Impact of Coronavirus on eCommerce: Consumers Settle Into Quarantine (Update 4)

As more and more cities and regions across the world adopt lockdown and shelter-in-place measures, digital consumer patterns are once again shifting to reflect new needs and ways to adjust to an altered reality.

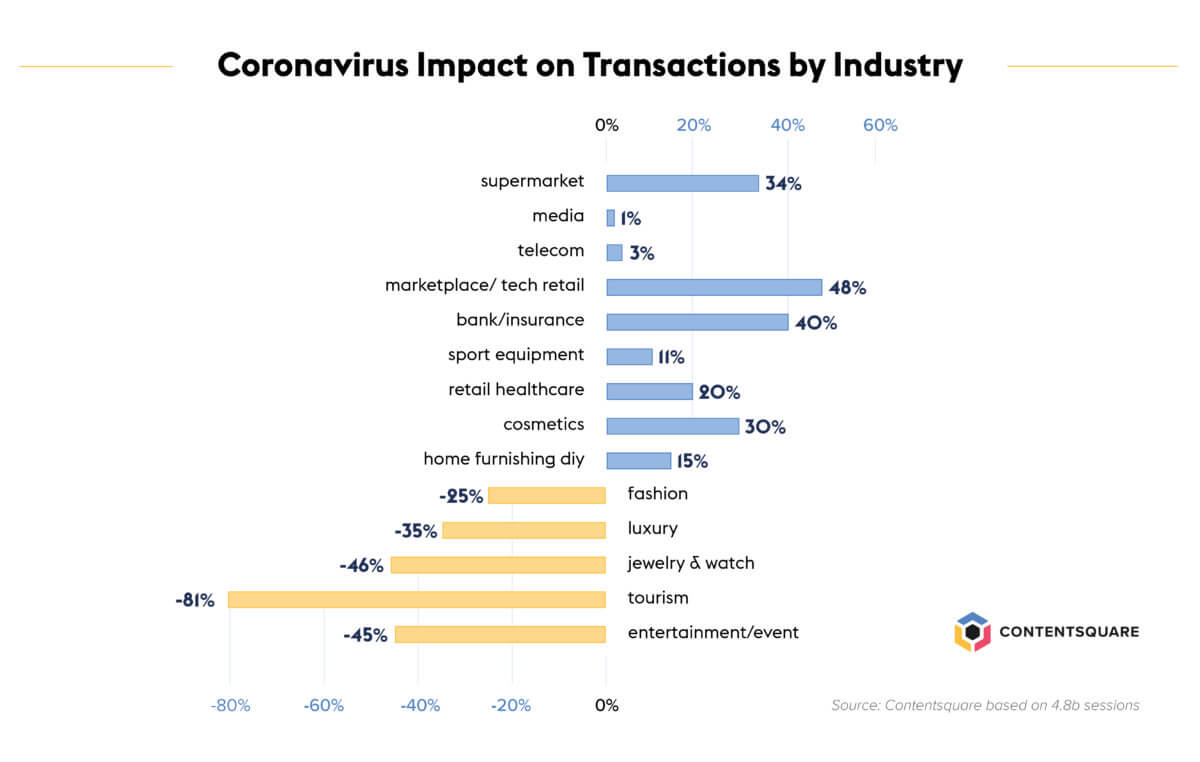

We’ve been analyzing billions of user sessions every day to bring you week-by-week updates on global browsing behaviors across industries. We have broadened our approach to include more than 4.8 billion sessions and 23 billion page views over the last 12 weeks of 2020, from January 6th 2020 to March 23rd 2020. To understand how the fast-evolving situation has impacted global eCommerce, we’ve compared recent weeks to the period immediately preceding the global reporting of the outbreak (or, the first 6 weeks of the year which we call the reference period).

In last week’s update, we referenced American psychologist’s Abraham Maslow’s hierarchy of needs, illustrated as a pyramid, with the lower tiers covering the most basic of needs, including food, safety, social needs etc. What we observed this week is that, after focusing their efforts on securing the most basic of needs such as groceries, health products and financing, consumers have been shifting their online activity to focus on items and services that will help get them through an extended period of isolation.

Online Grocery Stores Struggling To Keep Up With Demand

Traffic to online grocery stores shot up +84% in the last week, contributing to an overall +161% increase in visits since February16. The number of transactions, however, was down -15% last week, in stark difference to the 32% increase recorded the week before. We have observed that in many countries, as consumers increasingly turn to online supermarkets to keep their pantries stocked, delivery slots are running low and some products are unavailable, resulting in a higher number of abandoned carts. At the extreme, in the UK, supermarket chain Iceland has restricted online shopping to “over state pension age, self-isolating and other vulnerable people.”

Retail healthcare clocked in a steady number of visits in the last week but significantly fewer transactions (down -35%), suggesting consumers may have already stocked up on essential medical supplies, vitamins, etc. to last them for the weeks to come.

As some grocery and retail healthcare players experience supply chain issues, it is worth noting that transactions on cosmetics websites were up last week by +33% from zero the previous week. Many beauty players have indeed decided to refocus their offering, with much success, on necessities such as soap and hand cleaning products.

Consumers Get Equipped To Stay Indoors

With a huge part of the workforce now officially in WFH mode, and a great number of children switching to e-learning, many consumers spent some time this week upgrading their hardware. Tech retail sites recorded a +20% increase in traffic in the last week — higher than the total jump in visits since February16 (+15%). The sector also recorded a higher number of purchases than any other week we analyzed, with a +30% increase in transactions. As a comparison point, the week immediately preceding this one had shown no change in the number of transactions.

Visits to sites specializing in books and toys increased +25% in the same period — double the total increase since the start of the outbreak. As parents everywhere contemplated weeks of homeschooling and indoor play, the number of transactions followed suit, with a +140% increase in the last week only.

And despite a -2% dip in the number of visits, sports retailers saw a +30% increase in the number of transactions this past week, a significant increase compared to the changes recorded in previous weeks. As social distancing measures limit people’s ability to go to the gym or take part in group sports, consumers are making sure they have the right equipment to keep up with their fitness regime at home. This is true in particular in the US with more than 60M American members of a gym club now in need to work out from home!

Traffic to Media and Streaming Sites Peaks

Visits to TV/streaming sites went up +34% in the last week — almost three times the increase recorded during the previous week, and +43% since the start of the outbreak. Transactions for the sector doubled week on week, with a +108% increase over the previous seven days.

Media sites continue to record a weekly traffic increase (+24% this week), steadily adding up to a +80% increase since the start of reporting.

Connectivity has taken on a whole new importance in people’s lives over the last few weeks and the telecom sector is continuing to see its traffic grow. The +7% increase in visits to telecom sites this last week is half the spike in traffic observed three weeks ago, implying many customers have now made sure they are properly connected to weather the next few weeks or months.

Tourism and Real Estate Continue to Suffer

Following three weeks of relative stability and a slight dip two weeks ago, the real estate sector recorded a huge dip in traffic this past week — -46% compared to -52% since the beginning of the outbreak.

The travel and hospitality sector continues to experience a slowdown in traffic, which was down – 44% last week. Transactions were also down -67%, contributing to a decrease of -81% since the start of the crisis. Luggage sites followed suit, with a -42% decrease in visits — the biggest drop since we started our analysis.

Meanwhile, visits to fashion and luxury sites were down approximately -15% this past week, and apparel sites in particular saw a -8% decrease in transactions.

For a free walkthrough of the latest data, sign up for our upcoming webinar on March 31st, 1pm. Our CMO Aimee Stone Munsell will be sharing fresh verticalized insights in an effort to help experience stakeholders make sense of the impact we are all experiencing.

Keep Reading...