The company

NatWest is one of the largest retail banks in the U.K., with over 19 million customers who rely on the company for banking services, loans, credit cards, and mortgages.

Ollie Mitchell, Digital Experience Manager at NatWest, and his colleagues act as an internal conversion rate optimization (CRO) agency, partnering with product teams to help personalize and improve their digital customer journeys.

A self-professed “internal Contentsquare cheerleader”, Ollie heavily promotes the use of Contentsquare’s Experience Intelligence platform across NatWest to drive efficiency and enable everyone across the business to make data-driven decisions. With unlimited Contentsquare user licensing, Ollie has helped grow the number of users by 50% between H1 and H2 2023.

We want the product teams to be as skilled in their respective areas as we are, and a large part of this is making sure they're fully utilizing the analysis suite that we have, of which Contentsquare is a huge part.

The challenge

NatWest had been using Contentsquare for a while, but usage across different teams wasn’t where Ollie aspired it to be. According to him, “people understood the value of the platform, they just hadn’t created the habit of using it regularly.”

Ollie, his team, and the wider digital optimization team partnered with NatWest’s product teams to provide them with optimization expertise.

The long-term goal is to integrate Contentsquare across the business and use it to solve existing problems in their digital customer journeys.

The solution

To optimize its customer journeys, NatWest built what Ollie calls its “end-to-end testing model” and has incorporated Contentsquare within that model by

Using it to monitor key performance indicators (KPIs) and surface opportunities for customer journey improvement

Using Contentsquare’s Heatmaps, Session Replay, and Journey Analysis capabilities, as well as Contentsquare's AI, to uncover insights and surface issues

Using customizable dashboards to monitor A/B tests and analyze results

By building Contentsquare into this end-to-end testing model, NatWest has been able to achieve some very powerful customer journey optimizations, including:

1. Optimizing the mortgage applications journey

The NatWest mortgages team noticed a high drop-off rate in their online mortgage application journey.

AI insights showed that most of the drop-offs were happening on the mortgage detail page, where 2 input fields were stopping visitors from moving on to the next page.

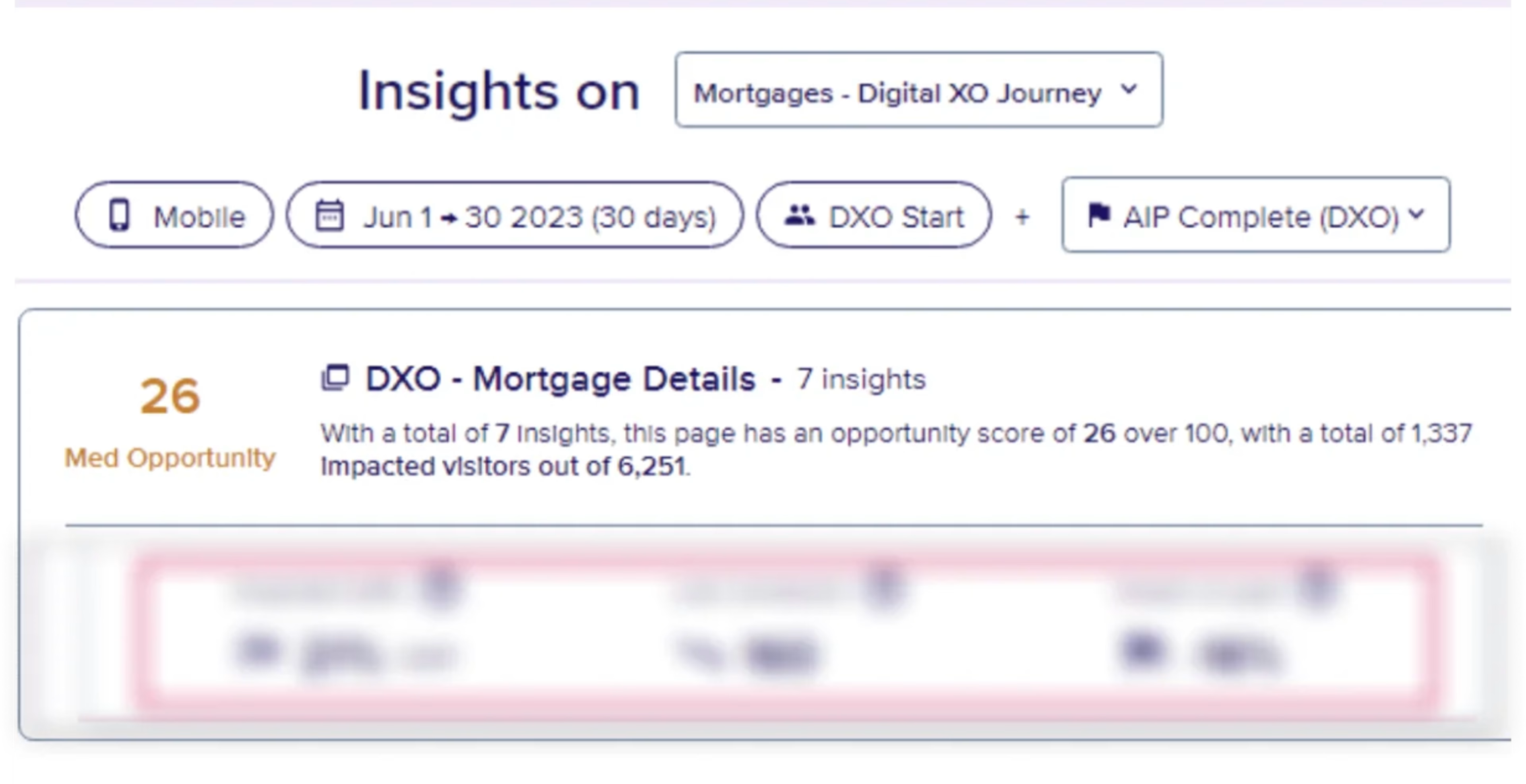

Contentsquare’s Sense showing optimization opportunities on NatWest’s mortgage applications page

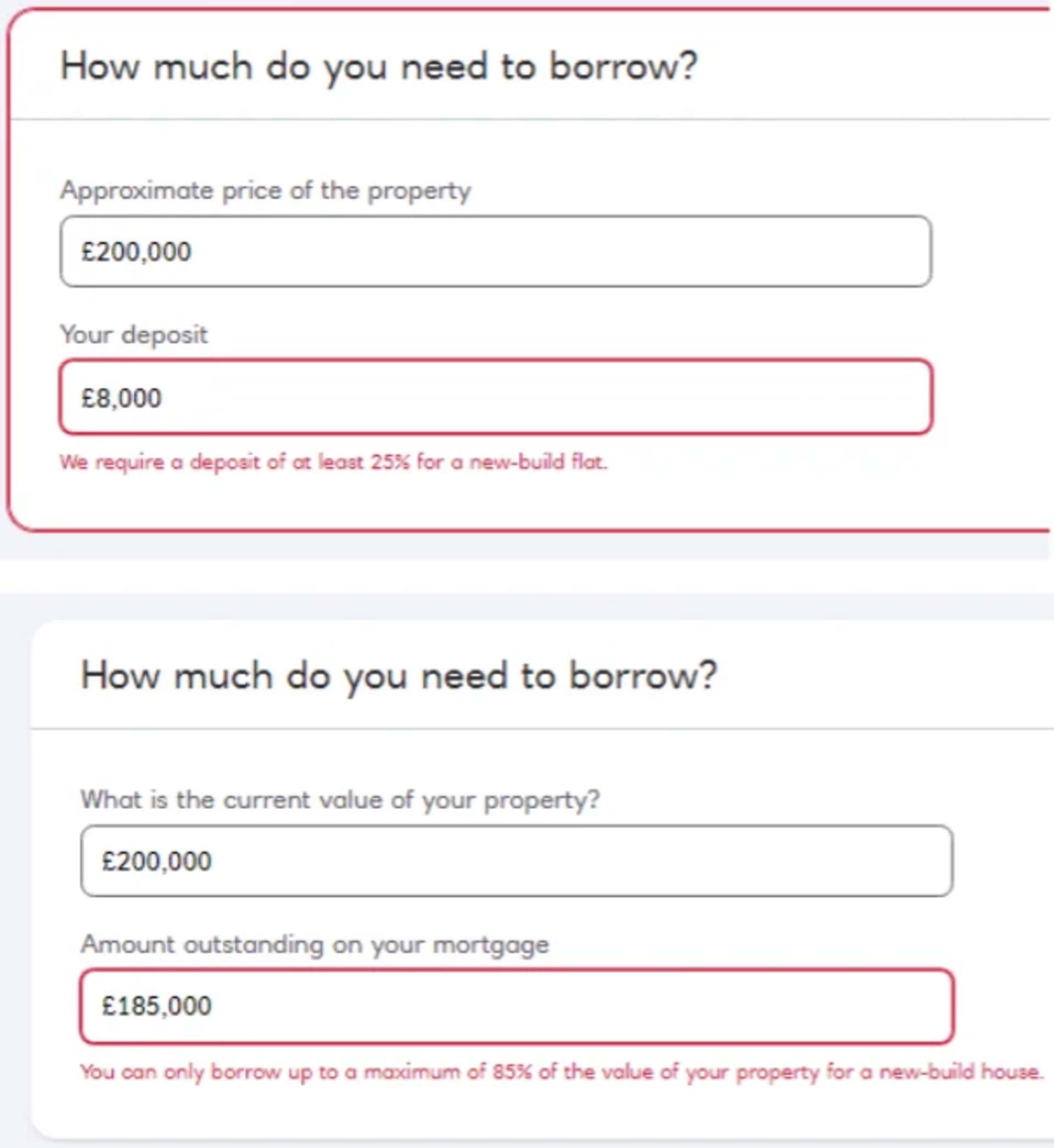

The team then used Session Replay to understand the behavior of users who left the page. They noticed that visitors on mobile devices were getting the same validation error when entering approximate property prices and deposit percentages.

Mobile users were getting the same validation error on NatWest’s mortgage application form

Users weren’t able to see the ‘Continue’ button at the bottom of the page without scrolling. They would enter numbers the page wouldn’t accept, then scroll to find they were unable to continue before scrolling back to try the input field again. This was creating friction in the user experience.

To solve this problem, the team enabled an auto-scroll feature. Once a visitor had inputted an acceptable number, they jumped right to the bottom of the page where they could click 'Continue'.

This resulted in a significant increase in visitors reaching the next stage of their journey.

2. Improving the NatWest mobile app savings experience

Analysis in Contentsquare’s Page Comparator feature—part of the platform’s Experience Analytics product—revealed a high exit rate on NatWest’s mobile app savings hub page. While this wasn't unusual, the team noticed that visitors were scrolling far down the page before leaving.

“So these weren’t pure bounces with people opening the page and leaving right away,” Ollie says. “Instead, visitors were coming in, digesting most of the content and then leaving. So they were looking for something that the page wasn’t providing them.”

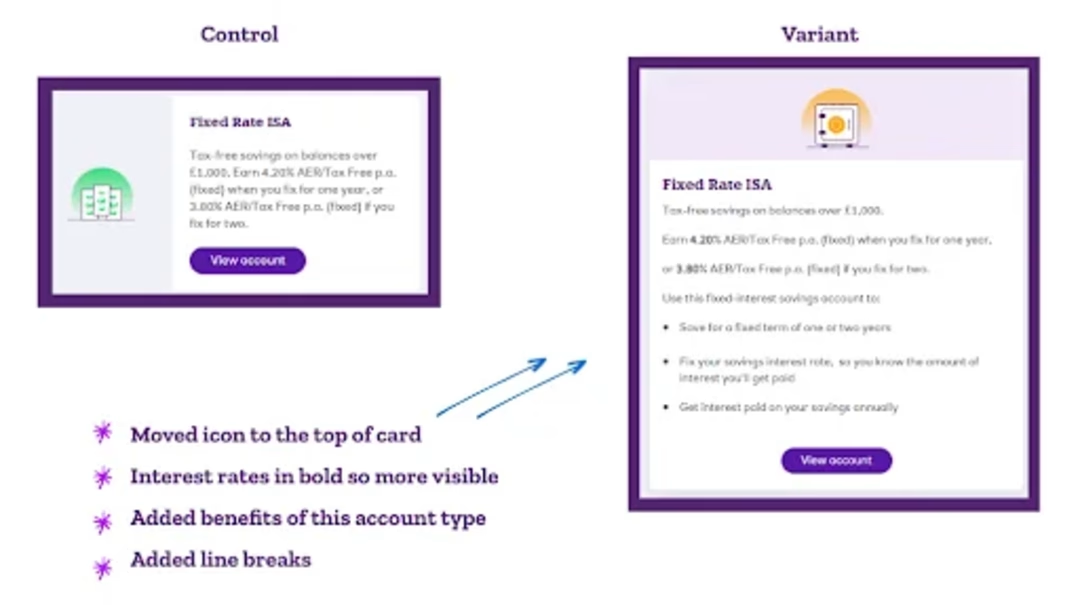

NatWest’s A/B test on the mobile app savings hub page

The teams hypothesized the hub page design didn’t have the key information visitors wanted. They A/B tested a variant Fixed Rate ISA card on the page with scannable and digestible content.

The result was a significant uplift in visitor-to-application completion rate.

“It might not sound like much, but given the high volumes of people we get through these pages, that uplift represents huge value for us,” Ollie explains.

All sections of the new variant also have a higher attractiveness rate, with customers able to find products on their first attempt without getting stuck in a loop.

3. Boosting the application rate on a youth savings product

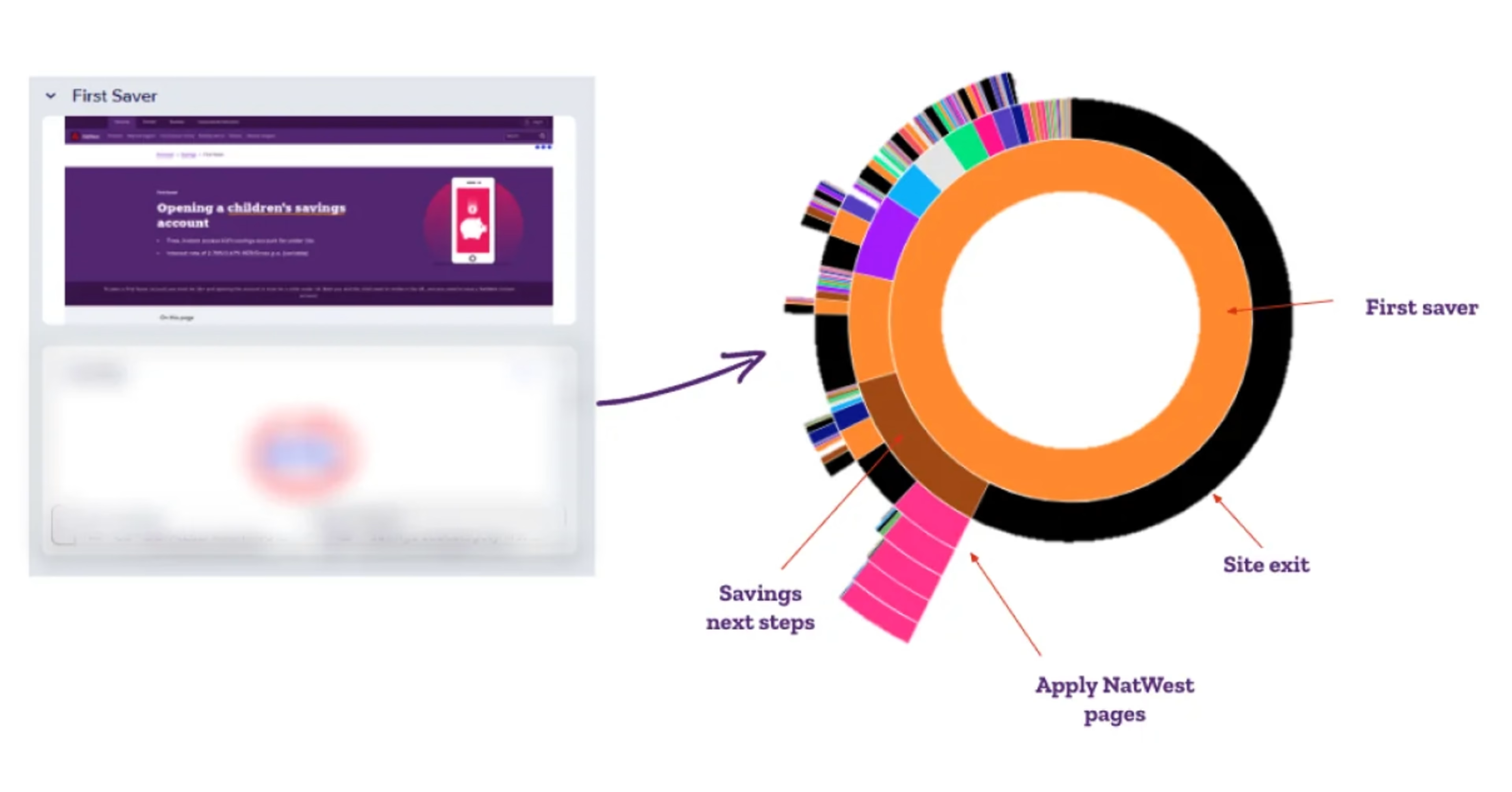

Using Contentsquare’s customizable dashboard, featuring the Journey Analysis capability, NatWest identified its youth savings product page was struggling with a high exit rate. Further analysis showed a high drop off from the hero image and that visitors weren’t reading the ‘Apply Now’ button.

Contentsquare Journey Analysis of NatWest’s Youth Savings page showing a high exit rate

“This is the CTA we really wanted people to click on, and yet on some devices, you couldn’t even see it until you scrolled below the fold, so we were really missing a trick there,” Ollie says. The team A/B tested a page variant without a hero image but with more added key benefits and interest rate information.

This optimization of content and on-page navigation resulted in an uplift in visitor-to-application completion rate. The new variant also reduced the drop-off of the previous page, inspiring the teams to continue optimizing.

The results

As a result of using Contentsquare, NatWest has been able to optimize its customer journeys across several key retail banking services.

Given where these optimizations are in their respective funnels, the results have been huge for us. However, never resting on our laurels, we're always looking to improve the funnel even more.

— Ollie Mitchell, Digital Experience Manager at NatWest