FinServ Digital Experience Benchmark Report

Get the insights you need to deliver better, more human, digital experiences.

In July 2022, the UK’s Financial Conduct Authority (FCA) released the new Consumer Duty, which aims to put customers at the forefront of FinServ products and services. For many firms, this means slight tweaks in their customer experience, product or services. However, for some, it will require more time and resources to become fully compliant.

To find out where FinServ brands are in their compliance journey, we asked attendees at a Contentsquare FinServ event in October whether or not they had already started preparing for the regulations. Surprisingly, only 23% had either started preparations or internal discussions, while 35% of attendees said they hadn’t started and a whopping 42% weren’t even aware of the new Duty.

In this blog, we’ll cover the basics of FCA’s new Consumer Duty and dive deeper into how digital experience analytics can help firms with preparations and compliance.

FinServ Digital Experience Benchmark Report Get the insights you need to deliver better, more human, digital experiences.

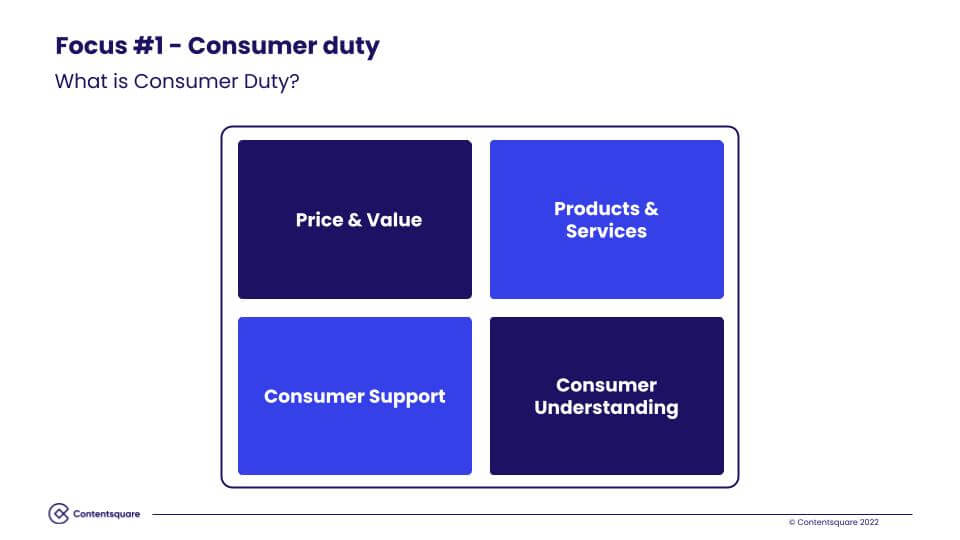

Consumer Duty is a new principle set by the FCA to help firms build better consumer experiences. It sets “higher and clearer” standards to protect FinServ consumers, requiring businesses in the industry to prioritize their needs.

According to Sheldon Mills, FCA’s Director of Consumers and Competition, due to the current economic climate, enabling consumers to make solid financial decisions is “more important than ever before”. In a recent speech delivered at the Consumer Protection in Financial Services Summit, he said that the Duty will require all firms “to put their customers first” by providing the correct information and support. Financial firms must comply with regulations by 31 July 2023 on both existing and new products.

The FCA’s rules outline four outcomes relating to the following elements; price and value, products and services, consumer support and consumer understanding.

During the Contentsquare FinServ event held in October 2022, one of the main requirements highlighted was ensuring that firms provide helpful and accessible customer support. Angelique Joly, Financial Services Regional Director for UK and Ireland at Contentsquare pointed out the importance of optimizing the customer journey. “Firms need to ensure that their messages are adapted to each customer and their needs at each point of the customer journey,” says Angelique.

When it comes to products and services, the key is to enable customers to “cancel or switch financial products as easily as it was for them to first apply for it,” explains Angelique.

Ensuring customer understanding means providing easy-to-understand and timely information about both products and services. Angelique shares what this could mean in practice, “For example, firms must make sure that terms and conditions are explained clearly and not hidden from customers as they go through their journey online.”

In his speech about what firms and customers can expect from the new Consumer Duty, Sheldon Mills, Executive Director, Consumers and Competition at the FCA said:

“It’s more important than ever to ensure they have key product information, such as features and charges, easily accessible and understandable. This is about the consumer journey, the digital user experience as well as the disclosure of contract terms.” — Sheldon Mills, Executive Director, Consumers and Competition at the FCA

Not only does digital experience analytics (DXA) enable FinServ firms to understand how customers navigate through their website or app but also why experiences work (or don’t). Contentsquare’s experience insights help to identify friction and instantly surface new opportunities to improve the customer journey, enabling their customers to make smart financial decisions.

By enabling firms to see where customers struggle online, DXA can support firms to prepare and comply with the new Duty. Capabilities like Session Recording allow service teams to actively assist customers if they’re stuck. For example, suppose a customer encounters an issue while signing up for a new account. With DXA, your support team can review their online journey to understand exactly where they struggled, then help them complete their intended action. They can also pass this information back to their digital team to ensure it doesn’t affect other customers in the future.

Data retention plays a key role in compliance as well. The new Duty outlines that firms must “collect information to monitor the outcomes that their customers are receiving” and “provide evidence of their monitoring and assessment of these outcomes and any resulting action, on request”. With Contentsquare, firms can optimize their data retention and easily provide evidence of compliance. “Our FinServ customers can provide access to the platform across teams to ensure the data can be shared and stored in the right way,” says Angelique.

During the Contentsquare FinServ event, Tommi Kerr, Digital Experience Lead at Natwest, shared how their team is preparing for the Duty. “We have Contentsquare to help us with compliance. We want to focus on how to put it at the front and center of our testing strategy to see where we can learn and experiment more.“

Richard Carter, Customer Data and Interactions Optimization Manager at DirectLine Group, added how their recent implementation of the EU’s Insurance Distribution Directive (IDD) had laid the groundwork. The IDD is about “asking the customer the right questions to determine what they need and what they don’t,” says Richard. He shares that implementing IDD should “hopefully put us in a better position to address Consumer Duty.” Using digital experience analytics is not only going to help firms execute requirements set out by the FCA, but also ensures a customer-driven approach across their digital space.

By using digital experience insights, HSBC improved customer understanding on their current accounts pages across their brand’s sites. Initially, they noticed that customers weren’t spending time reading the Terms and Conditions (T&Cs). To ensure a better level of awareness, first direct’s (a division of HSBC) T&Cs were summarized into six key points with the option to read all. Customers now have a clearer understanding of terms without being overwhelmed with heavy legal text.

Transforming Digital CX in Finserv Hear from Natwest and Direct Line Group on their digital transformation journeys.

Although the regulation will only be enforced next summer, firms must start preparations now. Morgane Veaute, Senior Customer Success Manager for Financial Services at Contentsquare, gives the following actionable advice for firms;

“You need to avoid implementing changes right before the Duty is enforced because you’ll want to go back and compare data from a few months before. To do this, you need to start preparing now. Having solutions like Contentsquare Session Replay in place will help, but also thinking about data retention.” – Morgane Veaute, Senior Customer Success Manager for Financial Services at Contentsquare

To find out how Contentsquare can help you prepare and comply with the FCA’s new Customer Duty and provide a customer-driven, accessible digital experience, book a demo with one of our FinServ experts today.

Get a demo Request a personalized demo with a digital experience expert!