Take a product tour

Get to grips with Contentsquare fundamentals with this 6 minute product tour.

Will Langdon-Davies, Senior Digital Personalisation Manager at TSB, spoke at our recent CX Circle about website analysis and shared why the ‘so what’ factor is so important in personalizing customer experiences.

When Will was tasked with a key project of redesigning the home and product pages of TSB, he had a clear vision in mind: to give customers the confidence to choose the right product, make information more accessible, and improve conversion through better UX.

“Financial products can be slightly complicated. The way the pages flow together, the way information is shown is really important,” he says.

The project kicked off with three main objectives:

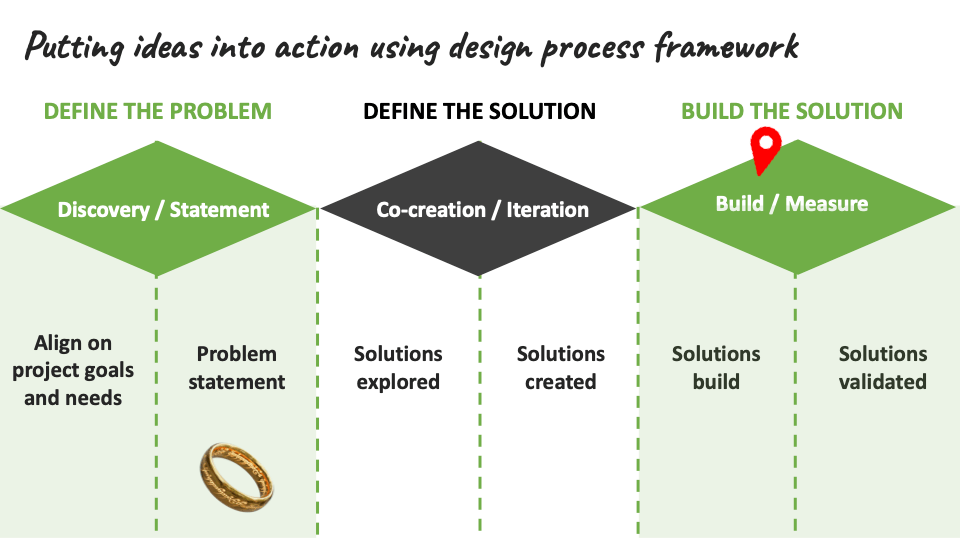

“We put our ideas into action using a simple design process framework: define the problem, define the solutions, and build the solution. None of this is rocket science, but it helps to use a framework to align on project goals and needs.”

Will explains that discovery was a key step in the website transformation, to truly get in the minds of customers and understand the pain points. This is where you put in a lot of time and effort looking at your behavioral analytics, what your customers are doing on your website, what potential customers are searching for. Where’s the customer getting stuck or going round in circles?

“For us, our problem statement was identifying pain points on our public website – where customers had a lot of friction and couldn’t find what they needed to, they’d fall out of the journey.”

To deliver the right insights and customer experiences, TSB teamed up with CX agency, REO Digital, and Contentsquare.

Will says that one of the most fundamental learnings was how critical analysis is in a website redesign. “This is where working with people like REO and Contentsquare really helped us to answer the ‘so what’. It’s easy to put loads of information together, but to turn that into data that informs is the skill.”

He explains that this partnership was crucial to understanding both customer behaviors and what competitors were doing. Customer insights were derived using key performance metrics using website heat maps, understanding what they were seeing above or below the fold, discovering if the CTA was clear enough, and also looking at the funnel and identifying where the problems were.

With competitor analysis, Will asserts that it did not necessarily mean looking at the same digital spaces as other banks.

“It’s not to copy your competitors. We do care what our competitors are doing because it gives you a flavor of what your customers might expect. But what we found is that people are selling an experience, not a product. Certainly, in financial services, as products become more difficult to differentiate, they are selling the brand, the experience, what it feels like to be a customer of theirs as opposed to specific products.”

Catch up on their presentation on our CX Circle recap page

According to Will, a website makeover is not the last stop in converting new customers and delivering better user experiences. Frequent user testing and optimization are core elements of online customer journeys. Will says it is vital that a testing and optimization plan is kept ready because “once you’ve finished, keep testing. It may not always turn out how you want it to.”

He explains that moderated user testing was probably the most powerful of all the things they did.

“Whatever industry you are in can always be a bit of a bubble. People always speak the same language in financial services, you have all these acronyms and ways of thinking. But when you talk to real customers, it is amazingly powerful when you hear about their financial concerns, the things that scare them, things they wish they had known about a financial product. That’s when you can really take the human element of what you’re trying to do.”

Engaging stakeholders early was another key success factor in the transformation project, especially for a regulated industry such as financial services.

“Taking our stakeholders, such as the compliance team, on our journey with us was super important. The way we talk about our products is very prescriptive – we have many regulations to adhere to which adds friction and makes it more complicated for customers to understand. Ultimately what we are trying to do is improve our CX, present the product with the right information, so customers can make the right decision.”

Contentsquare’s powerful visualization tool can help map your customer journeys and identify anomalies such as looping behaviors and where unexpected drop-offs occur. See how visitors progress through your site, page by page, from entry to exit. Take a product tour see how easy it can be to perform a website analysis to identify and quantify your customer journeys.

Take a product tour

Get to grips with Contentsquare fundamentals with this 6 minute product tour.

TSB is a major retail and commercial bank established in the United Kingdom

www.tsb.co.uk

REO Digital is a leading CX agency specializing in UX, Design and Experimentation

www.reodigital.com