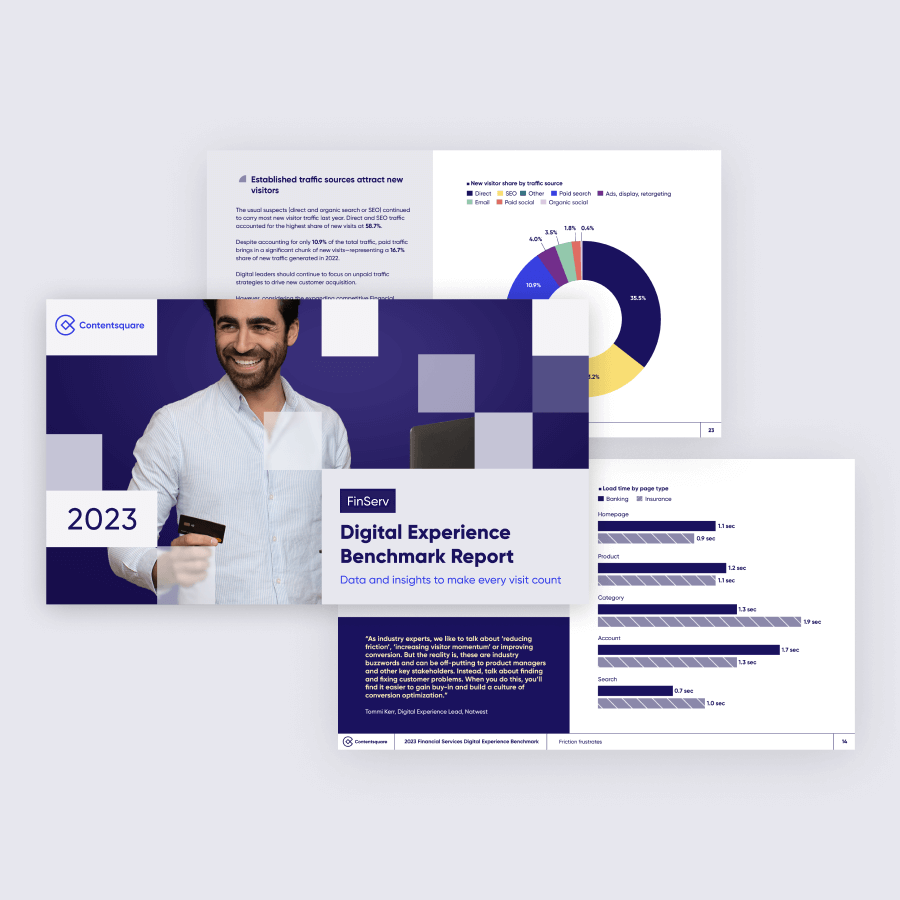

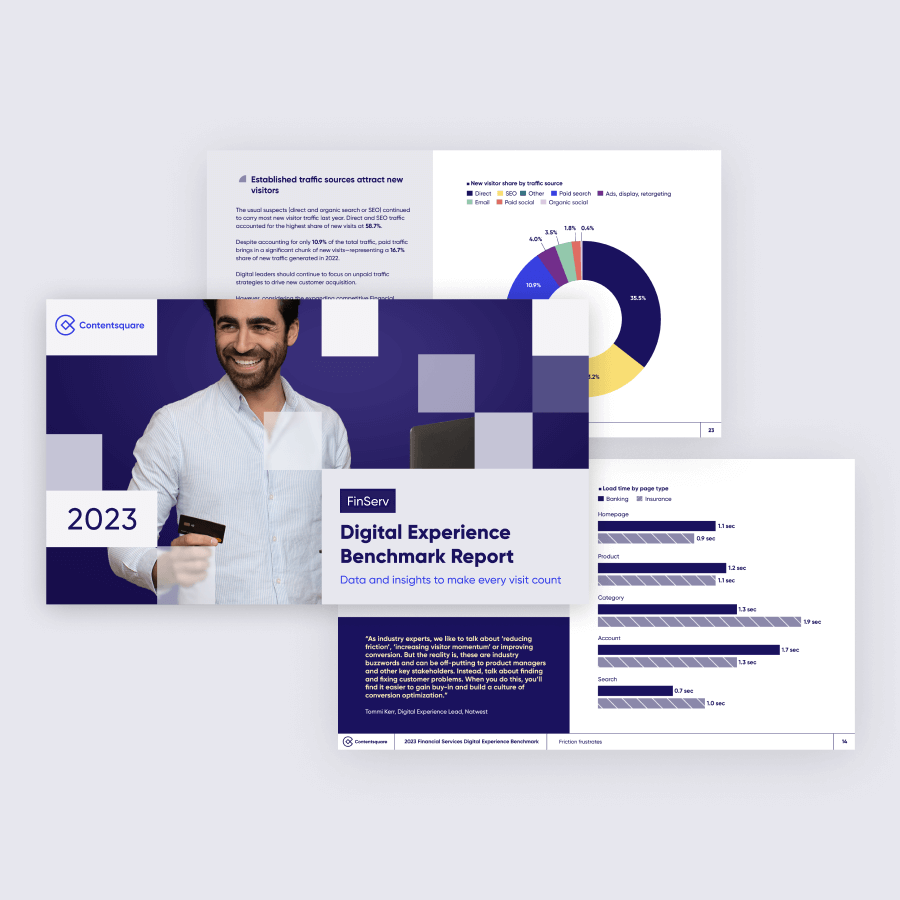

See how your digital experience stacks up.

Download the 2023 Financial Services Digital Experience Benchmark report.

Customer retention is one of the most urgent challenges facing financial services firms today. Consequently, customer retention strategies for banks and insurance providers are in high demand.

Of course, customer retention has always been valuable. Returning customers cost less to serve, have a higher lifetime value and are more likely to refer new customers your way.

In fact, according to a study by Bain and Company, FinServs who increase customer retention by a mere 5% can see a 25% increase in profit.¹

But in the current financial services market—highly competitive and technologically and economically disrupted—customer retention isn’t just great for business: It’s essential.

In our last article focusing on how financial services firms can optimize their digital customer experiences for growth, we gave readers a broad overview of findings from our Financial Services Digital Experiences Benchmark report.

In this article, we’ll share three customer retention strategies for banks and insurers to ensure you can continue to grow your customer base and business in today’s unstable, ultra-competitive market.

A recent Forrester survey reports that among direct banking customers who felt valued, 87% planned to stay with the brand.

Similar percentages planned to purchase more from the brand and advocate for the brand—and the numbers were even better for multichannel banking customers.

Bottom line: A valued customer is a loyal customer, and in this digital-driven era one of the most powerful ways to make them feel valued is to ensure you’re offering them an outstanding digital customer experience.

Now let’s talk about customer retention strategies that will help you do exactly that…

Customer retention hinges on emotion. Forrester writes: “Emotion—how customers feel about their experience—has a bigger effect on customer loyalty than the ease or effectiveness of the experience.”

In order for financial services firms to provide their customers with the best possible digital experiences, they first need to know how their customers feel about the experiences they’re already being offered—and what sort of experiences visitors to financial services sites feel really good about.

But it can be tough to get in touch. While FinServs often get to directly communicate with customers and find out how they’re feeling, whenever customers fail to leave feedback or get in touch with your contact center, their emotions will remain a mystery to you.

And what you don’t know can hurt you. So how can FinServs understand the emotions of their customers better?

Item one on their agenda should be to download the 2023 Financial Services Digital Experiences Benchmark report—which offers a comprehensive, metric-by-metric overview of how financial services site visitors felt about their experiences last year.

See how your digital experience stacks up.

Download the 2023 Financial Services Digital Experience Benchmark report.

That will get you off to a great start. But when it comes to accessing your site visitors’ emotions on a day-to-day basis, you’re going to have to invest in a digital experience analytics (DXA) platform.

Traditional analytics platforms show you how many clicks, bounces and conversions you’re getting. But these metrics (while vital), don’t show you how visitors are behaving between clicks, much less how they might be feeling at any given stage of your digital journeys.

A DXA platform like Contentsquare Digital Analytics Cloud can give you the metrical insights and investigative tools you need to understand not only how visitors are behaving when navigating through your site, but also why they’re behaving as they are.

A surefire way to make a customer feel valued is to treat them like an individual instead of a generic visitor. That’s why personalization is a vital.

Getting personalization right depends on data. You need to know as much about site visitors as possible so you can tailor your experience as closely as possible to their needs—including where they’ve come from to get to your site, what device they’re using to access your site, and whether they’ve been there before.

For a general picture of the traffic sources your customers are most likely to be coming from, the devices they’re most likely to be using and what percentage are most likely to be new or returning, you can refer to our Financial Services Benchmark report.

However, every company is unique, with its own unique audience, and you need to know the ins and outs of your specific audience in order to serve them a suitable experience. Knowing their actions, intent and needs is crucial, and requires a DXA platform to provide context to metrics.

Catering to each individual who visits your site is also about flexibility.

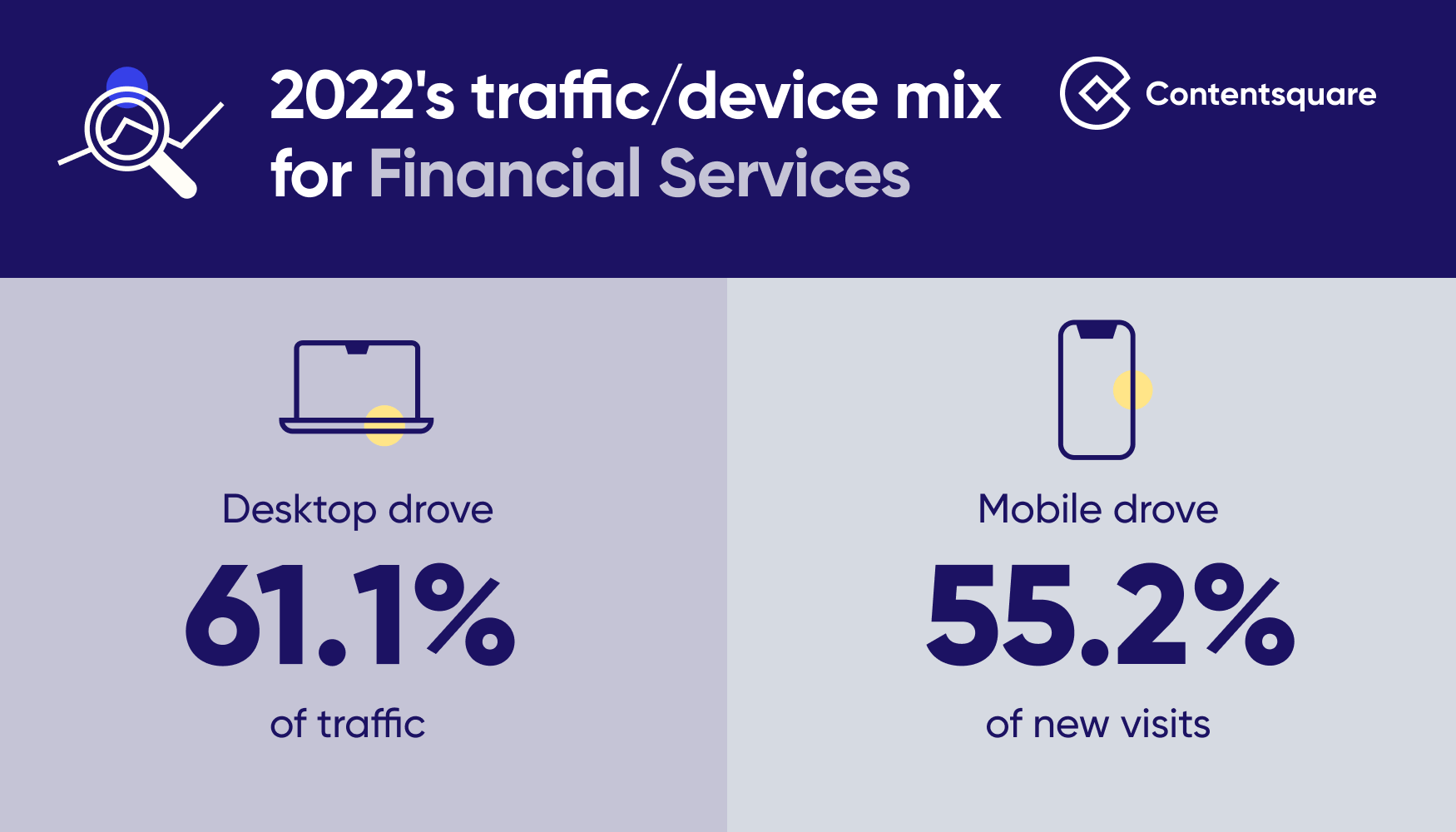

Spoiler alert: our Benchmark report reveals an extremely varied and complex mix of devices and traffic sources in traffic to financial services sites.

Desktop traffic dominates overall—but mobile traffic is driving most new visits. Unpaid sources drive most new visits—but paid traffic is driving a significant percentage of new visits.

In a word: It’s complicated. And these stats are really only scratching the surface.

You have to enable digital customers to interact with you in whatever way is most convenient to them at that time (including in-person branch visits), without ever ‘breaking’ the experience by obliging them to reiterate who they are and what they want with every change of channel.

FinServs should seek to curate cross-channel journeys that let customers finish online what they started in-branch, and vice versa. And for maximum flexibility, they should also aim to add more channels—such as WhatsApp—into the digital mix.

If there’s one thing banks need to value about their customers, it’s their time.

The biggest selling point of digital banking and insurance for customers is convenience. By handling their financial services transactions digitally, they avoid having to take the time out of their day to visit a branch.

But if your digital FinServ experience is excessively time-consuming, that convenience is compromised or even nullified and customers could start Googling around for a more efficient alternative.

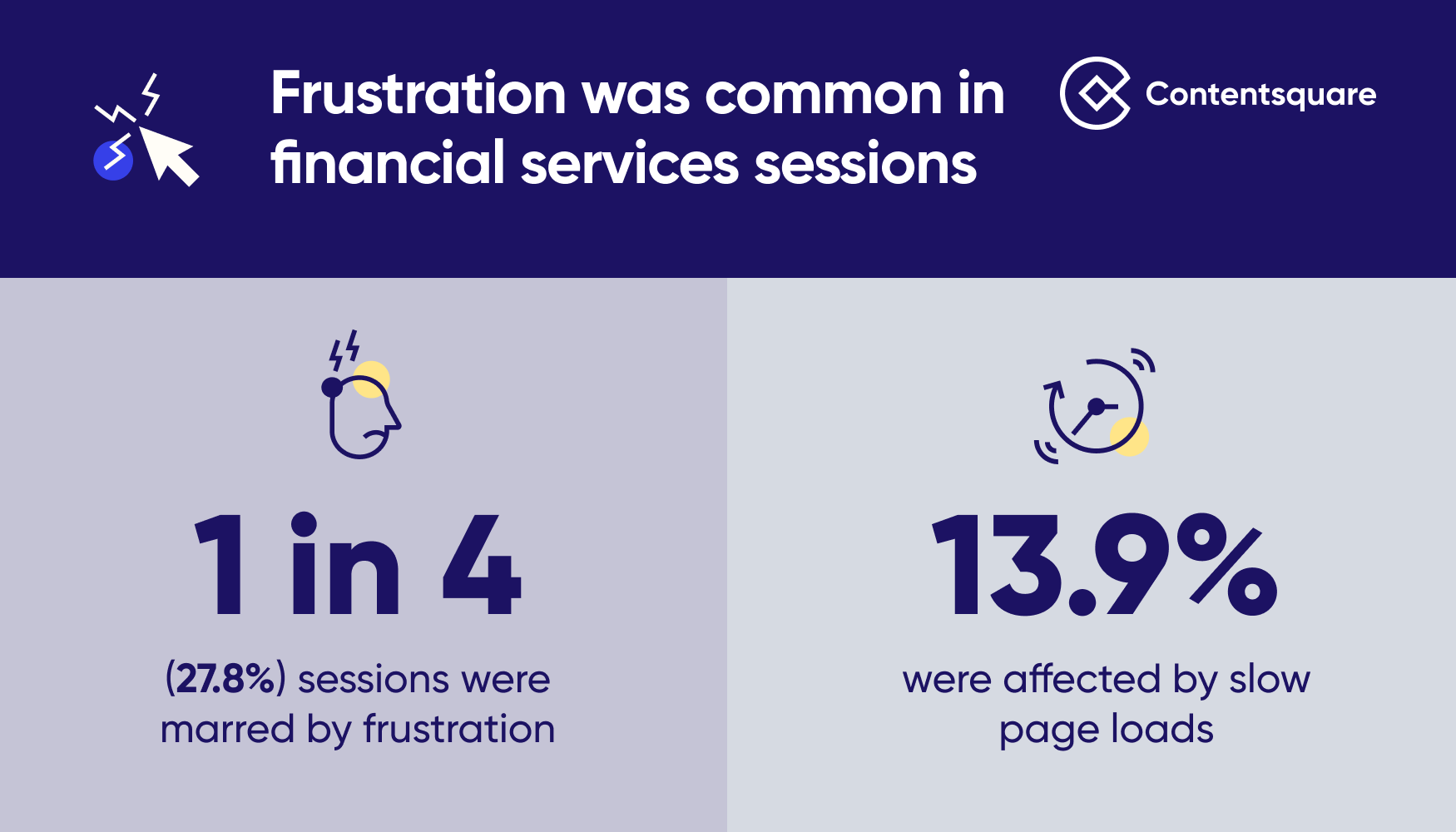

Unfortunately, the financial services site experiences analyzed in putting together our Financial Services Benchmark report show clear signs of testing users’ patience.

More than 1 in 4 (27.8%) of sessions were marred by some form of user frustration—and the most common form of frustration was one explicitly tied to wasting customer’s time: Slow page loads.

Slow page loads impacted 13.9% of sessions—and impacted them seriously, with sites that had load times of over two seconds seeing 9.2% higher bounce rates than those that load in under one second.

For insurers and banks, customer retention is often nurtured by giving their customers something extra in their digital customer experience. But it’s equally important to take frustration away from them.

By removing obstacles from their journeys—whether that’s a slow loading page, a technical error or a flaw in page design—and by offering them in-page, easily accessible support when they get stuck, you’re making things easier, quicker and less stressful for them.

The real challenge for businesses is to locate the precise points in their customer journeys where frustration is flaring up.

Once again, a DXA platform will be invaluable here. Here’s just a few of the ways Contentsquare helps businesses route out frustration from their journeys:

Ultimately, all three of the customer retention strategies for banks and insurers that we’ve laid out in this article are about optimizing your digital customer experience—a goal our DXA platform is specifically designed to achieve.

To understand how Contentsquare can help your financial services firm build experiences that attract and retain customers, why not check out this demo?

Take a product tour Get to grips with Contentsquare fundamentals with this 6 minute product tour.