Getting to the bottom of customer churn takes some detective work. You may have stats about how many customers unsubscribed from your service or stopped buying your product, but that doesn’t really give you the full story of why they decided to leave in the first place.

That’s where customer churn analysis comes in. It helps you find the root causes of customer dissatisfaction, pinpoint what’s going wrong, and better empathize with future customers to meet their needs.

This guide gives you a step-by-step framework for customer churn analysis, so you can proactively address problems—and prevent current and future customers from leaving.

What is customer churn analysis?

Customer churn, also known as customer attrition, is when a customer decides to stop doing business with you. It’s measured using customer churn rate, a metric that shows the percentage of customers who churn during a given period of time (typically yearly, quarterly, or monthly).

Churn rate is useful for many things: understanding company performance, making future projections, calculating customer lifetime value (LTV), analyzing the effect of changes on retention, and seeing who your most successful prospects really are.

Customer churn analysis is the process of identifying and understanding the ‘why’ behind your churn rate. Higher churn rates mean lost revenue and stalled company growth—so analyzing and reducing it helps you dramatically increase profitability.

How do you calculate customer churn?

Calculate your customer churn rate by dividing the number of customers you lose during a time period by the total number of customers at the beginning of that period. The formula for customer churn is:

Customer churn rate = (lost customers / total customers at the beginning of the period) x 100

Let’s say you want to calculate your company's annual customer churn rate. You started the year with 1000 subscriptions. Throughout the year, 200 customers decided to cancel, while 800 customers decided to renew. Your churn rate would be:

20% = (200/1000) x 100

You can use the same formula to calculate your annual, quarterly, and monthly churn rate.

You may also want to track your revenue churn rate. This is the financial impact of customer turnover in a given time period. The formula for revenue churn rate is:

Revenue churn rate = ([revenue at the beginning of the period – revenue at the end of the period]/revenue at the beginning of the period) x 100

What’s a ‘good’ churn rate?

Customer churn rates vary from company to company and from industry to industry. An acceptable figure for SaaS churn is between 3-5%, but it varies with size and age of company, number of customers, and the amount (and quality) of competition. Generally, lower is better, and absolute rates matter less than changes over time. If your churn rate is going down, encourage that trend.

If you’re trying to reduce your churn rate, analyze churn as it occurs, so you can quickly make changes and improvements, like creating an onboarding experience that shows users the value of your product.

Pro tip: aim to minimize churn, not eliminate it. Perfect retention is impossible, and there will always be some customers who churn—so it’s critical to track and analyze this turnover.

How to analyze customer churn: a step-by-step guide

There’s more to understanding churn than simply calculating percentages. To get to the truth behind customer churn, you need to collect voice-of-customer (VoC) insights, so you can uncover the real reasons why people stop using your product.

But whose job is it to analyze churn? Increasing customer retention isn’t specific to just one team—it should be everyone’s priority to retain customers and boost user engagement. Teams like customer support, marketing, sales, product, and customer success should all participate in the process.

Let’s take a look at the four steps to effectively run a customer churn analysis:

1. Look for clues: collect insights from customers

Perhaps customers thought they needed your product but quickly realized it didn’t give them what they wanted or help them achieve their jobs to be done (JTBD). Or maybe customers want your product but aren’t yet ready to invest. Whatever the reasons may be, the first step is to gather qualitative and quantitative insights to find out what’s behind customer decisions to churn.

Qualitative insights to collect to understand customer churn

To find out why customers are churning, send a survey to them straight away. Not only will this give you valuable insight, but it’s also a chance to leave a positive impression on customers who are about to leave.

![[Visual] Exit-intent survey](http://images.ctfassets.net/gwbpo1m641r7/70LxdbnLg3vHHjjMfZjfmb/27391018ec8ea4b3a71a9af59d4a6d79/ASK-VOC-Exit-Intent-Hero.webp?w=3840&q=100&fit=fill&fm=avif)

With Contentsquare’s Survey tool, you can ask for feedback the moment customers churn

Try to keep things short and sweet, as quick-to-complete customer satisfaction surveys are likely to have a higher response rate. Also, be sure to include a mix of open- and closed-ended questions in surveys to keep participants engaged in the content. Here’s a set of example survey questions to give you an idea:

If you could improve anything about our product, what would it be?

Would you consider becoming a customer once again? Under what circumstances?

What tool will you use instead of our product? Why?

Which tools, would you say, are essential to your success?

What’s the main reason you decided to stop using our product?

To bring in more qualitative insights, you might try these other customer feedback techniques:

Exit interviews provide you with the unique opportunity to listen to customers’ unfiltered problems. Since they’re leaving anyway, they won’t have a problem sharing their dissatisfaction with you.

Social media listening tools like Hootsuite let you track mentions of your brand (and your competitors) across social media platforms

Focus groups are a great way to tap into user frustrations through conversation and interactions. If your client base is spread out, consider conducting online focus groups as an alternative.

Quantitative insights to collect to understand customer churn

When used in tandem with survey and feedback responses, quantitative insights give you a different perspective on why customers are leaving.

Perhaps you notice that the conversion rate on your sign-up page is going down. For example, visitors might land on your web page and start to fill out your form, but then leave halfway through.

To find out the story behind the numbers, use a Google Analytics integration to find out what’s happening during the user journey.

🔥 Pro tip: use product analytics tools like Heatmaps and Session Replay to understand customer behavior and engagement while they’re using your site or product. Heatmaps, for example, help you gain insight into how users behave during the signup process by showing you the most and least popular page areas users click on.

For example, if customers leave your website without completing the signup form, use heatmaps to see where users are actually clicking and find out which page elements are confusing or distracting them, so you can make changes that lead more people to sign up for your product.

![[Visual] Zoning and Heatmaps](http://images.ctfassets.net/gwbpo1m641r7/1fY6bBg1dnmmchw0aGq0u7/22f31b8e8a5bd586dce9a6df783184a1/Screenshot_2024-11-04_at_18.31.54.png?w=3840&q=100&fit=fill&fm=avif)

Contentsquare’s Heatmaps let you see where users click and scroll through a page

2. Dig deeper with user segmentation and cohort analysis

Rather than trying to analyze churn cases one by one, it’s better to get a big-picture understanding first. With user segmentation, you can create segments of churned customers for cohort analysis, enabling you to recognize larger trends and factors that might be leading customers away.

By putting users into cohorts, you can see what your highest-value and most-engaged users do, then adapt your product or site to nudge more people to perform the same activities or follow the same user flows.

Cohort analysis can also tell you which groups need attention and which types of users tend to be loyal, so you can prioritize your marketing and re-engagement efforts accordingly. When you attract right-fit users in the first place, you’ll have fewer problems with churn later.

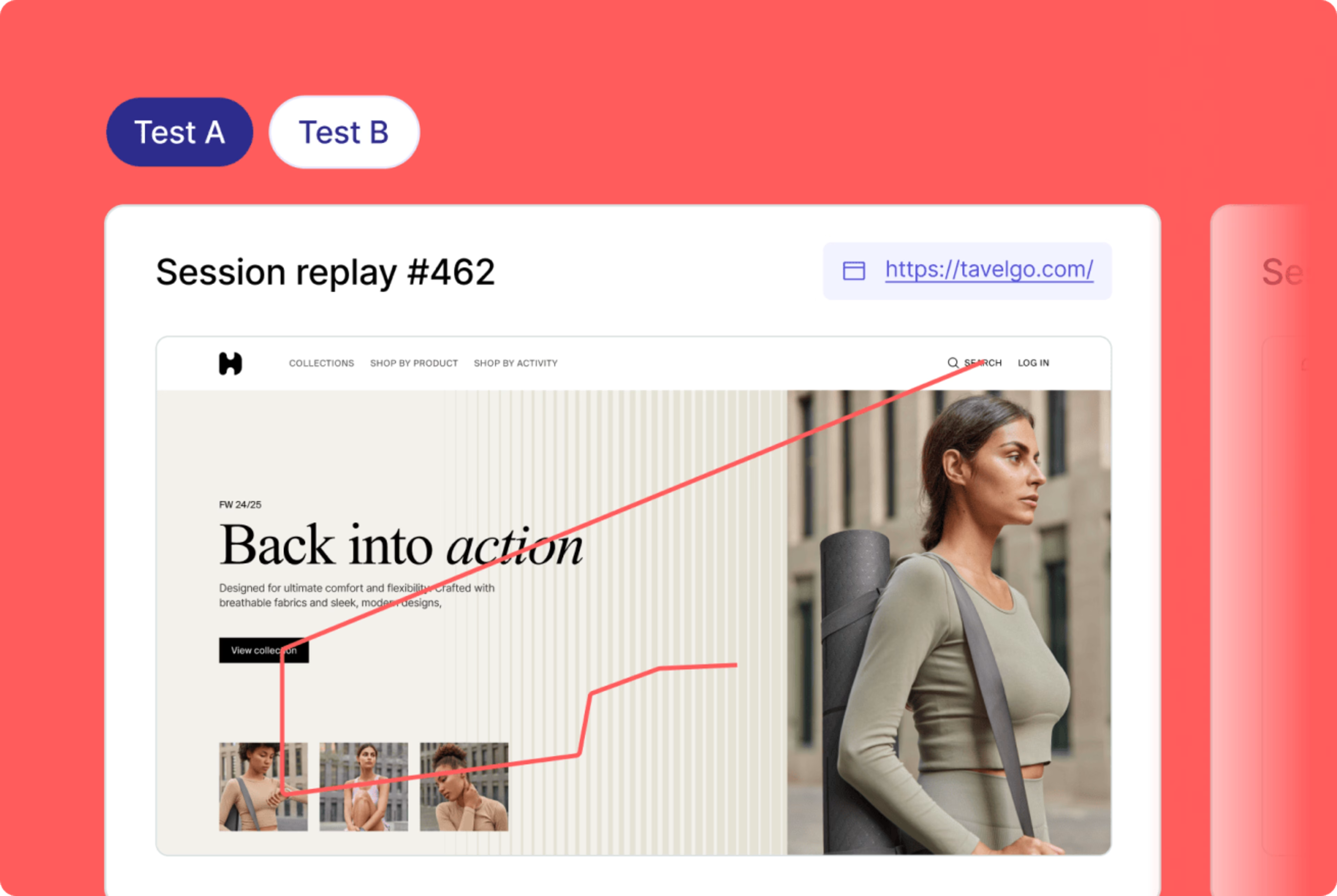

To get even more insights for your cohort analysis, watch session replays to see exactly how users from different groups navigate your site: what they engage with, where they get stuck, and any moments of friction.

Enrich your cohort analysis with session replays to see exactly how different users behave on your site

3. Use your evidence: find out when and why

Once you have enough data, it’s time to make observations and create hypotheses. Ask yourself the following questions to get a clearer picture of the reasons for customer churn:

At what stage are customers leaving? Is it early on or at a later stage of the process?

How do customers across different industries engage with your product or service?

Which customers frequently engage and make contact with your customer support team?

How do customers across different pricing plans differ in terms of churn?

Which customers are more likely to upgrade their plan?

Early vs. later customer churn

Understanding when customers are leaving will help you understand which stage in the customer journey needs your attention and what you can do to better meet user needs and encourage loyalty.

For customers leaving at an earlier stage of the process, such as during sign-up, observe their behavior with session replays to find out what's wrong—maybe you have too many data fields to fill that are frustrating users, or maybe your sign-up button isn't working properly and customers are rage-clicking.

Use Contentsquare’s Session Replay tool to capture customer interactions on your website and product and immediately detect errors or undesirable behaviors.

For customers leaving at a later point of the process, take a closer look at their engagement patterns over a longer period of time. Look for factors that point to this change. Are customers frustrated with your product in any way, or are they churning because they only needed your service or product for a set period of time? Let's take a look at the factors you need to keep an eye on to prevent customer churn:

Customer engagement

User engagement metrics are an excellent indicator as to whether or not customers are about to churn. If you notice that customers suddenly stop communicating with your support team, it doesn't necessarily mean they're having a smooth product experience. They might be on the verge of leaving and don't want to waste any more of their time trying to fix the situation.

Competitive pricing

While conducting customer churn analysis, continually keep tabs on the pricing plans and campaigns of your competitors. If you have customers who churn because they can’t afford the product, it might not mean that you need to cut prices across the board. However, it might be a good idea to create an alternative pricing option that covers their basic needs.

4. Take it one step further: actively reduce churn

Once you’ve gone through the analysis process, the next step is to implement a churn management strategy to improve your customer retention rate. Depending on your findings, adopt one (or more) of the following tactics:

Ask for feedback often: the best way to reduce your churn rate is by proactively detecting pain points before customers decide to leave

Provide users with a more complete onboarding process: this helps ensure that customers are aware of all of the product’s features and can navigate it with ease

Send out regular product updates and newsletters: this is a great way to engage existing customers and build a lasting relationship with them. Sharing useful content to nurture customers will help encourage brand loyalty and increase retention.

Try different pricing options: this works well if you’re having difficulty retaining customers from smaller businesses. Always have your eyes on the competition and make sure you’re offering the right audience the right pricing plan.

![[Visual] Feedback button - How would you rate your experience](http://images.ctfassets.net/gwbpo1m641r7/6zpie5F6Gwd4oyqXaxBfcN/b7e9b7f3bfcc6265f47b5294d8fec319/Feedback_button.png?w=3840&q=100&fit=fill&fm=avif)

Use Surveys to collect feedback about the customer experience and uncover dissatisfaction before it leads to churn

What are the most important KPIs and metrics to monitor for churn?

Alongside your customer churn rate, here are some other metrics you should keep an eye on:

Growth rate is the number of new customers acquired within a given time period. If your growth rate is higher than your churn rate, congratulations—you’re making money! But when churn rate is the higher number, your customer base is slipping away. Time to do something.

Gross dollar/gross value churn measures the loss of your highest-revenue customers—including those who stay on, but downgrade. You definitely want to know when users think your premium offerings aren’t worth the cost.

Expansion revenue measures new income from current customers. Customers who keep buying tend to be happy, and upselling them helps increase profits while mitigating acquisition costs.

Renewal rate is a loyalty metric. Divide the number of customers who renew by the number of customers up for renewal in a given time period. Then multiply by 100 to get a percentage. (It’s about revenue, not number of subscribers.)

Customer retention cost is how much you spend per customer to keep them. To calculate it, add up expenses from your customer success program in a given period, then divide by the total number of customers in that period. Comparing retention costs against marketing efforts indicates how efficiently you’re retaining your hard-won customers.

Finally, support tickets are excellent indicators of account health. Your success team should analyze recurring friction and bottlenecks and create resources to educate users so they don’t need to contact support.

Predict and prevent customer churn

It's inevitable that some customers will stop using your website or product. What matters is making the effort to learn why they leave by analyzing customer churn, and taking steps to prevent it in the future. Customer churn analysis lets you:

Better understand your customers’ pain points

Detect underlying frustrations and problems with your product or service before customers leave

Understand where to target your efforts and make improvements

Pinpoint weaknesses and take steps to overcome problems

Provide future customers with a better overall experience

Tuning into why customers are leaving helps you make lasting improvements to your product, processes, and customer service, so you become more adept at meeting their needs.

FAQs about customer churn analysis

Customer churn analysis is important because it helps you lower your customer attrition rate and increase profits. It’s much more cost-effective to retain existing customers than to acquire new ones.

Analyzing churn also helps you identify weaknesses in your product features or with your customer service teams, so you can address specific problems that help you enhance the customer experience and encourage brand loyalty.

![[Guide] [Qualitative data analysis] homepage - cover](http://images.ctfassets.net/gwbpo1m641r7/6kzjLsEHjvo1IbshVwMEpF/38fc695b40d4f7084545239e628ea90f/AdobeStock_283571591.jpeg?w=3840&q=100&fit=fill&fm=avif)