It’s nearly impossible to give customers a smooth digital banking experience when know-your-customer (KYC) records, transaction logs, service history, and behavioral data live in separate systems.

This setup forces teams to make decisions in isolation, instead of collaborating around the full context of the customer’s experience. When that happens, users get a fragmented experience across digital banking channels, which is a sure-fire way to say goodbye to frustrated customers.

This article will look at some common examples of data silos in banking and financial services, including what they look like, why they happen, how they affect customers and institutions, and what you can do to overcome them.

Key insights

Siloed data prevents the complete view of a customer’s accounts, behaviors, and service history from being seen, causing banks to send mismatched offers that often frustrate more than entice.

Contentsquare’s Data Connect automatically pulls customer experience and error data into your warehouse (Snowflake, BigQuery, or Amazon Redshift), so you can combine it with CRM, support records, and other departmental data to see the full story—where customers got stuck, why issues happened, and how to fix the issue

Connecting interactions across all digital channels into a single journey view means teams can spot friction quickly and act fast to prevent churn

Using collaborative features in your behavioral analytics platform—like dashboards and shareable video replays—ensures every team works from the same customer insights, making it easier to align on what to fix

6 real examples of data silos in banking (and how to fix them)

According to The Personal Bank survey by The Harris Poll, just 22% of the 1,500 digital banking users surveyed feel their bank knows them well enough to make relevant suggestions, while 74% are comfortable with banks using their data to create more tailored experiences.

So how do banks make their customer journeys feel more personal? By combining financial records, transactional data, and behavioral patterns to get a holistic view of the customer. This foundation also helps banks advance in data maturity—from simply reporting on what happened to predicting what will happen and turning those insights into smarter, data-driven decisions.

But first, you need to identify data silos in your current setup and break them down. Here are 6 common data silo examples in banking—and what you can do about them.

1. Product silos

The issue

Product silos in banking show up when each line of the business—such as checking, savings, credit cards, loans, or mortgages—keeps its customer data separate, instead of combining it into a single profile.

This normally happens because banks tend to set up their internal systems around products, not people. A savings account might run on one platform, mortgages on another, and credit cards on a different one altogether, with little or no integration between them.

As a result, updates to customer details in one product line don’t always carry over to others. For example, a customer might update their phone number on a savings account shortly after onboarding, but the mortgage team still calls the old number because their system never got updated.

Sometimes this silo also forms along geographical lines, where data from one branch or region isn’t easily accessible to another. So if a customer moves cities, they may have to resubmit documents because the new branch can’t access updates from the old one.

This kind of disconnect frustrates customers, which in turn weakens their relationship with the bank. Meanwhile, teams waste hours manually reconciling records that should update automatically across systems.

The fix

Pull all customer data from checking, savings, loans, credit cards, and mortgages into a data warehouse (Snowflake, BigQuery, or Amazon Redshift) to create a single customer profile. Then set up real-time integrations—through APIs or streaming tools like Kafka—so that updates flow automatically across all platforms and regions.

Contentsquare’s Data Connect builds on this by exporting crucial behavioral, error, and product data directly into your data warehouse of choice. With this setup, every department gets a quantitative and qualitative view of the customer to make recommendations that fit their actual needs. This strengthens the overall customer relationship and frees up time for analyst teams to focus on higher-value work.

2. Channel silos

The issue

Channel silos happen when customer interactions on web, mobile apps, call centers, and branches are managed in separate systems instead of being linked together.

This type of silo often exists because of how customer touchpoints in the banking industry have evolved. Branches and call centers were the original touchpoints before customers moved online, with banks rolling out web portals, mobile apps, and eventually chatbots to meet rising expectations. Since each channel was introduced at a different time—and often with its own system—many banks never fully connected them, making it hard to see the full customer journey in context.

For example, a bank may not realize the same customer who started an application online later called support and then sent a message on Instagram. Without a clear way to connect these interactions and view the full journey, the customer gets frustrated repeating themselves, while teams miss patterns across channels that could reveal recurring pain points and fix them proactively.

The fix

Connect customer interactions across all your digital banking channels into a single journey view with Contentsquare’s experience intelligence platform.

That way, if someone applies for a loan on the website, pauses to ask a question over chat, and then completes the application later in the mobile app, your teams see it as one journey instead of 3 disconnected events.

Then, use customer behavior data to spot where people get stuck, so you can fix issues before they churn. That’s exactly what NatWest, one of the U.K.’s largest retail banks with 19 million customers, did. To bridge gaps across its digital channels, its digital experience team built an end-to-end testing model and integrated Contentsquare into it.

Using capabilities such as Journey Analysis, and Session Replay, paired with Contentsquare’s AI, Sense, they uncovered friction points across the entire journey, understood why customers were dropping off, and made changes based on those insights.

![[Visual] Journey Analysis visualization of NatWest’s Youth Savings page, showing a high exit rate](http://images.ctfassets.net/gwbpo1m641r7/6dcARUJSzSYGLP5lIUDDDi/92e959056b80beb07e6c19c127f1a287/Journey_Analysis_visualization_of_NatWestâ__s_Youth_Savings_page__showing_a_high_exit_rate.png?w=3840&q=100&fit=fill&fm=avif)

Journey Analysis visualization of NatWest’s Youth Savings page, showing a high exit rate

The improvements fixed a major pain point in the mortgage journey on the web and made the savings journey smoother in the mobile app—boosting completion rates and reducing drop-offs across their digital channels.

Given where these optimizations are in their respective funnels, the results have been huge for us. However, never resting on our laurels, we're always looking to improve the funnel even more.

3. Compliance silos

The issue

Compliance silos show up when fraud checks, KYC, or anti-money laundering (AML) systems run separately from the tools agents and relationship managers use to help customers.

This silo usually happens because fraud and compliance tools are kept on their own systems, separate from CRMs and support platforms. That setup helps protect sensitive data, but it also means the people talking to customers don’t see the same alerts the back-office teams do.

Say a customer’s card gets declined while shopping online because the fraud team flagged the transaction as suspicious. When they contact support, the agent can’t explain why or what to do next—so the issue gets escalated and the customer faces longer wait times.

Or a relationship manager is handling a credit card dispute without realizing the same customer is also behind on a loan. Without that context, they may miss patterns of risky behavior, approve an action they shouldn’t, and expose the bank to fraud losses or regulatory penalties.

The fix

To break this silo, surface fraud, KYC, and AML alerts directly in the tools your customer-facing teams already use. Put role-based access controls in place so support agents, relationship managers, and compliance officers only see the level of detail relevant to their role. For example, agents see a high-level fraud alert with clear action steps to guide customers, while compliance teams access full case details with audit trails. This prevents data governance issues while streamlining decision-making.

4. Department silos

The issue

Department silos are one of the most common data silos examples in banking, as every team usually manages its own tools and data separately, without sharing across the organization. Without a process or platform to connect those systems, the information stays stuck in one department.

For example, marketing knows which campaigns a customer responded to, product sees how they’re using the app, and support teams have detailed ticket history—but each team keeps that data in different systems.

As a result, customers get conflicting communication—like being offered an upgrade right after complaining about pricing—which makes them feel unseen. Teams, on the other hand, miss opportunities to act on the bigger picture, which means fixes or optimizations that could actually reduce churn and keep customers loyal aren’t seen.

The fix

Instead of trying to shift every department onto the same platform, focus on choosing one that makes it easy to collaborate and share insights across teams.

Contentsquare makes it easy for every team to work off the same data, even if they don’t have an account. Collaborative features and saved collections make insights accessible across departments.

For example, if support notices a spike in complaints about loan applications, they can share a session replay link with data analytics, product, UX, or marketing—even if those teams don’t have a Contentsquare account. Everyone can watch the exact customer journey, see where people got stuck (like an error loop in the application form), and work together on a fix.

![[Visual] Sharing a replay allows teams to share recorded customer sessions with others through a simple URL](http://images.ctfassets.net/gwbpo1m641r7/263G1xx64VTCpx7oAx8ACD/e9d6a66344265d08e70b84cbfbad9269/Sharing_a_replay_allows_teams_to_share_recorded_customer_sessions_with_others_through_a_simple_URL.png?w=3840&q=100&fit=fill&fm=avif)

Sharing a replay allows teams to share recorded customer sessions with others through a simple URL

Sharing data can also help bring teams like legal on board when they need proof to make informed decisions. That’s what the digital team at Leeds Building Society did.

They noticed product pages weren’t converting, with visitors looping between product and home pages, scrolling past long blocks of legal text, and missing key details. Legal was hesitant about simplifying the legal content, but once the team showed session evidence of what customers were actually doing, they got the green light.

The redesigned pages, along with a new comparison tool, resulted in a +40% increase in the average conversion rate, with some pages experiencing up to an +80% increase.

5. Vendor silos

The issue

Vendor silos happen when data from third-party providers—like payment processors, credit bureaus, insurance partners, or fintech integrations—sits in separate portals instead of being connected to the bank’s core systems.

This silo shows up because external vendors give banks their own dashboards and feeds, but without integration, those insights stay locked away. As a result, customer-facing teams can’t see vendor data alongside internal records.

For example, if a credit bureau update doesn’t reach your system on time, a loan officer might not see the latest score and the application gets delayed. Or if a payment processor flags a transaction, a support agent may not know whether the issue came from the bank or the processor—leaving the customer waiting while the team investigates.

The fix

To break down this silo, use API integrations or ETL tools to pull in external feeds—like credit scores, payment approvals, or insurance updates—so they show up right alongside your own customer records. Then surface that data in shared dashboards or CRM tools, so staff don’t waste time jumping between vendor portals or guessing where an issue started.

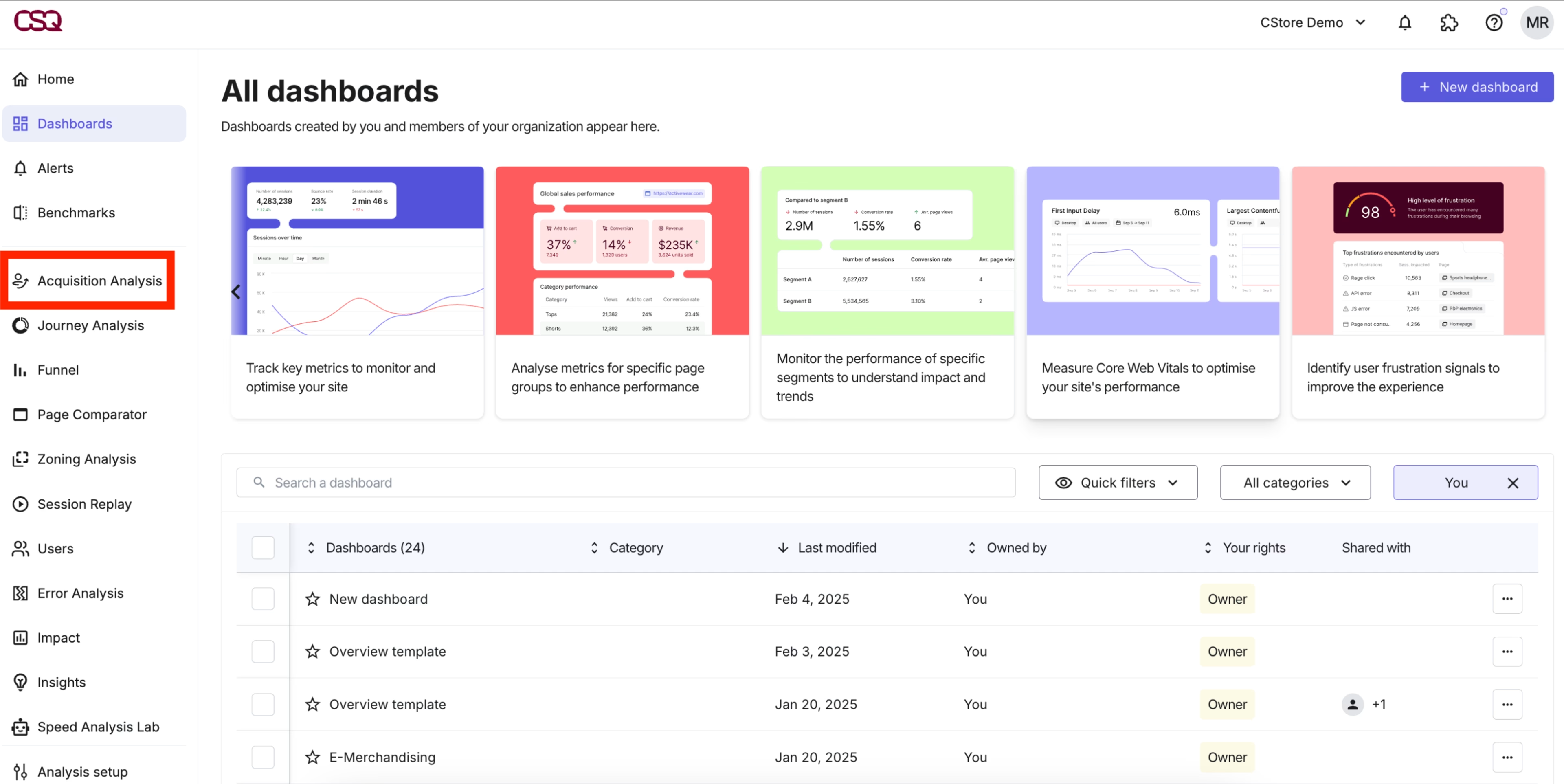

💡Did you know? You can build dashboards in Contentsquare to monitor core website and in-app metrics like sessions, bounce rate, views per session, time on site, and conversions alongside behavioral signals like clicks, scroll depth, navigation paths, error events, and drop-offs, all in one place.

Dashboards give you a high-level overview of your most critical metrics in one place

You can take it a step further with Contentsquare’s Data Connect capability, which lets you export experience, error, and product data into your data warehouse (Snowflake, BigQuery, or Redshift) and analyze it alongside external datasets like credit scores, transaction logs, or user account data.

This way, your teams see exactly what users did before a failed payment or application drop-off—such as abandoning a payment flow or hitting user interface (UI) errors—and uncover what triggered the issue. With this context, your teams can dig deeper and fix problems proactively to prevent churn.

6. Legacy system silos

The issue

Legacy system silos are another common data silo example in banking, especially for traditional institutions moving their operations online.

They happen when banks rely on old mainframes or systems that don’t talk to modern tools. Because these outdated cores weren’t built for APIs or real-time updates, data gets stuck in different systems.

As a result, teams end up spending more time patching and maintaining these outdated systems than improving the customer experience, with customer-facing teams unable to easily get the information they need to serve customers. In some cases, outdated records also make it harder to stay compliant with regulatory requirements that require accurate, up-to-date customer information.

The fix

Bring both old and new customer records—like account details, credit scores, or demographics—into a single data warehouse, stored alongside newer information. Then integrate behavioral analytics signals, such as page drop-offs, error events, or form abandonments, to see how people interact with those records.

For example, you might discover applicants with certain credit profiles abandon loan forms more often because outdated validation rules block them from moving forward. Once you spot patterns like these, you can address the issues immediately, even while long-term system upgrades are still in progress.

Break silos by bringing all your data into one place

Data silos, regardless of the type, keep teams working with only half the picture. Customers feel it through slow service, repeated questions, or offers that aren’t related to their needs. Inside the bank, it shows up as delays, duplicate work, and missed opportunities.

The first step to breaking down these silos is to consolidate data from all the different systems into one place, so every team has a single source of truth. With that full context, teams can share insights to resolve issues faster and give customers the smooth, consistent experience they expect.

Contentsquare makes insights accessible to everyone through collaborative features like shareable replays and saved collections, plus its AI, Sense, which helps teams quickly surface the patterns they might otherwise miss.

This way, support, UX, marketing, data, and product management teams can all work from the same evidence and act faster—without relying on second-hand reports.

FAQs about data silos in banking

Data silos in banking happen when customer information is stored in separate systems that don’t connect with each other. For example, a bank might keep loan records in one platform, credit card data in another, and branch interactions in a third. Because these systems don’t share data, teams don’t have the same data access and view. So, customers are treated as a different person in each system, rather than having a unified relationship.

![[Stock] CRO Cart abondoment Stock photo](http://images.ctfassets.net/gwbpo1m641r7/7fFJ2IkPNULSfMm7GJ3Gwu/c2d807aa55f9593f17d4c65d13be31f4/5961638.jpg?w=3840&q=100&fit=fill&fm=avif)

![[Visual] Contentsquare's Content Team](http://images.ctfassets.net/gwbpo1m641r7/3IVEUbRzFIoC9mf5EJ2qHY/f25ccd2131dfd63f5c63b5b92cc4ba20/Copy_of_Copy_of_BLOG-icp-8117438.jpeg?w=1920&q=100&fit=fill&fm=avif)