Your team just launched a new product or feature, and for a moment, everything looks great: user engagement is up, feedback is positive, and it feels like a win. But then a competitor releases something strikingly similar—but with a sleeker design, an extra layer of functionality, or a pricing model that undercuts yours. Suddenly, you’re no longer leading; you’re playing catch-up.

This is where competitive product intelligence becomes essential. By tracking market shifts and competitor offerings, you can anticipate changes rather than react to them. But what exactly is competitive product intelligence and how can you incorporate it into your workflow?

This guide covers the fundamentals of competitive product intelligence and why it matters. You’ll also learn

How to conduct competitive product intelligence to strengthen your product positioning

Essential tools and best practices for building an effective intelligence strategy

Real-world examples of how competitive insights drive user retention and revenue

How to use Contentsquare’s all-in-one platform to level up your competitive product intelligence analysis

Key insights

Competitive product intelligence is about staying ahead, not catching up. Businesses that proactively track market trends and competitor moves can anticipate shifts before they happen, rather than reacting after the fact.

Success comes from differentiation, not imitation. Simply replicating competitor features isn’t effective; the true competitive advantage comes from understanding user needs and delivering unique value.

Prioritization turns insights into impact. With the right data, businesses can focus on competitive opportunities that drive the biggest gains in revenue, engagement, and retention.

Continuous monitoring is essential for long-term success. The competitive landscape is constantly shifting, and maintaining a strong position requires ongoing analysis, iteration, and adaptation to shifting user expectations.

What is competitive product intelligence and why is it important?

Competitive product intelligence is the process of gathering, analyzing, and applying insights about competitor products to strengthen your own. It helps businesses stay ahead by evaluating features, pricing, user experience, and technological advancements.

By understanding what competitors are doing well—and where they fall short—businesses can better identify opportunities for differentiation, anticipate competitive moves, and refine their product strategy with confidence.

While competitive product intelligence is valuable for many teams, it’s particularly important for

Product managers who need to prioritize feature and product development, identify market gaps, and create better user experiences that drive adoption and retention

Marketing teams that need to highlight unique selling points and understand how competitors frame and pitch their value props

Sales teams that want to strengthen industry partnerships, refine trade show strategies, and position offerings more effectively in the market

Business owners who rely on data-driven insights to guide decisions on market positioning, pricing strategies, and investments

Competitive intelligence vs. market intelligence vs. competitive product intelligence

At first glance, you may think that competitive product intelligence, market intelligence, and product intelligence are interchangeable—and that’s totally understandable. They share many of the same goals and often work together to drive business success. There are, however, some key differentiators in scope and the questions these tools aim to answer:

Type | Scope | Example insights |

|---|---|---|

Market intelligence | Understanding macro trends, customer preferences, and external factors shaping demand | → What’s the total addressable market (TAM) for my product? → How is customer demand shifting within the industry? → What economic or regulatory trends impact my market? |

Competitive intelligence | Gathering and analyzing insights about direct and indirect competitors to inform business strategy | → What are my competitors' key strengths and weaknesses? → What are their upcoming product launches and go-to-market strategies? |

Competitive product intelligence | Deep dive into competing products to understand differentiation, user experience, and feature gaps | → How does my product compare to competitors in terms of features, UX, and pricing? → What product innovations are gaining traction in my industry? → How do customer reviews and feedback about competing products inform my roadmap? |

⭐ Caveat: the capabilities and definitions of competitive intelligence, market intelligence, and competitive product intelligence may vary depending on the platform you’re using or the team you’re working with. Make sure to thoroughly assess your goals beforehand to determine which tools best fit your needs.

How to conduct competitive product intelligence in 6 steps

Effective competitive product intelligence requires a structured strategy. Follow these 6 steps to gather valuable insights, identify high-impact opportunities, and refine your product roadmap with data-driven decisions.

1. Define goals and scope

Before diving into competitor product research, it’s important to define what you want to learn and how broad your analysis will be. Are you identifying untapped customer engagement opportunities or comparing feature gaps?

Setting specific objectives ensures you focus on the most relevant insights, allocate resources effectively, and avoid wasting time on data that doesn’t directly inform your strategy.

Tools and strategies to define analysis goals and scope

Set clear, actionable objectives: move beyond vague goals like ‘understand the competition’ to specific objectives like ‘identify feature gaps that affect our conversion rates compared to competitor X’

Get a dedicated dashboard: if you’re not already using one, set up a digital experience analytics dashboard in Contentsquare to begin tracking competitive metrics and visualizing performance gaps in real time

Establish performance baselines: use Contentsquare’s Benchmarks capability to understand where your product currently stands compared to industry standards and identify competitive gaps

🔥 Pro tip: review Contentsquare’s free 2025 Digital Experience Benchmarks Report for a comprehensive overview of current digital trends—and identify areas where your product can stand out.

The report gives you

Extensive trend analysis: insights derived from 90 billion user sessions across 6,000 websites, providing a robust foundation for informed decision-making

Industry-specific benchmarks: metrics tailored to different sectors, enabling you to compare your product's performance against industry standards

Strategic guidance and insights: tips and tool recommendations to delve deeper into specific metrics and trends relevant to your business

![[Visual] Benchmark Report 2025](http://images.ctfassets.net/gwbpo1m641r7/37M2jL3ZXISUPOGkkSMuOj/3f30d6e88867555cda2f2be00156f9b6/BenchmarkReport2025.png?w=3840&q=100&fit=fill&fm=avif)

Contentsquare’s 2025 Digital Experience Benchmarks Report gives teams a data-backed snapshot of where they stand—and where they can go next

2. Audit current user behavior and product performance

With your competitive product intelligence goals in mind, the next step is to evaluate how users currently interact with your product and which features drive the most value.

This process helps you zero in on the areas that matter most to your audience. For example, you might find that although your product has multiple advanced features, the majority of customers engage with just 3 core tools. This highlights where optimizations will have the greatest impact on satisfaction and ROI.

Tools and strategies to review user behavior and product performance

Track the digital user journey: use Contentsquare’s Journey Analysis capability and customer journey map template to visualize how users navigate your product and pinpoint new opportunities to refine high-value conversion routes

Monitor across devices: use mobile app analytics and web analytics to collect performance data across different endpoints and platforms, ensuring you capture a complete picture of user behavior

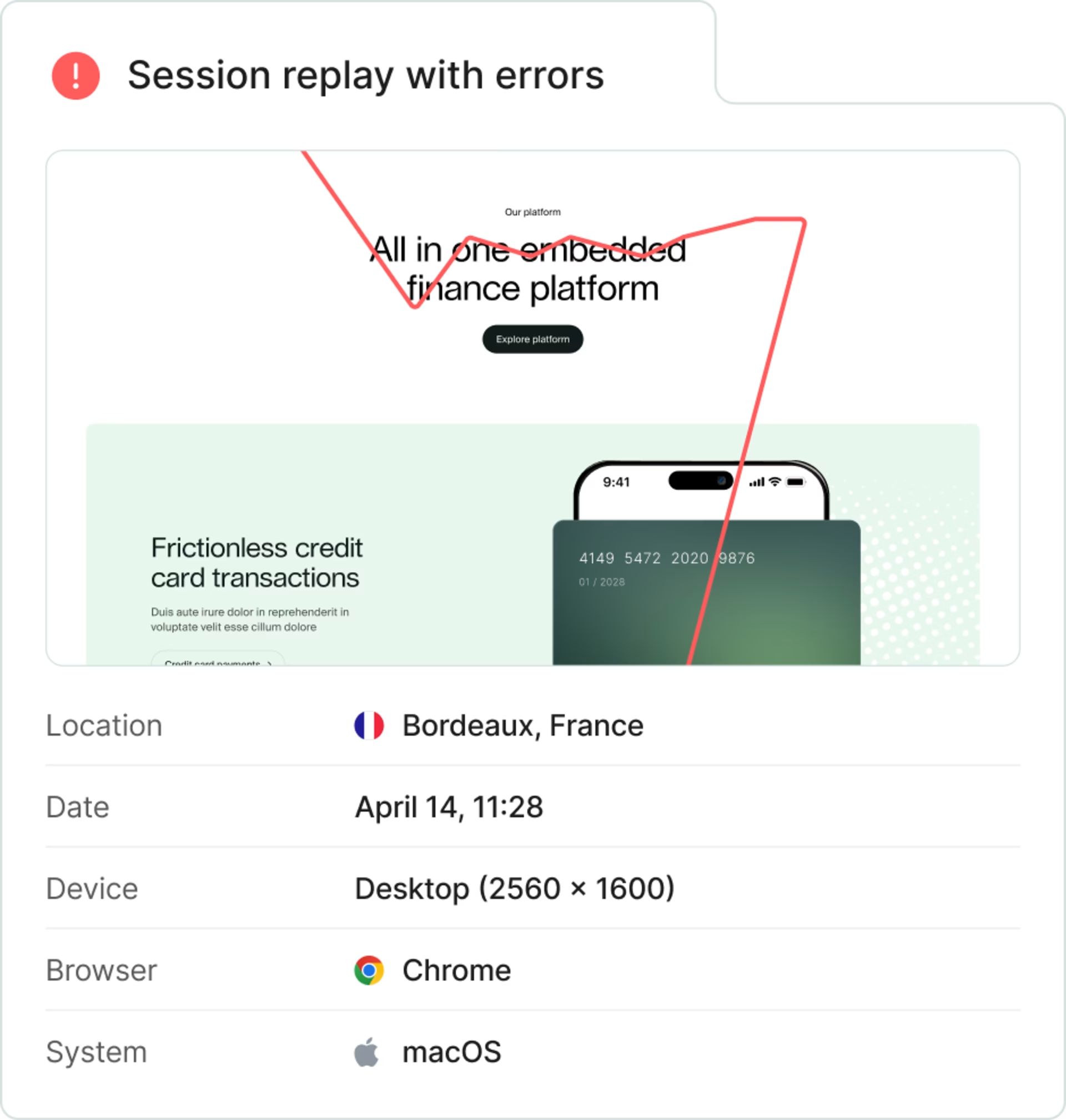

Review user sessions: use Contentsquare’s Session Replay and Error Analysis capabilities to see exactly where—and why—users struggle, revealing friction points that could drive them toward competitors

Contentsquare’s Session Replay capability shows you exactly what the user was doing when they experienced friction or frustration

3. Conduct competitor analysis and market research

With your internal baseline established, the next step is to gather external data on competitors and market trends. This involves analyzing quantitative and qualitative insights—like industry reports, user feedback, and competitor websites—to build a holistic view of the current landscape.

Extending your view to the broader market helps you uncover more top-level insights that internal analytics might otherwise miss, like industry-wide pricing trends, competitor messaging tactics, and changing customer needs.

For example, you might learn through user interviews that customers choose a competitor's product not because of its superior features, but because of its pricing structure or the quality of its customer support.

Tools and strategies to conduct competitor analysis and market research

Study competitor positioning: examine industry benchmark reports, pricing models, and competitor messaging

Go deeper with one-on-one user interviews: have in-depth conversations with customers to uncover the why behind their decisions. Find out what draws them to competitors, which features truly impact their experience, and where they see gaps that no solution currently addresses.

Validate interview learnings at scale: use Voice-of-Customer (VoC) tools like feedback widgets and exit-intent surveys to see if interview insights reflect broader user sentiment. For example, if users say a competitor’s product is easier to navigate, add a quick poll after key journeys to ask if they had trouble finding what they needed.

🔥 Pro tip: strengthen your market research with smarter participant targeting.

The quality of your market research depends on who you’re talking to.

Use Contentsquare’s Interviews capability to recruit from a global pool of over 200,000 participants and filter by demographics, behaviors, or product familiarity to ensure you're hearing from the right voices.

Whether you're exploring competitor perceptions or validating feature gaps, this kind of targeting helps you surface insights that reflect your actual market.

![[Visual] recruit user interviews](http://images.ctfassets.net/gwbpo1m641r7/1jtyKwfvr0FkPQ8L5tTnuc/47b69004fa7e6d5f826f2a37226c1e6c/CSQ-recruit-user-interviews.png?w=1920&q=100&fit=fill&fm=avif)

Contentsquare’s Interviews capability lets you recruit and interview members of your target audience to capture focused market research insights

4. Analyze and compare your results

With both internal and external data in hand, it’s time to dig into your findings and convert them into actionable insights. This step involves revisiting your original goals, stacking your performance against competitors’, and looking for patterns that highlight clear opportunities for differentiation.

Comparing your product’s strengths and weaknesses to those of your competitors helps you determine which improvements will have the greatest competitive edge. For example, you might find that your product’s functionalities already align with customer needs—but a competitor’s advanced customization tools set them apart, signaling an opportunity to refine personalization features.

This process also challenges assumptions and secures stakeholder buy-in, ensuring decisions are based on data rather than intuition.

Tools and strategies to analyze your results

Segment for precision: break down your analysis by user segments (new vs. returning, mobile vs. desktop, geographic location) to see how different audiences value certain features—and then tailor your strategy for your most valuable segments

Search for untapped opportunities: identify where pricing, placement, or promotions could drive higher conversions using Contentsquare’s Merchandising capability

Contextualize competitive data: use Contentsquare’s Benchmarks capability to evaluate your findings against key performance indicators (KPIs) and industry benchmarks to focus on high-impact areas, like global retailer Cotton On Group did below

🔍 See it in action: how Cotton On Group used Contentsquare to catch up to—and then outpace—its key competitors.

Cotton On Group, a retail powerhouse operating 5 major brands across 17 countries, was struggling to keep pace with a quickly changing retail market. Without clear insights into market trends and competitor performance, they often found themselves making decisions in the dark—resulting in missed opportunities, ineffective marketing campaigns, and an inability to differentiate from competitors.

Using Contentsquare's Benchmarks capability, they unlocked real-time competitive intelligence, which helped them:

Track key metrics like conversion rates, product popularity, and customer behavior compared to competitors through a live dashboard

Identify specific areas where competitors were outperforming them, particularly in site navigation and category merchandising

Make strategic decisions to adjust marketing campaigns, product offerings, and website features based on industry trends

This not only helped Cotton On Group attract new, higher-value customers but also retain existing ones, driving higher revenue, customer lifetime value (CLV), and customer satisfaction.

5. Prioritize and apply competitive opportunities

Once you’ve analyzed your findings, the next step is to determine which competitive insights warrant immediate action. This is especially important for teams with smaller budgets or businesses with limited resources.

While your research likely uncovered numerous competitive gaps, not all will deliver equal value. The goal here is to identify the opportunities that will make the biggest impact on customer experience and business performance—and then begin applying those changes in a focused, measurable way.

For example, your research might show that competitors heavily promote an offline mode, making it tempting to add to your roadmap. However, analysis reveals this would only benefit 3% of your current users—compared to say a 25% increase in conversions if you streamlined your checkout process. In this case, implementation should prioritize the higher-impact opportunity.

Tools and strategies to identify and prioritize competitive opportunities

Rank by impact: use tools like Contentsquare’s Impact Quantification and Frustration Scoring to pinpoint the friction points costing you the most conversions—so you can prioritize fixes that close performance gaps exposed in competitor comparisons

Focus on high-impact site elements: use Contentsquare’s Zoning Analysis to see conversion and revenue attribution for individual page elements—like CTAs, banners, or product cards—so you can optimize the parts of the page that matter most for driving conversions

Test and implement changes: once you’ve identified a potential competitive opportunity—like a clearer CTA, updated button placement, or a redesigned feature—run A/B tests to see which version performs the best. Then, roll out the winning version to your broader audience to apply the change with confidence.

🔥 Pro tip: supercharge your A/B testing systems with Contentsquare.

A/B testing tools tell you which version of a feature, page, or experience performs better—but it doesn’t always explain why.

This is especially crucial when evaluating competitor-inspired changes. Simply replicating a feature or offering without understanding its impact leads to wasted resources and frustrated customers.

Contentsquare bridges that gap by providing qualitative insights that add context to test results and support data-driven decision-making.

Integrating Contentsquare into your testing workflow lets you

Compare heatmaps and session replays for control and test variants to see how user behavior changes and whether competitor-driven updates truly improve engagement

Link customer feedback and survey responses directly to A/B test sessions, helping you uncover the why behind preference shifts

Analyze impact on KPIs like conversions, revenue, and engagement, so you can prioritize competitive changes that drive real business outcomes

![[Visual] Side-by-side analysis Heatmaps](http://images.ctfassets.net/gwbpo1m641r7/3xBZNtb3Ie4QoEXjvcUSsE/64ab8e4a40407ee56f7b98b87289b473/Side-by-side_analysis__1_.png?w=3840&q=100&fit=fill&fm=avif)

Comparing heatmaps gives you more relevant insights during your A/B tests

6. Continuously iterate, improve, and monitor

Competitive product intelligence isn’t a one-time effort; it’s a continuous cycle of monitoring, adapting, and refining.

Continuously tracking target market trends, competitor activity, customer expectations, and the impact of your own optimizations helps you spot emerging trends early. This ensures that your strategy remains proactive, data-driven, and aligned with real-world user behavior.

As Ulf Sthamer, UX Design Lead at SBS Australia explains, “Your audience is different. You can’t just copy what a competitor is doing—because you don’t know if they have a new feature in the pipeline or if constraints shaped their decisions. It’s always better to test for yourself."

Tools and strategies to iterate, improve, and monitor

Use predictive analytics: leverage AI-powered insights to predict customer behavior and anticipate performance issues before they escalate

Validate ongoing improvements: regularly conduct user tests to assess the effectiveness of recent changes, uncover unexpected friction points, and ensure updates continue to meet evolving user preferences

Stay up-to-date with benchmarks: use Contentsquare’s Benchmarks capability to track market trends and competitor performance, so you can adapt your strategy in real time and stay ahead of industry shifts and user expectations

Set up alerts: configure real-time alerts with your team’s workflow tools (like Slack or Jira) so you can act quickly on emerging trends or changes in user behavior

![[Visual] api errors](http://images.ctfassets.net/gwbpo1m641r7/653rSu9QkCs6jIS6ZGBSyt/b6e3222ac3c3ceecb22b577538ef1a04/api_errors.png?w=1920&q=100&fit=fill&fm=avif)

Get notified of error rate anomalies on your website by setting up real-time alerts

Competitive product intelligence starts with knowing your customers

At its core, competitive product intelligence is about understanding your customers better than anyone else. While competitors will continue to evolve, the real advantage lies in how well you listen, learn, and adapt to shifting user needs. Companies that commit to continuous improvement—not just one-time competitive analysis—are the ones that build lasting customer loyalty and market leadership.

FAQs about competitive product intelligence

Competitive product intelligence is the process of gathering, analyzing, and leveraging insights about competing products to refine your own offerings. It helps companies understand feature gaps, pricing strategies, user experience differences, and market trends—allowing them to make smarter, data-driven product and business decisions that drive adoption and retention.

![[Visual] Competitive product analysis](http://images.ctfassets.net/gwbpo1m641r7/5KKQOOjvDBCQtGIQCFnGgE/1c07d3d5527db0fe1c5f6c5476a8beb1/AdobeStock_846417258__1_.png?w=3840&q=100&fit=fill&fm=avif)

![[Visual] Contentsquare's Content Team](http://images.ctfassets.net/gwbpo1m641r7/3IVEUbRzFIoC9mf5EJ2qHY/f25ccd2131dfd63f5c63b5b92cc4ba20/Copy_of_Copy_of_BLOG-icp-8117438.jpeg?w=1920&q=100&fit=fill&fm=avif)