In the financial services (FinServ) industry, where acquiring new customers is increasingly difficult and costly, focusing on customer retention is arguably the real driver of growth.

By turning every digital interaction into a meaningful experience, FinServ brands can work towards building lasting loyalty that keeps users coming back.

This article looks into the 4 retention strategies FinServ organizations can incorporate today to help turn one-time visitors into loyal customers.

Key retention data points in Financial Services

Here’s a look at the current traffic landscape for FinServ from Contentsquare’s 2025 Digital Experience Benchmarks report.

Mobile visitors are more loyal: 30-day retention on mobile increased by +8.7% in the past year, representing a 45% raw increase

Returning traffic is shrinking: visits from returning users fell -4.8% year-over-year

High Net Promoter Score® (NPS®): 64.3% of FinServ users are considered ‘promoters’, indicating that positive experiences translate into brand advocacy

![[Visual] 90 Day Retention FinServ](http://images.ctfassets.net/gwbpo1m641r7/3oldOnwzdPM0yq9oW57Hw0/01cdb8fa164ee2ebef62f807eff34528/90_Day_Retention_FinServ.png?w=1920&q=100&fit=fill&fm=avif)

4 strategies to drive retention across FinServ sites with Contentsquare

Leading FinServ brands are successfully shifting their focus from costly acquisition efforts to proactive re-engagement strategies to keep users coming back. By employing the following 4 strategies, you can build long-term relationships that turn users into lifetime customers.

1. Stay close to your customers

Retention begins with truly understanding your customers' needs throughout their entire journey. Using Contentsquare’s Voice-of-Customer (VoC) product allows you to connect user feedback directly to their behavior. You can deploy surveys instantly using 40+ expert-built templates or leverage the platform’s AI, Sense, to auto-generate survey questions tailored to any goal.

Exit-intent surveys are particularly powerful in the FinServ industry, capturing feedback at critical moments such as loan application abandonments, account opening flow, or investment product comparison.

Beyond simply collecting feedback, the real power of VoC lies in connecting what customers tell you with what they actually do. Every survey response in Contentsquare is automatically linked to a session replay, allowing you to watch the exact session that led to the feedback. This means when a user says "I couldn't find the information I needed" or "The process was too complicated", you can immediately see their journey, understand the context, and identify the specific friction points they encountered.

💡Pro tip: leverage Sense to generate summary reports of open-text responses. Summary reports automatically identify key themes, actionable recommendations, and user sentiment across hundreds of responses in seconds.

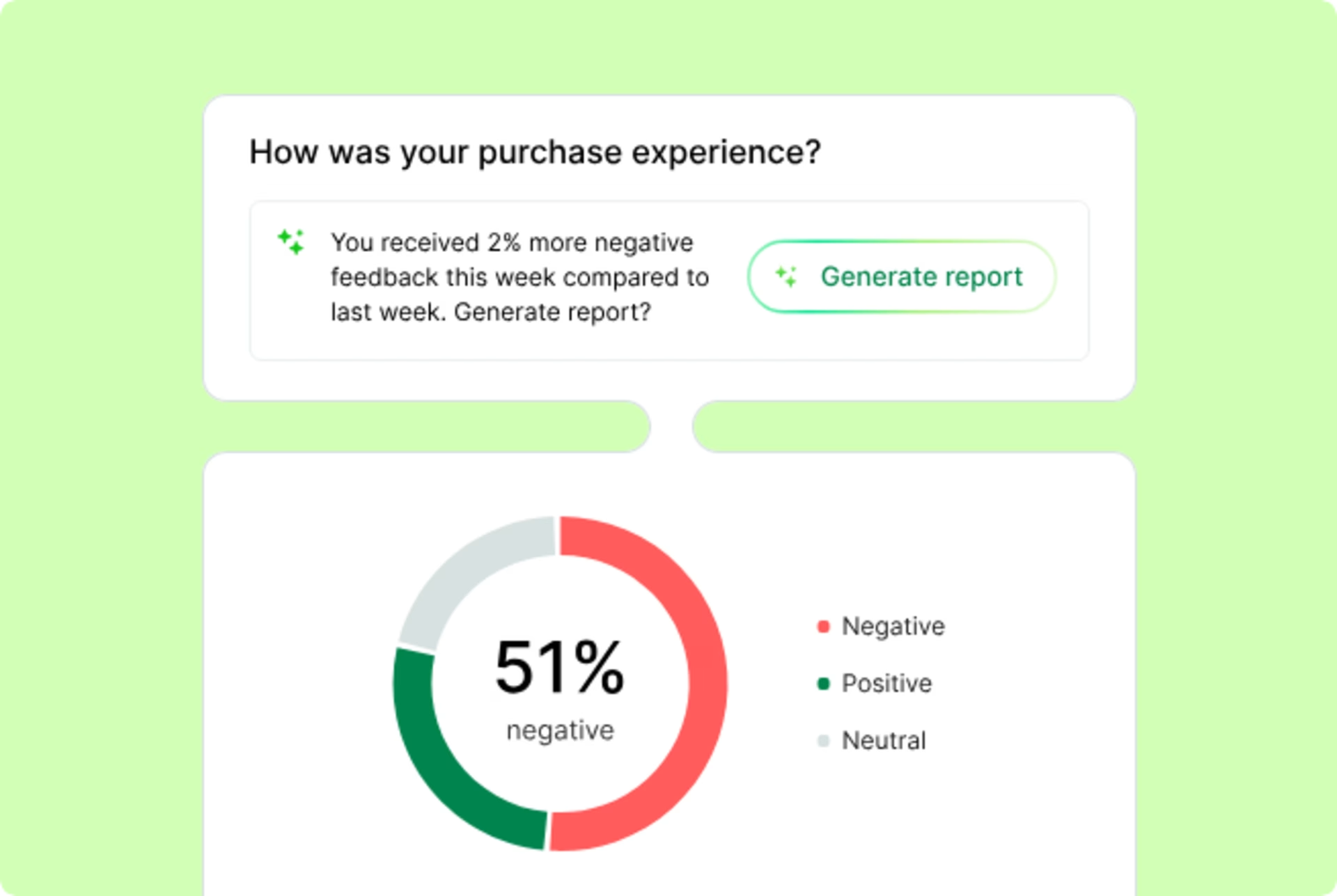

AI-powered sentiment analysis categorizes feedback as positive, neutral, or negative, helping you quickly prioritize issues that are hurting retention.

You can also create segments based on survey responses, such as users who gave negative feedback or those categorized as NPS® ‘detractors’ and apply these segments across Contentsquare’s Journey Analysis, and Impact Quantification capabilities to measure business impact and optimize the full user experience.

This combination of qualitative feedback and quantitative behavioral data enables FinServ teams to proactively address issues before they escalate into support tickets or customer churn, ultimately building experiences that keep customers engaged and loyal.

2. Dig into successful retention patterns

Use Contentsquare’s Advanced Journey Analysis to map user loyalty over time across web and mobile, visualizing how users progress through different paths. This cross-session and cross-device visibility is particularly valuable in FinServ sites, where customers often research on mobile but complete transactions on desktop, or browse anonymously before opening an account.

For example, you might discover a percentage of users who left during a loan application actually returned to complete it at a later stage. This is critical insight for FinServ companies whose customers often pause to gather financial documents, consult with family members, or review terms with advisors.

![[Screenshot] Journeys - Journey Analysis - insights](http://images.ctfassets.net/gwbpo1m641r7/2FUORqw438kCYsl1M2HViQ/904b78442955cf47962c361e7c82e1e2/journey_insights.png?w=3840&q=100&fit=fill&fm=avif)

You can also pinpoint high-value content using lifetime metrics, such as user retention (the percentage of users who return after viewing a page) and average lifetime revenue per user, to prioritize content that cultivates long-term loyalty. These metrics help you identify which pages, features, or content drive customers to return and transact, even across multiple sessions, so you can optimize the experiences that matter most.

For high-consideration purchases common in FinServ, you can use Contentsquare’s Funnel Analysis to uncover cross-session drop-offs, helping you differentiate a true abandonment from a temporary device switch. Understanding multi-session conversion patterns is critical, as FinServ customers often need several sessions to complete complex applications or make significant financial decisions.

💡Pro tip: Use lifetime segments like 'returned in a later session' or 'converted across multiple sessions' to specifically analyze and optimize for your multi-session converters.

![[visual] Contentsquare Funnel setup](http://images.ctfassets.net/gwbpo1m641r7/5EX1R2zY8dxcIJvHEYEe8m/b31846b2b709fad619d81fe04bcadbd4/funnels.png?w=3840&q=100&fit=fill&fm=avif)

3. Build better connections

Traditional introductory offers like lower interest rates or sign-up bonuses attract customers but don't build lasting loyalty. Instead, successful FinServ brands are reimagining rewards programs to drive habitual engagement.

Credit card perks have evolved beyond traditional travel rewards, which lost relevance during the pandemic, to cashback on everyday purchases, partnerships with leading ecommerce brands, and personalized offers based on spending patterns. FinServ apps are increasingly gamifying healthy financial behaviors, rewarding users with points or badges for reaching savings goals, completing financial literacy modules, or maintaining consistent budgeting habits.

4. Predict future behavior

Staying one step ahead means proactively leveraging insights to spot churn signals before a customer's interest fades. With Contentsquare's Sense, you can detect early signs of churn, like reduced engagement or a customer’s sudden disengagement with their investment portfolio.

Chat with Sense allows you to ask questions in natural language, such as "What changed last week that could impact NPS®?" or "Which user behaviors predict account closures?" Sense then automatically runs the analysis, correlating NPS® segments with behavioral data like rage clicks, error encounters, or changes in feature usage patterns. What used to take days of manual analysis can now be achieved in minutes, allowing you to act before customers leave.

Curious about Sense? Watch this video:

AI-powered alerts notify you when abnormal levels of frustration appear on critical pages like loan applications or account opening flows, so you can investigate and resolve issues at lightning speed. Sense helps you prioritize your next best actions based on urgency, effort involved, and potential revenue impact, analyzing both historical and real-time data to anticipate future pain points and opportunities.

![[Visual] Session Recording](http://images.ctfassets.net/gwbpo1m641r7/5bac7Oq2yxuRBqHXP6IO54/da0087a27132e67565edc9515c48845a/Session_Recording.png?w=1920&q=100&fit=fill&fm=avif)

Frustration scoring automatically surfaces friction, providing a single, actionable score prioritized by business impact. This helps you focus on the improvements that’ll generate the best results, visualizing and quantifying struggle events like multiple form field interactions or rage clicks to resolve issues faster.

![[Visual] CSQ-Frustration-Score](http://images.ctfassets.net/gwbpo1m641r7/42XUbRA4QZNcWpukMpln1m/44c3ab68cd5de383e3811680e94bd8a5/CSQ-Frustration-Score.png?w=3840&q=100&fit=fill&fm=avif)

Connect qualitative feedback with behavioral predictions: if you spot an issue in an AI-generated VoC survey summary, you can ask Sense how many users are facing this issue and the impact it's having on retention and revenue. This allows you to quantify qualitative feedback and prioritize actions that reduce churn and drive growth.

By combining strategic engagement incentives with AI-powered predictive analytics, FinServ brands can build experiences that not only keep customers coming back today but also anticipate and address loyalty risks before they materialize.

Driving customer retention forward

Retention isn't just about keeping customers, it's about building relationships that drive long-term value. By staying close to your customers through VoC insights, understanding the journeys that lead to loyalty, and proactively addressing churn signals with AI, FinServ brands can transform the gap between satisfaction and sustained engagement into a competitive advantage. The question isn't whether your customers are satisfied today, it's whether they'll choose to come back tomorrow.

![[Visual] Stock group in office](http://images.ctfassets.net/gwbpo1m641r7/4qn7ZZ3yGGwvON1mesdH3s/c4d1c9d121d8d67b184011b4bcd2b6bd/Untitled_design__3_.jpg?w=3840&q=100&fit=fill&fm=avif)

![[Visual] Contentsquare's Content Team](http://images.ctfassets.net/gwbpo1m641r7/3IVEUbRzFIoC9mf5EJ2qHY/f25ccd2131dfd63f5c63b5b92cc4ba20/Copy_of_Copy_of_BLOG-icp-8117438.jpeg?w=1920&q=100&fit=fill&fm=avif)