Preview the customer experience (CX) metrics covered

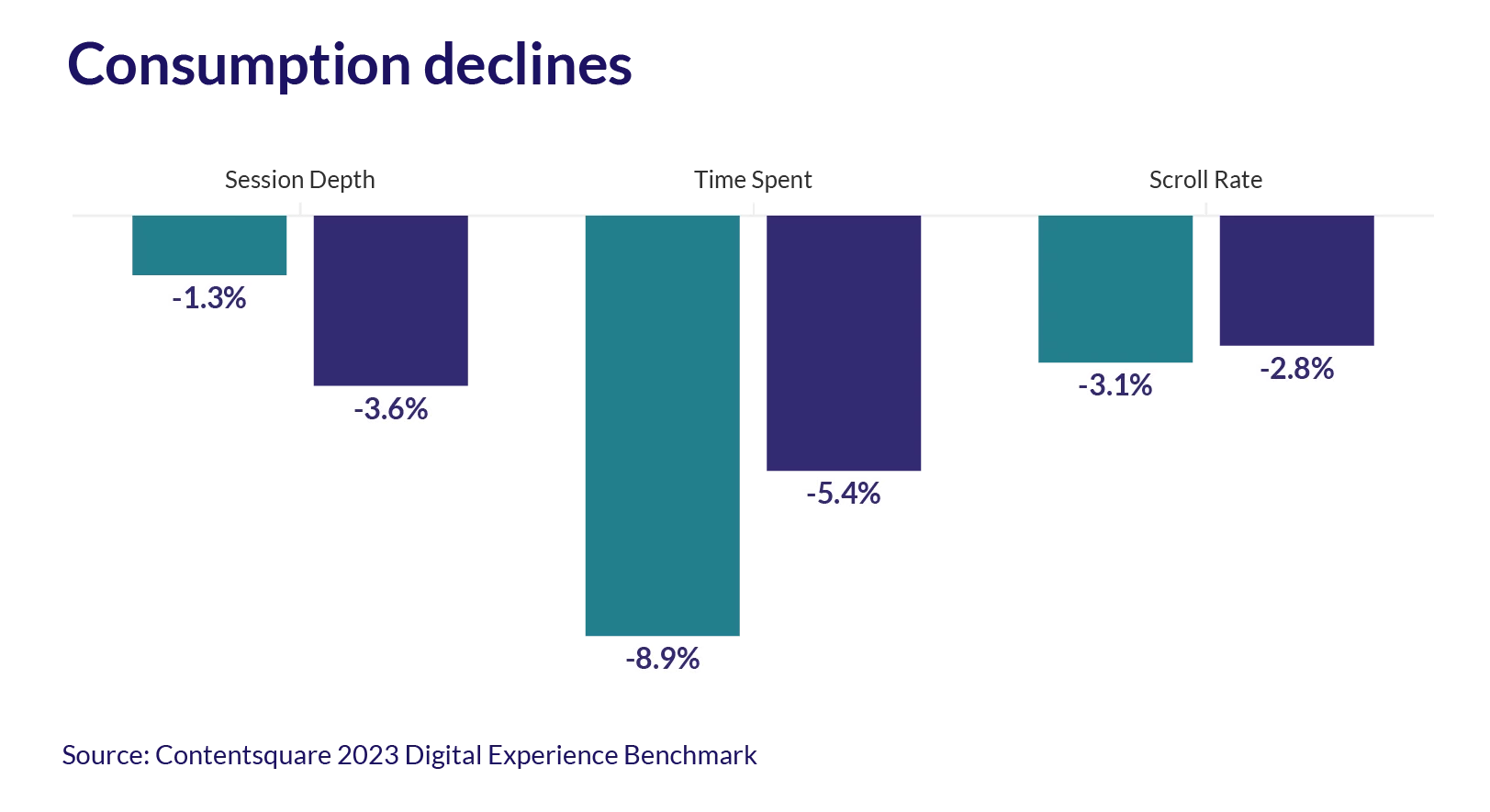

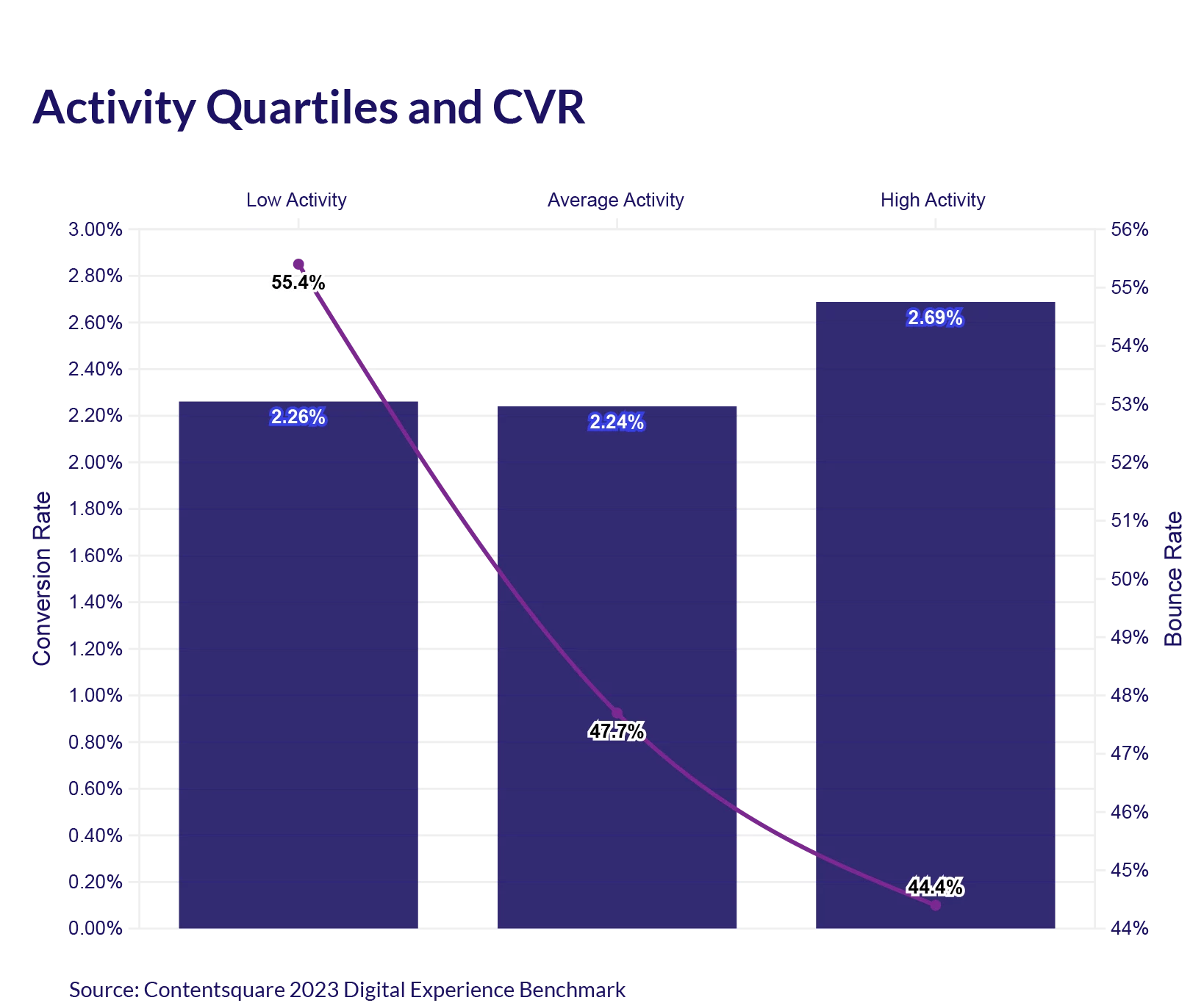

The digital landscape saw a mix of results in 2022, with traffic showing an upward trend of 5%, while user conversions experienced a slight dip of 3%. The key to CX success? Understanding the customer journey. The 2023 Digital Experience Benchmark explores the entire user experience to help you optimize experiences, convert customers and fuel growth.