In the highly regulated UK financial services market, selling consumers the wrong products can result in severe consequences. So, how can you ensure you create great digital experiences in insurance that drive customer value and are compliant? What can other companies learn from those who perform this impressive balancing act?

When selling insurance in the UK, it’s vital that consumers can access the information they need to make an informed purchase. Not only does this provide a great customer experience, but it’s also a legal obligation. Few companies understand this better than Admiral, one of the UK’s largest insurance providers since 1993.

That’s why we took the opportunity to learn from Head of Product Helen Kinch and Senior Product Owner Damian Squire how Admiral creates compliant and profitable digital customer experiences that improve customer engagement.

What are the secrets to selling highly regulated products online? And what can marketers and digital teams in other industries learn from their success?

How would an insurance company sell steak?

We’re all familiar with the age-old marketing adage to sell the sizzle rather than the steak—to emphasize the sexy, emotional aspect over the practical.

In the insurance industry, you can’t sell the sizzle, according to Damian. In fact, if selling steak was governed by the same regulations as selling insurance, you would need to ask several questions, such as:

How many grams of protein do you require?

Do you prefer your steak to be grass-fed?

Do you need it to be matured for at least 28 days?

Once the insurance customers had answered these and other similar questions about their needs, they would get four options to choose from:

Fillet

Ribeye

Sirloin

Rump

Once the choice is made, the customer must read and agree to extensive terms and conditions. They must also confirm that they have read all these terms and that the steak selection meets their demands and needs.

This is a light-hearted example of regulation’s impact on the sales process, but it shows the real challenges Admiral and others face. According to Helen Kinch, Admiral focuses on four key points when marketing their products. It all starts with understanding the customer.

Four tips for ensuring a seamless digital experience in insurance

1. Know your customer

In digital terms, this means “asking your customers loads of questions and giving them loads of filtering options.” Helen says.

When buying car insurance, customers need a lot of information. Admiral offers multiple ancillary products and add-ons as part of the process, making the customer journey complicated and lengthy.

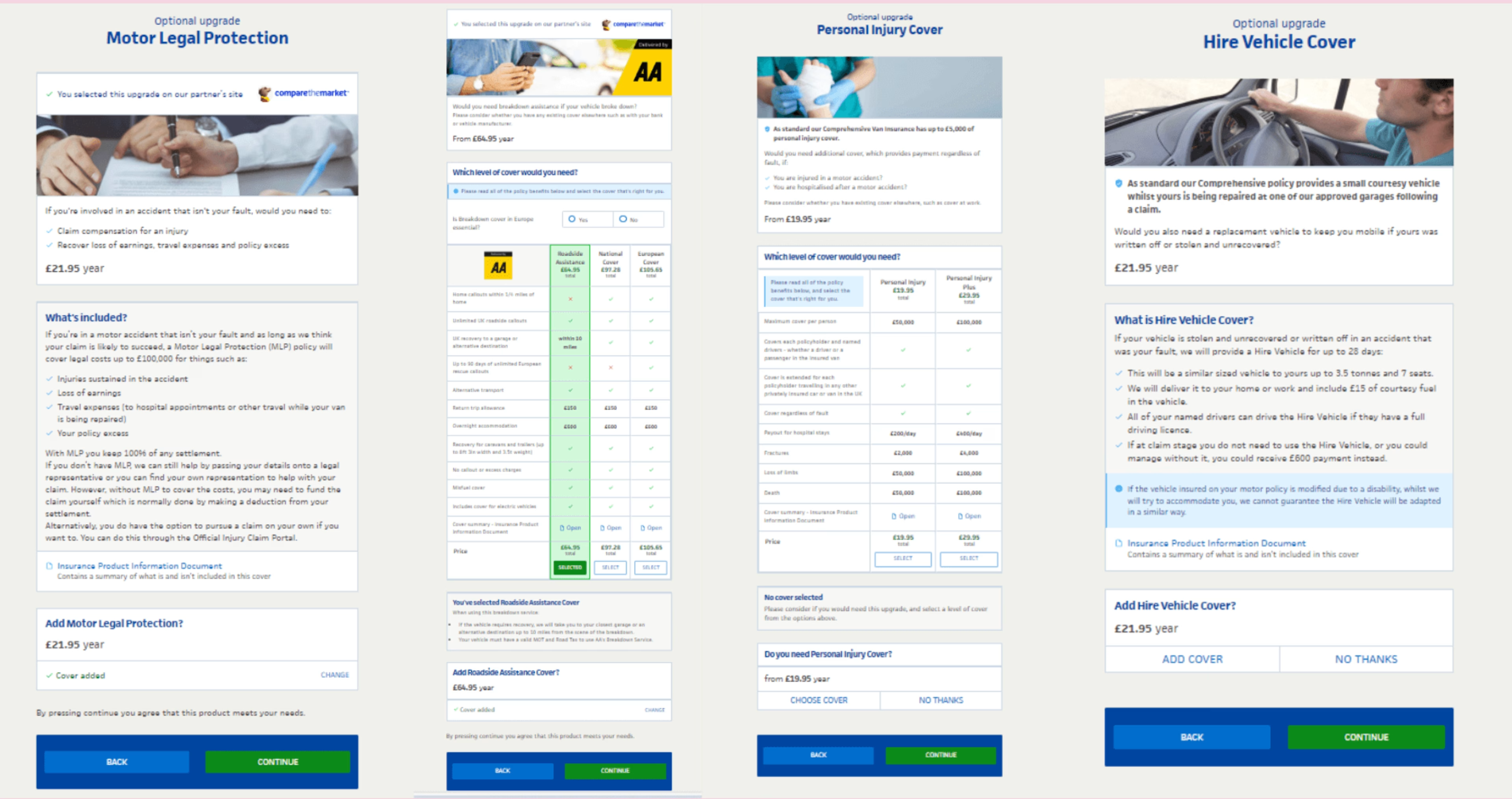

Admiral wanted to see if they could simplify and shorten this journey, so the team conducted an A/B test. They compared a multi-page journey containing one ancillary offer per page against a condensed version with all ancillary offers on a single page, where customers could click to expand the information if they wished.

**Multi-page form example**

Single page form example

Most marketers would likely assume that the shorter, condensed journey with fewer touchpoints would get better results. Perhaps surprisingly, this wasn’t the case.

“We ran that as an A/B test for quite some time because it was a close call,” Helen says. “Eventually, we found that our customers prefer the longer journey. They wanted the information.”

To Helen, this result proves why it’s vital to really understand customer expectations, wants and needs. Counterintuitively, customers prefer having more information when buying insurance products and during their decision-making process. Without testing, Admiral might have created a customer journey that didn’t meet these preferences.

“It’s not the most fun task buying insurance. You do have to answer a load of questions. But it’s with your interest at heart that we do it,” Helen adds.

The UK’s Financial Conduct Authority (FCA) obligates insurers to meet customers’ wants and needs. This also leads to customers being more likely to buy the right products for them at the right price, which helps foster trust and loyalty in the Admiral brand.

2. Be transparent

The FCA also emphasizes the need for insurers to communicate clearly and transparently with consumers about insurance products, policies and claims processes. “It’s important that customers know exactly what they’re covered for, what they’re not covered for, and any exclusions that may apply,” Damian says.

Admiral’s challenge is ensuring customers read the information they need to before making a purchase.

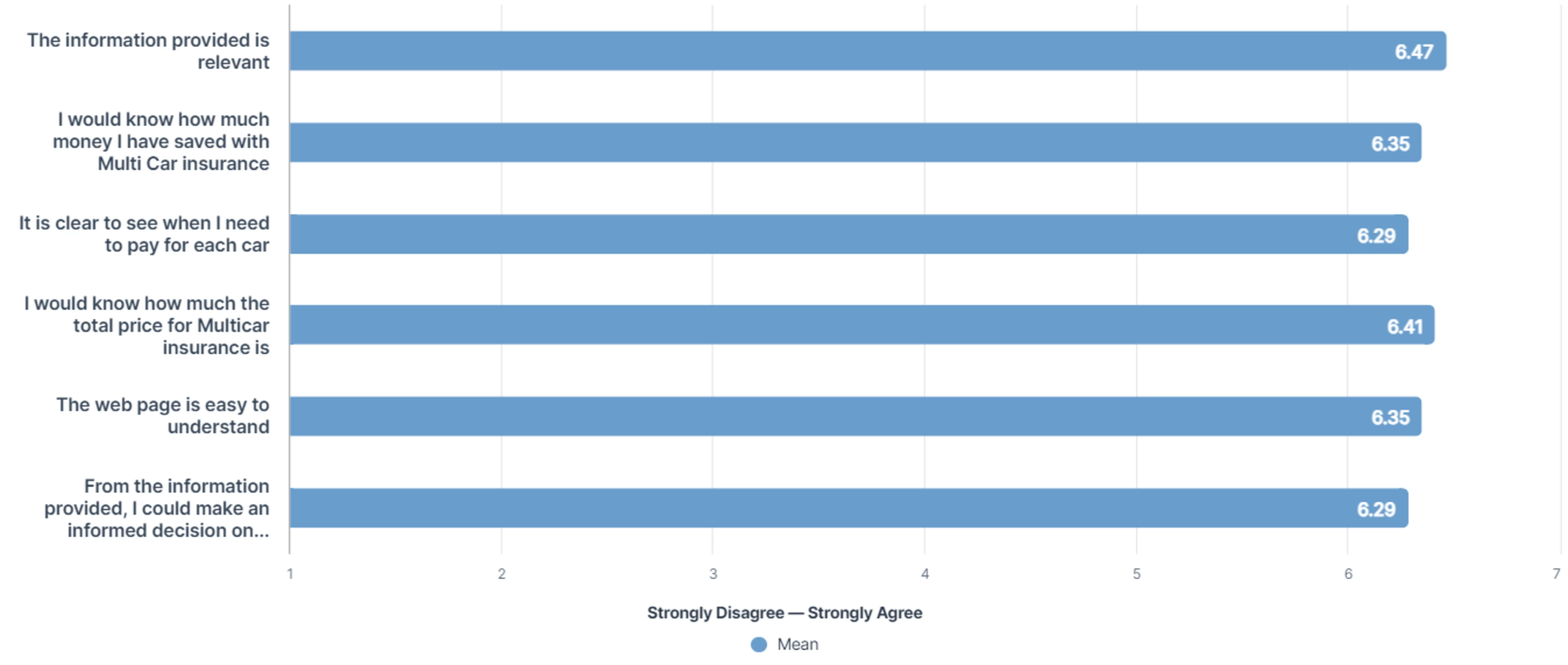

“We invest a lot of time upfront to make sure this happens,” Damian says. He explains that the product team works closely with the design and customer insights teams to create and test content with real customers. “That way, we know they really do understand the content we’re going to put online.”

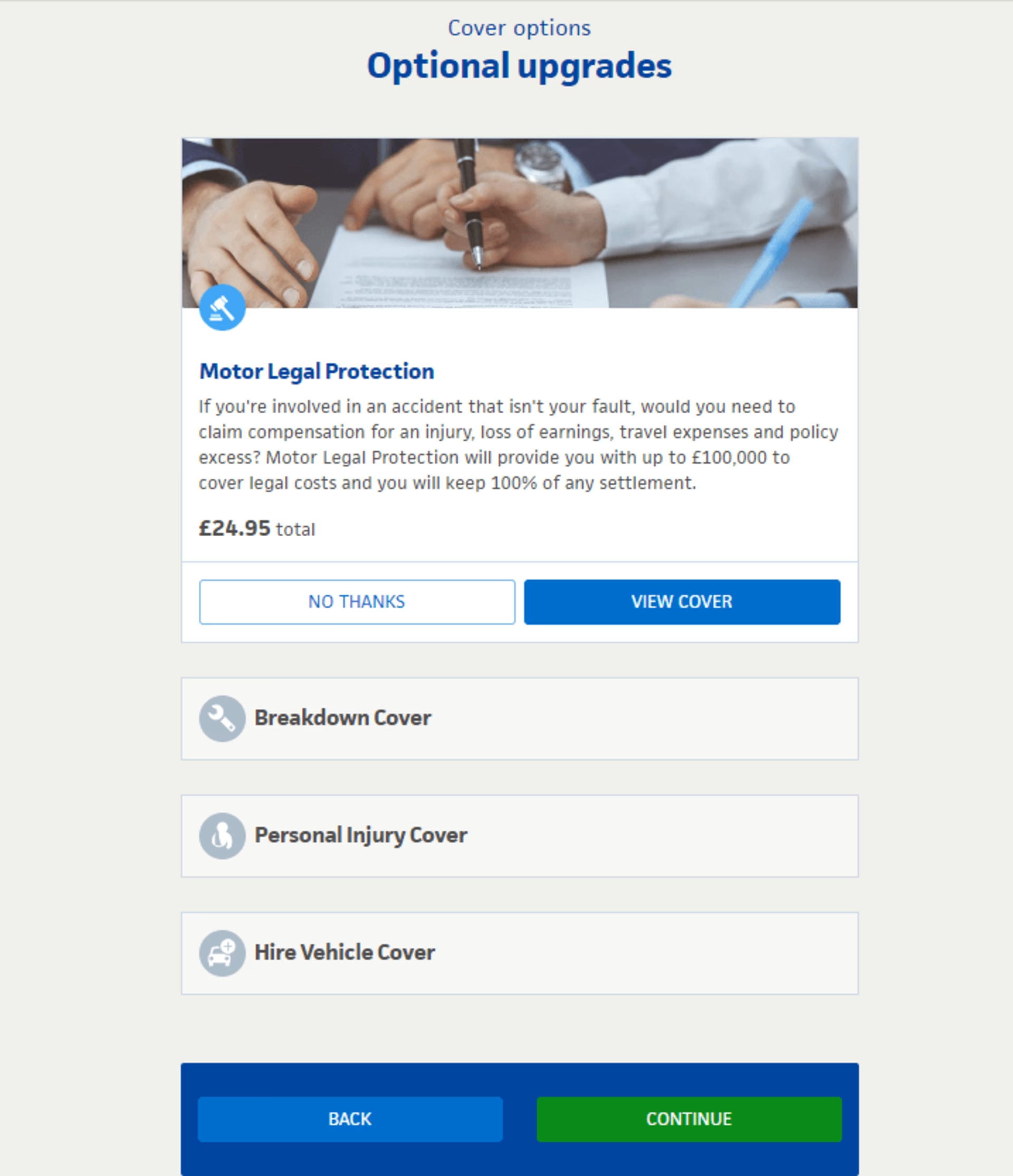

Example of Admiral’s pre-production survey

Once content is online, the company reviews complaints, Net Promoter scores, and Trust Pilot reviews. They look for what they can glean from positive and negative feedback that will help them improve the online journey and insurance customer experience.

Admiral’s Trust Pilot review rating

3. Always provide value

Because car insurance is a legal requirement, consumers tend to be very price comparison-led. This can be a problem if consumers try to save money by purchasing digital insurance that doesn’t meet all their needs, Helen explains.

There is a benefit, however.

Because most consumers start their search for auto insurance using a price comparison website, they receive multiple product recommendations while only having to answer a single set of questions.

Admiral’s pricing department works hard to ensure the company ranks high in price comparison searches. It’s then up to the product team to give those consumers the best possible journey once they click through to the Admiral website.

“When the customer lands on our site, it’s our job to give them all the information they need to buy the product that’s best for them,” Helen says.

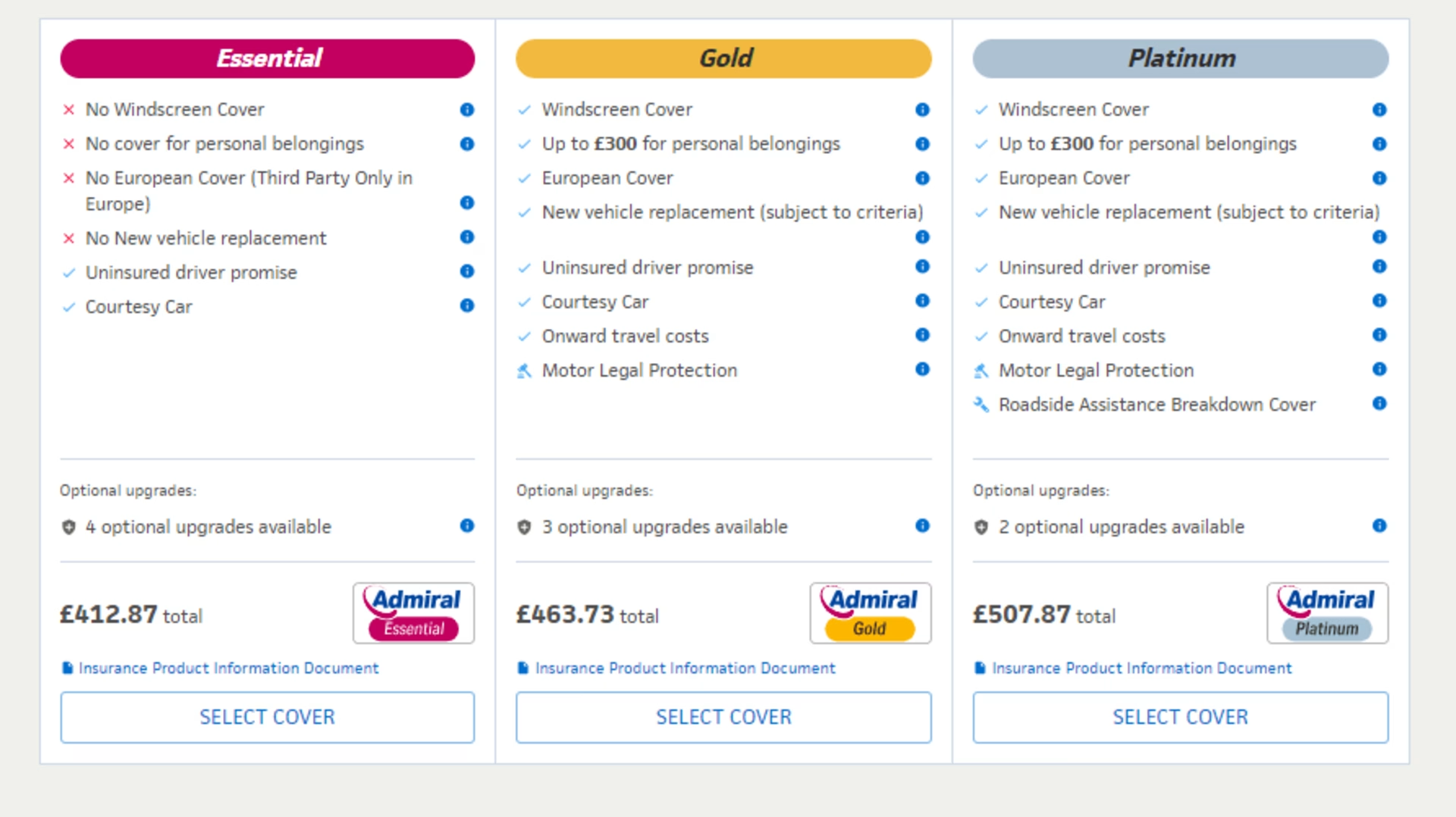

One way Admiral does this is by offering tiered products at different price points that clearly define the coverage. Because prices are often not much higher for more extensive cover, this incentivizes customers to choose more comprehensive packages. They can then make an educated decision.

Admiral’s tiered pricing model

4. Ensure “bloody great” customer outcomes

“Whilst achieving good outcomes is a regulatory requirement, it surely also has to be the ultimate goal for any customer-centric organization,” says Damian.

As well as testing their online content and actively listening to feedback, the product team also makes extensive use of Contentsquare’s digital tools, such as Session Replay.

“We record and monitor all contact center calls to see what we can learn to improve our services,” Damian says. “We’ve also applied that same philosophy to our online journeys.”

Admiral has reviewed over 1,500 completed online sessions to ensure those customers achieved their desired outcome, Damian explains. “This allows us to identify and take corrective action quickly.”

The result of this is that 98.5% of all digital outcomes are good; “that’s a direct result of all the reviews we do.”

Read Admiral’s success story to learn exactly how they’re using Contentsquare to optimize their digital quality assurance process.

Digital experience in insurance is all about building trust, loyalty and satisfaction

While insurers are obliged to follow strict rules when selling insurance, doing so also results in increased customer satisfaction, customer experiences and outcomes, building trust and loyalty over time.

All companies can benefit from this knowledge for their own digital journeys. “Understand your customer, be transparent, and offer value”, Helen concludes. Once you do these three things, that will drive great outcomes.

Contentsquare has been in business for 13 years since its founding in Paris in 2012. We offer a complete understanding of customer experiences across all touchpoints, our platform is designed to help businesses understand how users interact with their websites and mobile applications.