How NatWest optimized its mortgage calculator tool to drive an additional £500k per annum

"

Contentsquare is at the heart of our decision-making process. Since it’s been introduced to the bank, it has rapidly become a key tool for prioritizing wins for the business and for the customer. Without it, we would have missed a lot of opportunities.

It has more than paid its own way and I’m sure it will continue to do so."

Nathan King

Digital Experience Manager

The Context

The NatWest Mortgage Calculator Tool is a crucial first step in helping customers on their home buying journey, enabling users to get an agreement in principle (AIP) online.

With over 2.5m completions in the tool each year, AIPs are the lifeblood of NatWest’s mortgage business. Even incremental increases in completion rates could hugely impact performance, so it was important to remove as many UX frustrations as possible to increase the number of people completing an AIP online.

The Insights

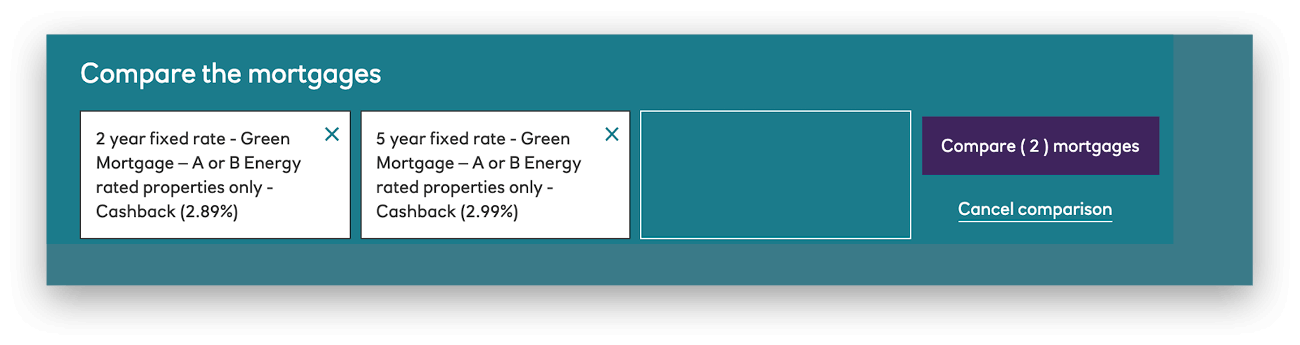

Contentsquare analysis into advanced customer behavior data revealed the ‘Compare’ functionality was only being used by 6% of customers. This highlighted an opportunity to replace the rarely used feature with a CTA to get an agreement in principle instead.

Contentsquare recommended relegating links to the "Compare" feature and instead increasing the prominence of the “Get an Agreement in Principle” CTAs throughout the journey.

The Solution

Thanks to Contentsquare analysis, the digital team at NatWest made the following changes:

- Shifting the "Add for Comparison" button across and instead adding a direct link to “Get an Agreement in Principle” next to the main CTA

2. Adding new product navigation for the "Apply" customer journey, with the primary CTA to “Get an Agreement in Principle”

The Results

- 20% increase in customers completing an AIP

- £500k estimated additional revenue