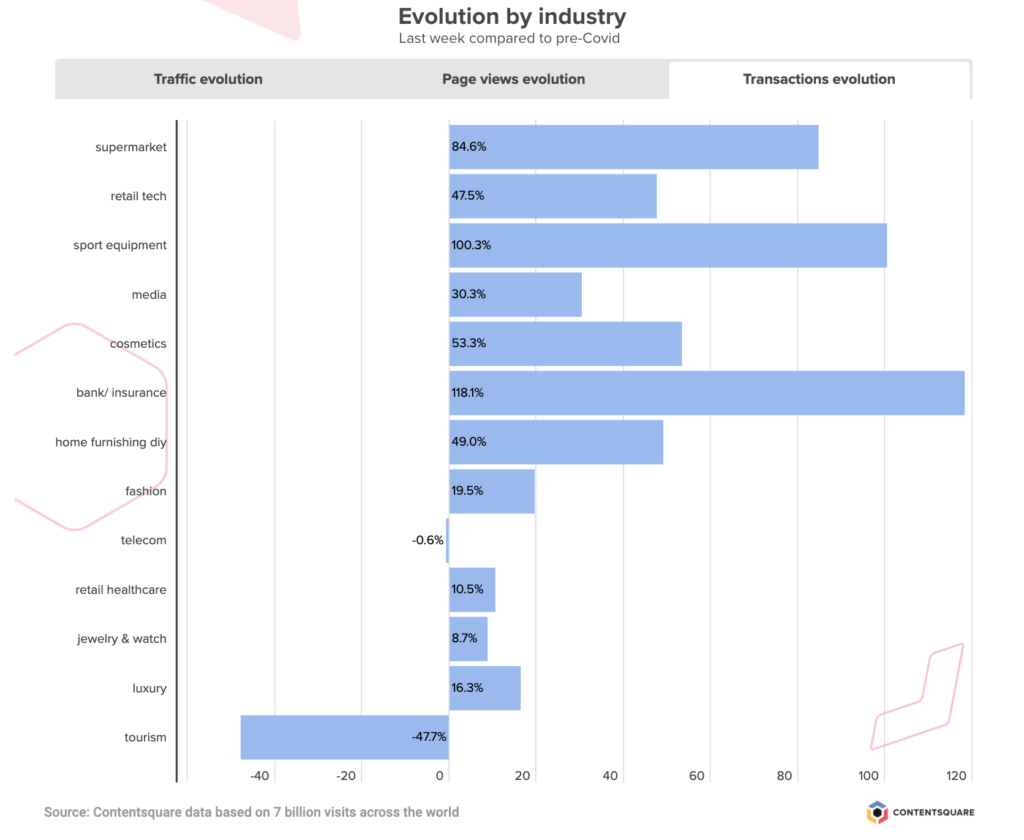

According to our latest data pull for the week ending 6/14, brands across industries are seeing on average +10% more digital traffic than they were back in January, and +33% more online transactions. Some industries — for example, sporting goods retailers or online supermarkets — are even seeing double the amount of transactions they are used to seeing. Other industries, such as travel, are of course dealing with the negative business impact of the pandemic, although recent weeks show positive — if slow — signs of recovery.

Online Grocery Sector Slows Down But Remains Stable in US

After an initial surge which saw regular volumes of traffic increase x3, the grocery industry continues to experience a slow but steady traffic decrease across the board (-10% drop this past week), although the breakdown by country tells different stories of consumer reliance on online grocery shopping.

The UK shows a pretty vertiginous drop since peak traffic at the end of March (from +440% down to +220% pre-Covid traffic levels), while the US has seen stable levels of digital engagement since the first week of April. Overall, traffic to grocery sites is still +61% higher than pre-crisis and the volume of transactions is +85% higher.

Consumer Electronics Sector Sees Slight Drop in Traffic And Sales last week

On the heels of two weeks of quick growth (traffic + transactions), consumer electronics retailers experienced a bit of a slowdown this past week, with traffic declining by -6% this past week and sales going down by -11%. Still, the sector as a whole is recording +46% more traffic than before the start of the pandemic, and +47% more transactions.

In the US, consumer engagement in this sector has been steadily going down since late April, with surges in the UK and France majorly impacting growth.

Tourism Still On The Up And Healthcare Retail Sees Gains Too

After taking the biggest hit of all industries, the travel and tourism sector continues to see its customers’ digital activity climb, with +7% more traffic this past week compared to the last, and +11% more transactions. These recent increases mean the industry as a whole is now closer to half its pre-Covid traffic and transactions levels — although it is important to note that our reference period, in January, would have different averages than during peak season.

While traffic has remained steady in the US since end of April, transactions have been steadily climbing for the past 7 weeks, reflecting greater consumer confidence when it comes to booking travel. Sites selling camping trips continue to see the greatest increases across all sub-sectors — both in traffic and conversions.

Meanwhile, last week was a strong week for Healthcare retailers, with +22% more traffic to these platforms and an impressive +68% increase in transactions.

Have you registered for Summer Camp yet? We’ve put together a six-part series for adventurous experience-builders looking to capitalize on the summer months to fast-track their digital transformation. Join us for six campfire sessions with digital leaders from Tile and other leading brands, to explore common digital challenges and how best to tackle them (A/B Testing merit badge, anyone?).