To provide understanding during this uncertain time, we are monitoring the impact of coronavirus on online consumer behaviors. See the latest data on our Covid-19 eCommerce Impact data hub.

As countries and cities open up again, or move to the next phase of their post-Covid plan, consumers everywhere are reconnecting with what it means to go into a non-essential store to make a purchase. We’ve been paying attention to digital shopping behaviors this past week (and since early March), to understand how the Coronavirus crisis has impacted online activity and businesses across industries.

We’ve analyzed more than 10 billion sessions — monitoring traffic, transactions and customer engagement — to see how the unfolding situation has affected digital business. To understand these changes, we’ve compared data from each week with the period immediately preceding the introduction of social distancing and store closures in the West (or, the first 6 weeks of the year, which we call the reference period).

This is what we observed this past week:

Traffic Goes Down For Fifth Consecutive Week But Transactions Remain Strong

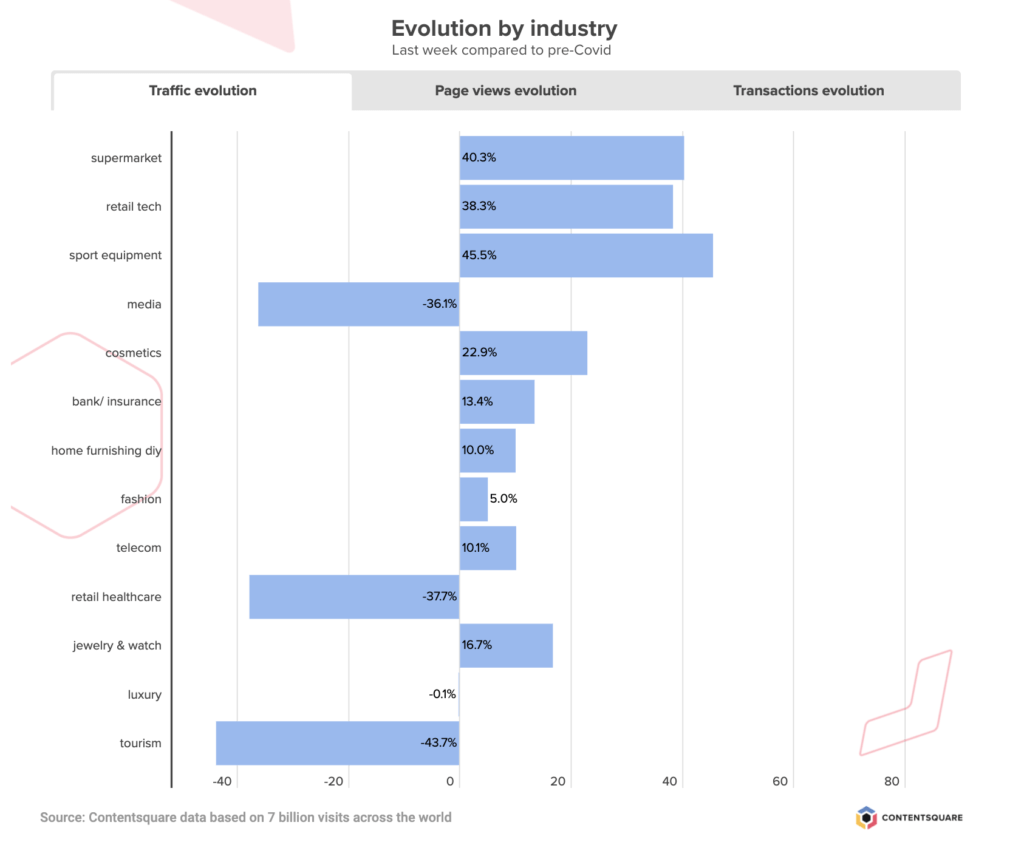

Global digital traffic has been decreasing steadily since mid-May (coinciding with the first wave of store reopenings in Europe), with a new -4% drop in the volume of visits this past week. This puts digital traffic today at +6% pre-Covid levels, although a breakdown by industry shows that some sectors are still seeing up to +45% more visitors than back in February.

Transactions however have not been dropping at quite the rate of digital traffic, with a -3% drop this past week, that does little to make a dent in the +29% transaction increase recorded since the onset of the crisis.

The UK is responsible for the greatest leap in the volume of digital transactions (+63%), while France and Germany have recorded slightly more conservative increases (+14% and +17% respectively). The US numbers are very aligned with the global average, with +28% more digital sales than before the introduction of quarantine measures.

Traffic to Fashion Sites Stabilizes As Pure Play Businesses Emerge Stronger

Traffic to Fashion Sites Stabilizes As Pure Play Businesses Emerge Stronger

Traffic to apparel sites remained steady this past week after several weeks of dwindling digital activity. Transactions were also stable, following a 40 point drop since late May, and the volume of digital sales today is +20% greater than it was before the crisis started.

We also compared traffic and transactions between click-and-mortar and pure play brands, and found that, since reopening, pure players (with no / limited retail) are experiencing more stability with their digital activity. Brands with physical stores are doing slightly better today than their online-only counterparts, but their volume of transactions has been decreasing steadily since late May, while pure play brands appear to be maintaining the increase in sales week on week. As of now it certainly looks like digital-only brands are emerging stronger from the Coronavirus crisis, particularly when you consider that for these storeless brands, extra traffic and transactions are net gains while for retailers the surge of online business was there to compensate for the drop of retail activity.

Grocery Sector Loses Traffic But Digital Sales Still Strong

Online grocery traffic continues on its downward trend, having steadily decreased since the massive surge in the third week of March and a more discreet peak in early April. This last week brought a -13% drop in the volume of traffic to grocery sites, but despite this latest decrease, the sector is still enjoying +40% more visits than before the first social distancing orders. And while transactions may have dropped -15% this past week, the global volume of online grocery transactions is still +58% higher than before the start of the crisis.

The breakdown by country reveals different dependencies on digital for food and household staples with France almost back at its pre-Covid levels of digital grocery transactions, the US at around +50% more, and the UK in the lead with more than double the number of sales. As other non-essential businesses open their doors, it will be interesting to see how a ‘return to normal’ shopping habits impacts the collective reliance on online grocery stores.

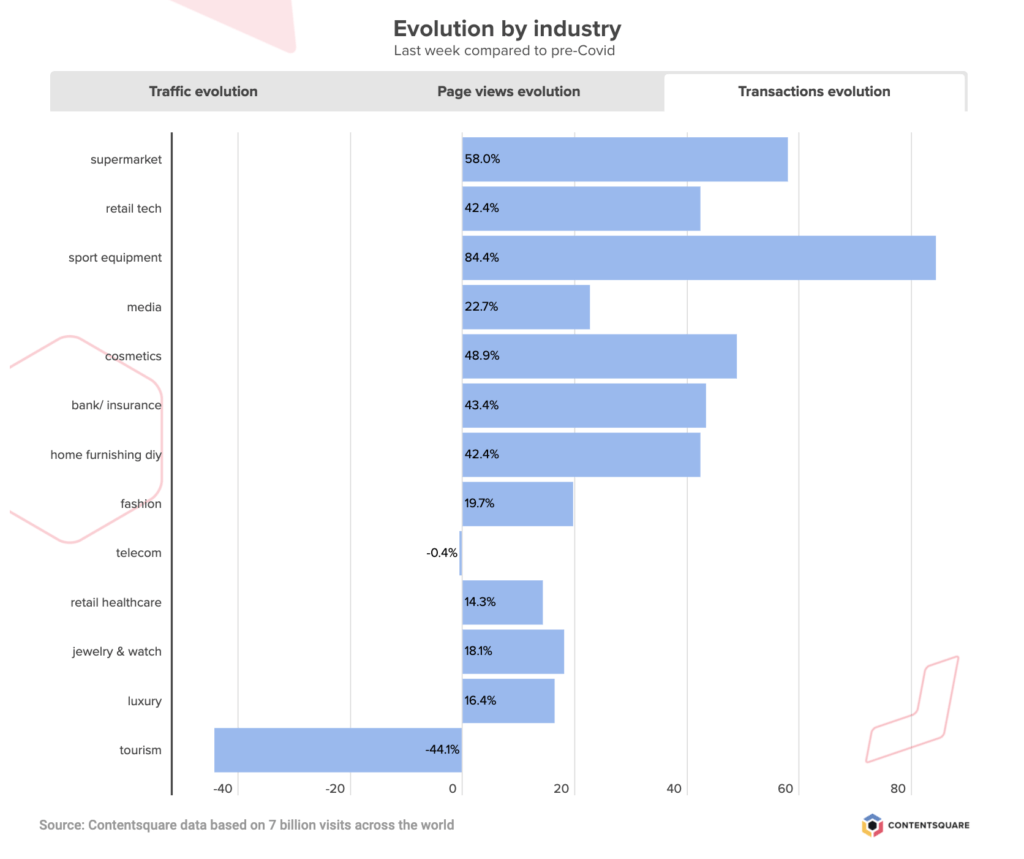

Tourism Sector Still On The Road To Recovery

Traffic and transactions on travel sites went up +7% this past week, marking another week of growth for the sector that has suffered the most since the start of the crisis. This latest positive chapter makes a small impact on the sector’s digital activity, and globally, travel sites are still experiencing -43% less traffic than it was back in February, and are recording -44% fewer transactions.

France is catching up faster than any other country we analyzed, and is today seeing -20% less traffic than it was before the start of lockdown and -25% the number of transactions. The US is the country that has suffered the biggest drop in visitors although interestingly, transactions are picking up faster in the US than in the UK, despite the UK boasting more traffic.

Have you registered for Summer Camp yet? We’ve put together a six-part series for adventurous experience-builders looking to capitalize on the summer months to fast-track their digital transformation. Join us for our next campfire session with Walmart, to explore common digital challenges and how best to tackle them (A/B Testing merit badge, anyone?).

Impact of Coronavirus on eCommerce: Online Engagement Still High As Many Sectors Record small decline of Traffic and Transactions (Update 15)

To provide understanding during this uncertain time, we are monitoring the impact of coronavirus on online consumer behaviors. See the latest data on our Covid-19 eCommerce Impact data hub.

Our team has been computing billions of user sessions over the past 16 weeks to share insights into how the unfolding Coronavirus crisis is impacting consumer behaviors across industries. Every week we look at traffic, transactions, and engagement data and compare the numbers with averages from the period immediately preceding the beginning of social distancing and quarantine in the West (or, the first 6 weeks of the year, which we call the reference period).

Here are some of the insights we surfaced this week:

Traffic And Transactions Go a bit Down But Online Engagement Remains Strong

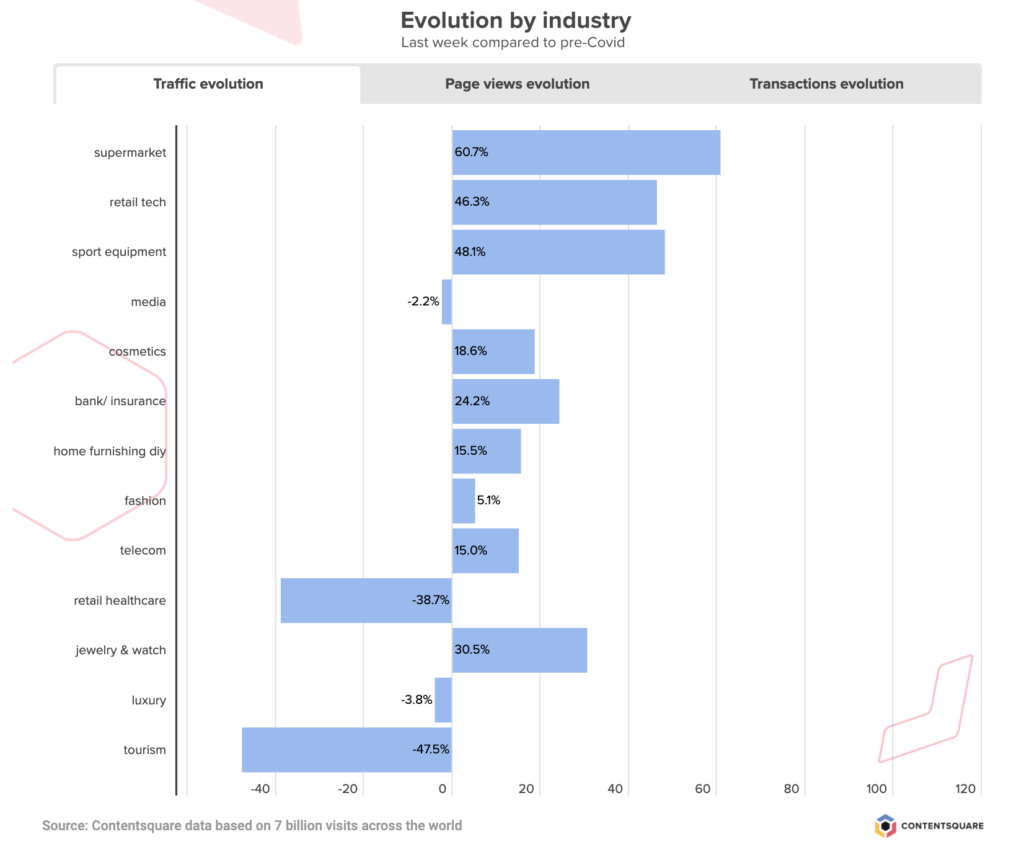

After a stable first week of June, eCommerce traffic and transactions dropped slightly this past week, with -4% fewer visits and a -3% decrease in transactions from the previous week. As stores reopen their doors to customers around the globe, digital customer engagement appears to be slowing down. Despite this, online consumer activity is still much, much higher than before the onset of the crisis, prompting many businesses to invest heavily in their digital operations.

The greatest increase in the volume of digital transactions is observed in the UK, where businesses are bringing in on average +67% more online sales than pre-Covid. In the US, this figure is +27%.

According to our latest data pull for the week ending 6/14, brands across industries are seeing on average +10% more digital traffic than they were back in January, and +33% more online transactions. Some industries — for example, sporting goods retailers or online supermarkets — are even seeing double the amount of transactions they are used to seeing. Other industries, such as travel, are of course dealing with the negative business impact of the pandemic, although recent weeks show positive — if slow — signs of recovery.

Online Grocery Sector Slows Down But Remains Stable in US

After an initial surge which saw regular volumes of traffic increase x3, the grocery industry continues to experience a slow but steady traffic decrease across the board (-10% drop this past week), although the breakdown by country tells different stories of consumer reliance on online grocery shopping.

The UK shows a pretty vertiginous drop since peak traffic at the end of March (from +440% down to +220% pre-Covid traffic levels), while the US has seen stable levels of digital engagement since the first week of April. Overall, traffic to grocery sites is still +61% higher than pre-crisis and the volume of transactions is +85% higher.

Consumer Electronics Sector Sees Slight Drop in Traffic And Sales last week

On the heels of two weeks of quick growth (traffic + transactions), consumer electronics retailers experienced a bit of a slowdown this past week, with traffic declining by -6% this past week and sales going down by -11%. Still, the sector as a whole is recording +46% more traffic than before the start of the pandemic, and +47% more transactions.

In the US, consumer engagement in this sector has been steadily going down since late April, with surges in the UK and France majorly impacting growth.

Tourism Still On The Up And Healthcare Retail Sees Gains Too

After taking the biggest hit of all industries, the travel and tourism sector continues to see its customers’ digital activity climb, with +7% more traffic this past week compared to the last, and +11% more transactions. These recent increases mean the industry as a whole is now closer to half its pre-Covid traffic and transactions levels — although it is important to note that our reference period, in January, would have different averages than during peak season.

While traffic has remained steady in the US since end of April, transactions have been steadily climbing for the past 7 weeks, reflecting greater consumer confidence when it comes to booking travel. Sites selling camping trips continue to see the greatest increases across all sub-sectors — both in traffic and conversions.

Meanwhile, last week was a strong week for Healthcare retailers, with +22% more traffic to these platforms and an impressive +68% increase in transactions.

Have you registered for Summer Camp yet? We’ve put together a six-part series for adventurous experience-builders looking to capitalize on the summer months to fast-track their digital transformation. Join us for six campfire sessions with digital leaders from Tile and other leading brands, to explore common digital challenges and how best to tackle them (A/B Testing merit badge, anyone?).

ECommerce: Nurturing Customer Trust in 2020

To provide understanding during this uncertain time, we are closely monitoring the impact of coronavirus on digital consumer behaviors. Find all the latest insights on our Covid-19 eCommerce Impact data hub.

After weeks of browsing for necessities only and preparing their homes for weeks (months?) of quarantine, consumers everywhere are resuming some of their normal buying behaviors. And with non-essential stores closed indefinitely in many western countries, digital is providing most of the answers to customer needs today.

We have captured and analyzed billions of user sessions since the beginning of the Coronavirus outbreak, and have been sharing week-by-week updates on the latest trends in consumer behavior across industries.

Our study includes more than 5.6 billion sessions and 27 billion page views, captured over the last 14 weeks of 2020, from January 6th 2020 to April 5th 2020. To understand how Covid-19 is affecting global eCommerce, we’ve compared recent weeks to the period immediately preceding the global reporting of the outbreak (or, the first 6 weeks of the year, which we call the reference period).

In last week’s update we wrote about the surge in traffic and transactions recorded in the grocery sector, but also the increases observed across KPIs in the fashion industry.

These are the trends we recorded this week:

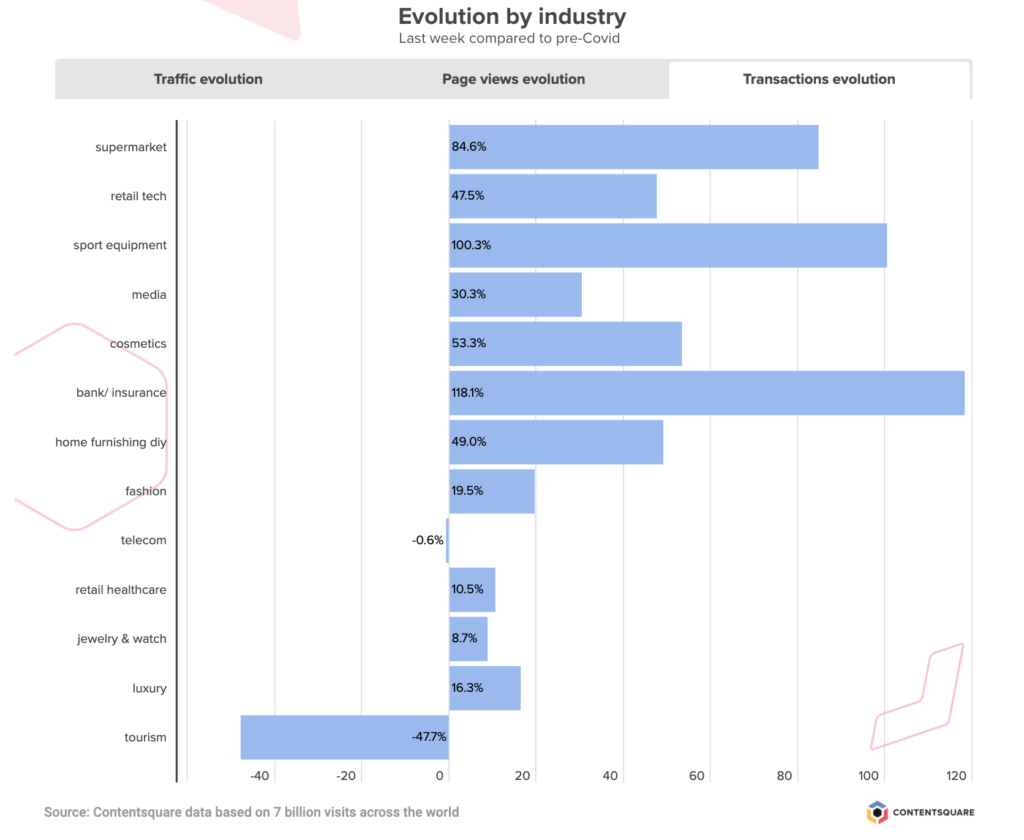

Traffic and Transactions Surge as eCommerce Habits Resume

Total visits across all industries were up +3.2% last week from the previous week, contributing to a +10.3% increase since the very start of the outbreak (or, reference week). We also recorded a +18.0% surge in transactions in the last week, bringing the total increase in the number of transactions since the beginning of the crisis to +32.6%.

What does this tell us? That after dedicating the first few weeks of home quarantine to procuring the most basic of necessities — starting with food and health items, and then moving on to home office and fitness equipment — consumers are now resuming some of their normal shopping habits.

And with non-essential brick-and-mortar stores still closed in many places, digital has shifted from convenience to necessity when it comes to making routine purchases. With traffic and transactions remaining steady or increasing across many of the verticals we analyzed, we are observing digital compensate for the pausing of offline retail.

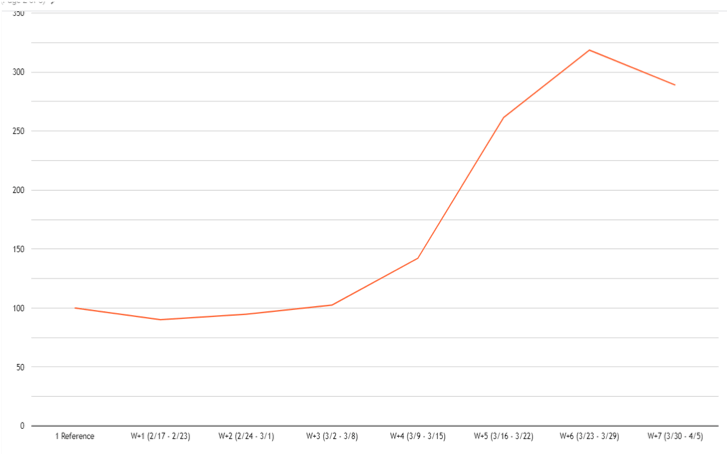

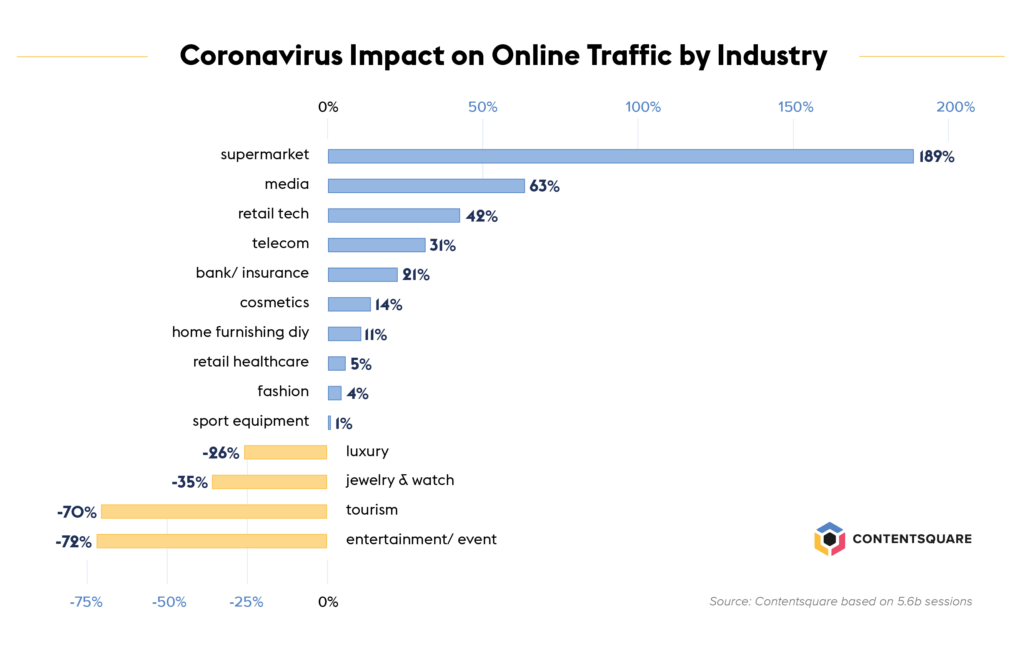

Impact of the Coronavirus on digital traffic since the beginning of the outbreak:

Impact of the Coronavirus on digital transactions since the beginning of the outbreak:

Home Decor and DIY Sectors Get Digital Makeover

Faced with the prospect of several more weeks at least of home quarantine, many consumers spent some of their time and budget this week on improving — or at least thinking of improving — their pad.

Some have found it hard to stare at their apartment or house all day without itching to make improvements, and consumers clocked in +46.8% more hours browsing furniture and DIY supplies since the start of the oubreak. This is the greatest increase in browsing time recorded across all industries.

Last week in particular saw a sharp increase in the volume of visits to websites from this sector (+22.8%). Many consumers last week hit purchase on items to upgrade their home office or living space, with a big +52.3% increase in the number of transactions compared to the previous week. In fact, this collective enthusiasm for home improvement and furniture has caused transactions in the Home Decor/DIY sector to more than double since the beginning of the outbreak (+101.4%).

The sector also recorded a +82.6% increase in the conversions rate — one of the largest rises observed across industries.

Grocery Store Supply and Consumer Demand Align

Visits to grocery sites were down for the first time in six weeks, dropping -9.3% last week compared to the previous week. But despite this slow down, overall traffic volume has grown a massive +189% since the beginning of the outbreak.

Meanwhile, transactions were up +19.6% last week from the previous week, contributing to an +80% increase since the beginning of the outbreak.

The combination of this slight dip in visits and increase in purchases could signify that customers are slightly more realistic this week about the delivery slot situation (scarce!), and are perhaps more accustomed to and willing to agree to product substitutions. Grocery stores everywhere have risen to the challenge of increasing consumer reliance on home delivery, and have come up with innovative ways of managing shifting customer behaviors.

Grocery sector: Traffic (Index 100: pre covid-19):

Grocery sector: Transactions (Index 100: pre covid-19):

And Then There’s Tiger King

While visits to TV/Streaming sites have grown a healthy +25.2% since the start of the crisis, transactions have escalated +125.9% as consumers look for alternatives to in-person socializing.

Interestingly, last week, both transactions and visits were down since the previous week (-16.8% and -12.5% respectively) — perhaps reflecting the fact that many consumers have now picked out and signed up for the subscription services/Netflix shows that will get them through quarantine.

Beauty Sector Sees a Spike in Visits and Transactions

As consumers resume some of their eCommerce routines (and run out of face cream or their favorite shampoo), personal care purchases are once more a thing, following on the heels of a bit of a resurgence two weeks ago. This renewed interest also reflects the way many players in the beauty industry have been focusing their promotions and homepage campaigns on hand soap and other necessities.

In fact, the Beauty and Cosmetics sector recorded an impressive +24.3% increase in visits last week compared to the previous week, coupled with a +36.7% surge in transactions. This contributes to a whopping +106.1% boost in the number of transactions since the start of the outbreak, for a modest +14.2% increase in the volume of visits.

Cosmetics / Fashion sectors: Traffic (Index 100: pre covid-19):

Cosmetics / Fashion sectors: Transactions (Index 100: pre covid-19):

Moving Up the Maslow Pyramid of Needs

The Fashion sector recorded a second week of growth in the volume of transactions (+20% compared to the previous week). This sector is now above pre-Covid-19 levels with a recorded +22.9% increase in the number of transactions since the start of the oubreak.

There seems to also be light at the end of the tunnel for the Luxury and Watch /Jewelry sectors, with transactions still below normal but up last week by respectively +18.5% and +53.5%.

At the top of the Maslow pyramid of needs, it is worth noting that the Tourism and Events sectors are still completely amorphous with -90% dip in the number of transactions compared to our reference week.

Luxury / Jewelry sector: Traffic (Index 100: pre covid-19):

Luxury / Jewelry sector: Transactions (Index 100: pre covid-19):

We will keep monitoring the data over the coming weeks to bring you timely updates on how events are impacting various sectors. In the meantime, sign up to our upcoming webinar, Showing Up For Your Digital Customers (Apr 15 @ 1PM ET) — a discussion around how to adapt to consumers’ fast-changing needs with our Head of Strategy Jean-Marc Bellaiche and special guests from Kohl’s.

Feature image by stokkete

Call Your Mom & Work Out From Home: 5 Ways The Coronavirus Impacted Browsing Behaviors Last Week

To provide understanding during this uncertain time, we are monitoring the impact of coronavirus on online consumer behaviors. See the latest data on our Covid-19 eCommerce Impact data hub.

We analyzed billions of visitor sessions this week to learn more about how consumers in France, the UK and the US are responding digitally to the unfolding health crisis. As people everywhere adjust to the new normal and prioritize the things that matter the most to them, this data surfaces fascinating insights on resilience and adaptation, and how even in uncertain times, some things never change.

Unless otherwise specified, we’ve compared data from the past week to figures from the period immediately preceding the global reporting of the outbreak (or, the first 6 weeks of the year which we call the reference period).

Wishing UK Moms a Happy Mother’s Day (From 6 Feet Away)

Consumers worldwide may be reserving the bulk of their digital time for carrying out essential quarantine activities such as grocery shopping and staying informed, but that doesn’t mean life doesn’t go on. With the PM urging UK families not to visit their moms last Sunday, many did not let the social distancing measures get in the way of celebrating Mother’s Day, which in the UK is on March 22nd.

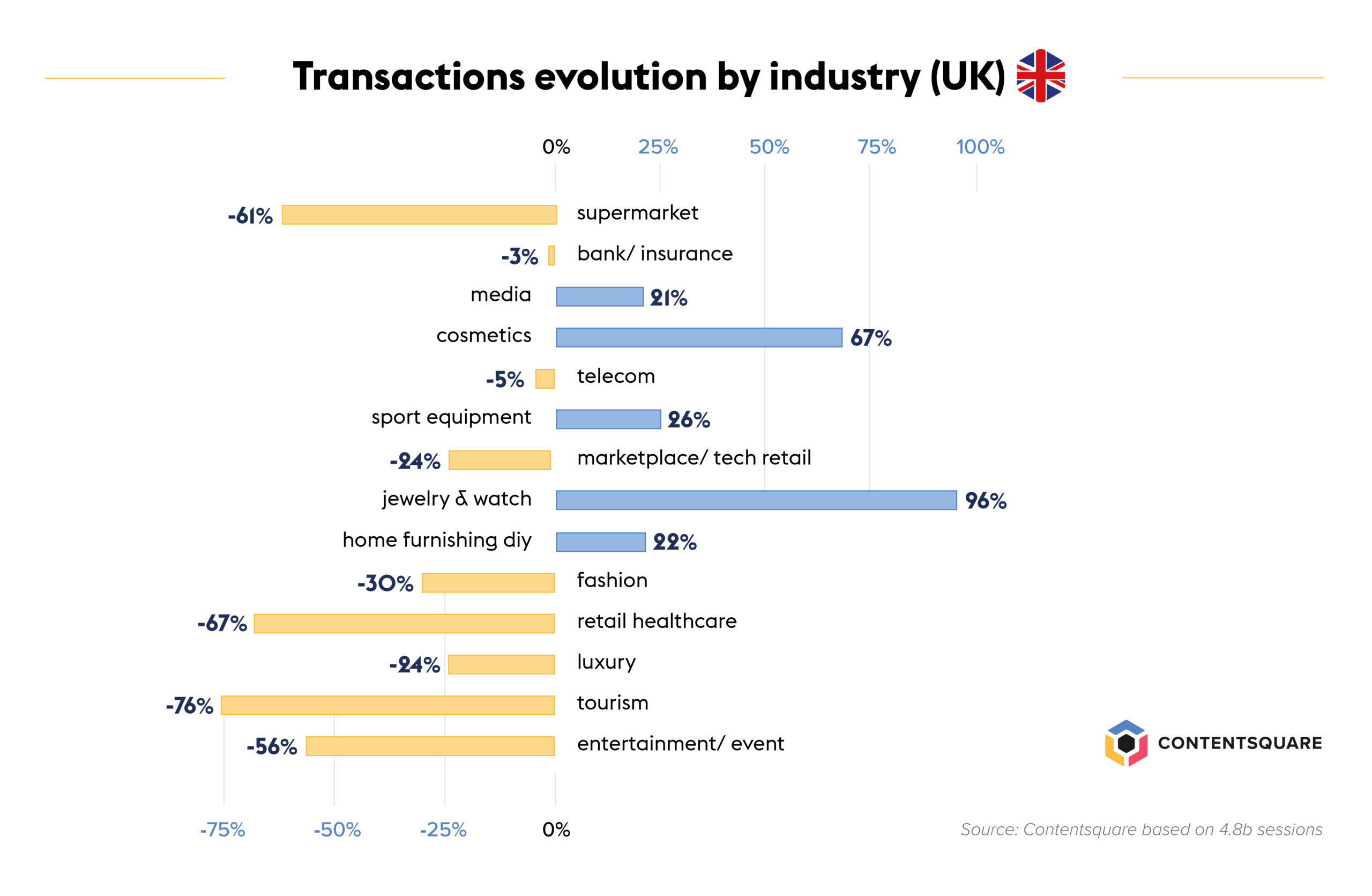

In fact, the week leading up to Mother’s Day saw a tremendous increase in the number of transactions on UK jewelry and watch sites (+96%), compared to the reference week (first 6 weeks of 2020 = reference period). On beauty sites, transactions were up +67%, compared to the reference period.

US Consumers Get Ready to Exercise at Home

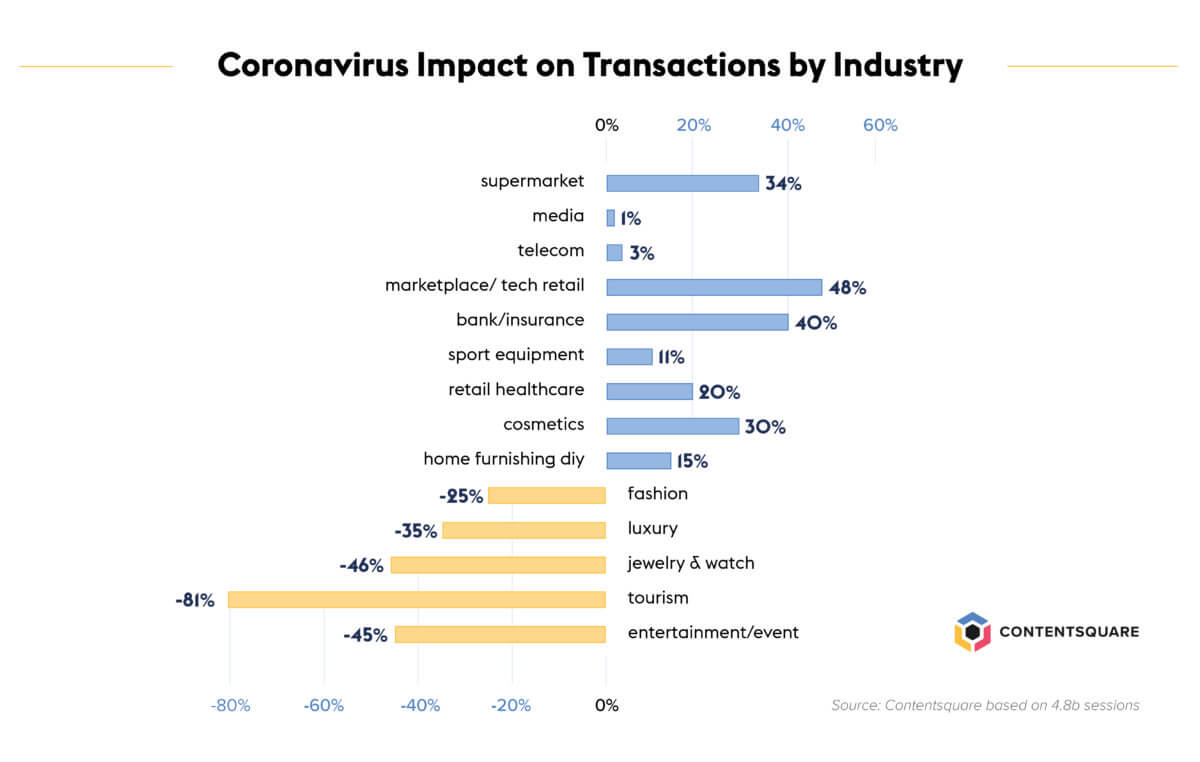

For the 62.5 million people in the US who have a gym membership, the closing of fitness and recreation centers around the country has meant coming up with new ways to stay fit from home. After a -20% drop in visits the week beginning March 9, the online sports retail sector in the US bounced back this past week with a +23% increase in the number of visits and a +186% hike in transactions, compared to the week before.

Sports equipment retailers in the US saw a +186% increase in transactions, compared to the week before.

French Fashion Says “Shopping Can Wait”

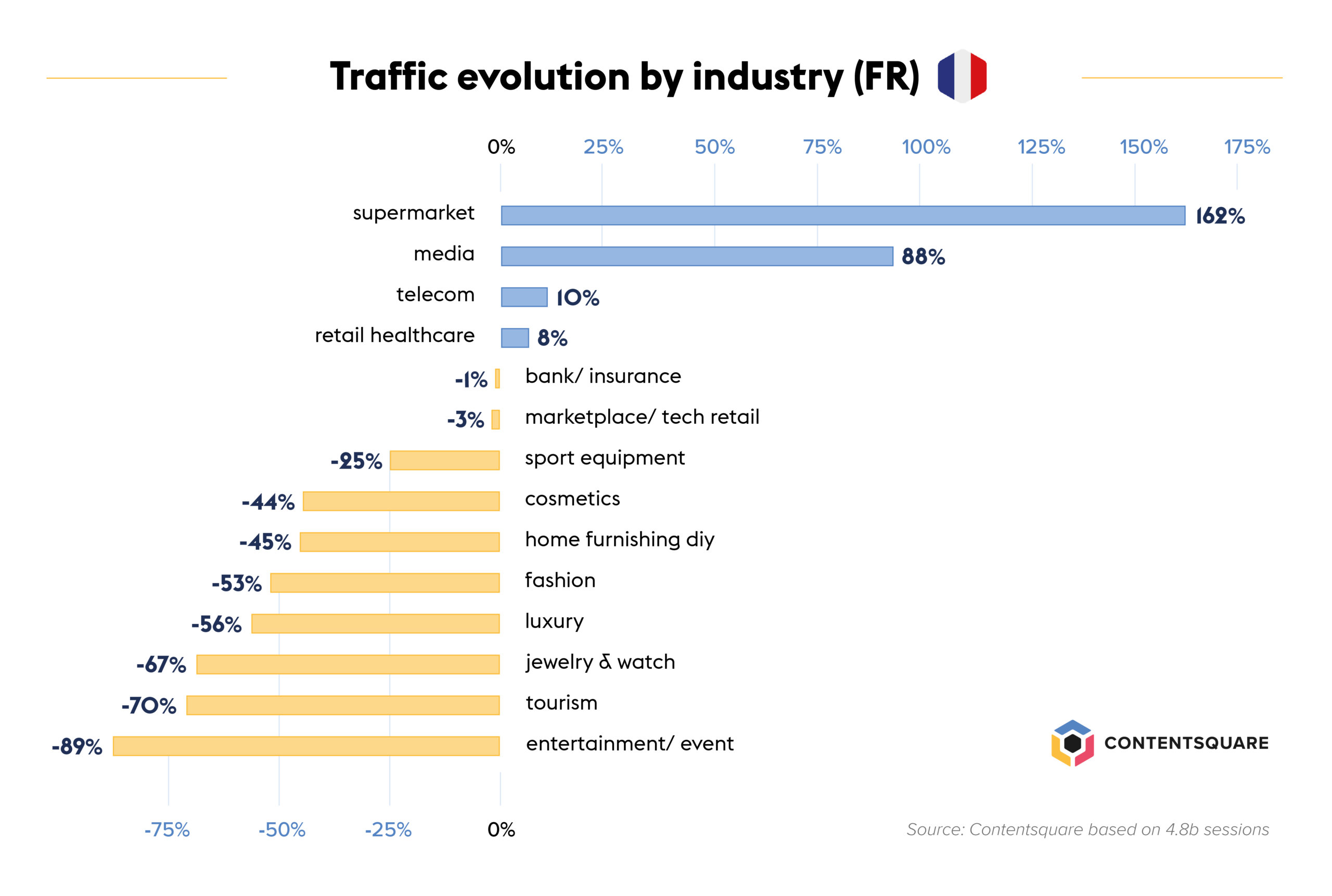

With French consumers part of the one third of the world that is currently on lockdown, industries most closely associated with French style — fashion and luxury — have taken a hit as people stay confined to their homes. While fashion sites have lost traffic the world over (-27% the number of visits), French sites have been particularly hard hit, with -53% fewer visits compared to before the start of the crisis.

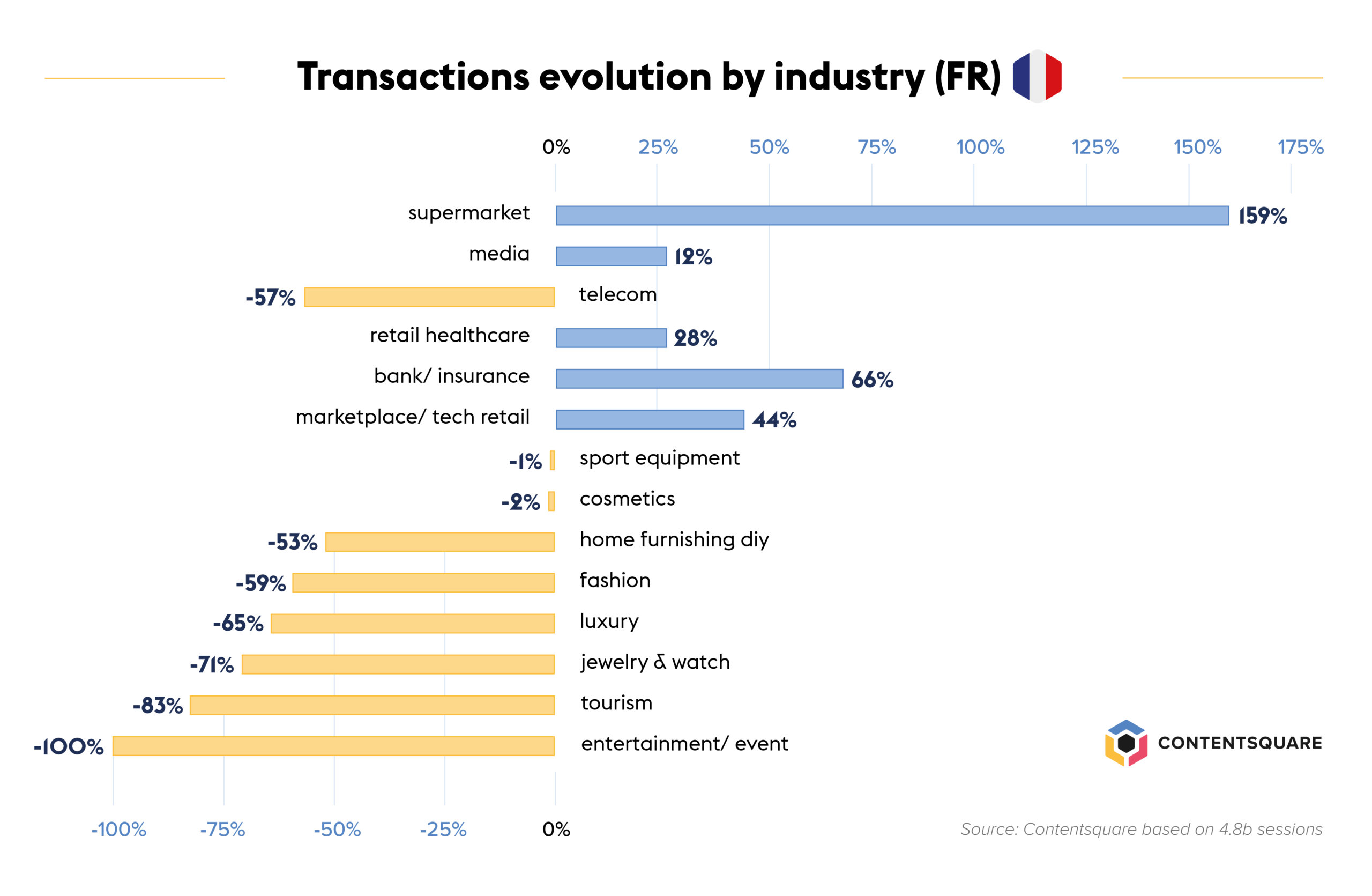

And while transactions on these sites have dropped -25% globally, the decrease was much wider in France, where sites recorded a -60% decrease in transactions. Popular high street fashion store Pimkie has suspended its eShop until further notice, stating that “Shopping can wait.”

Luxury told a similar story, with French traffic dropping -56% in the past week (compared to -32% globally), and consumers making -65% fewer transactions (compared to -35% globally). With Italy’s fashion and textile industry also on lockdown, a brand like Gucci, which has a warehouse in Tuscany, has had to temporarily suspend deliveries to Europe, while continuing to run normal online operations in the US.

UK Supermarkets Overwhelmed By Surge In Demand

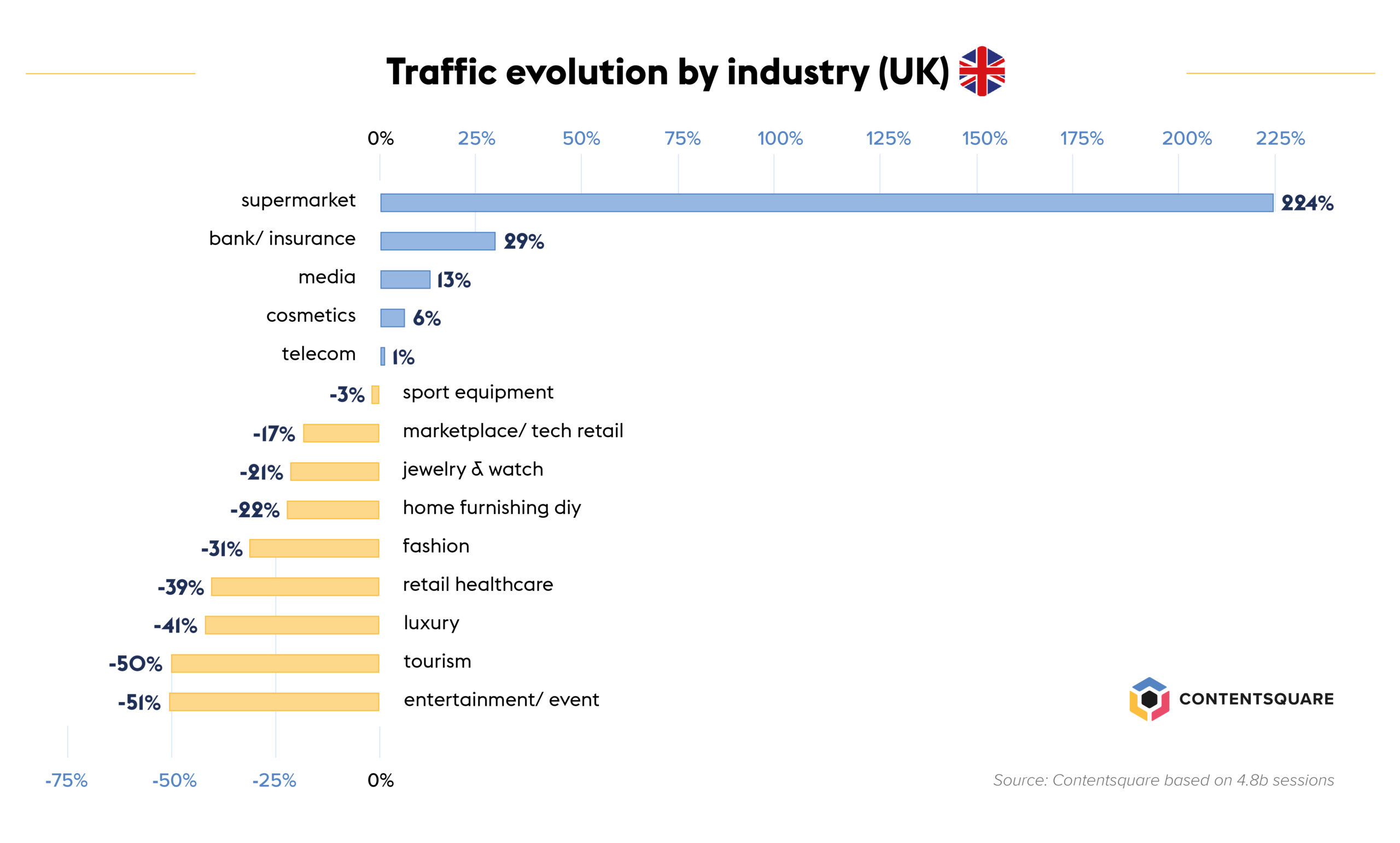

Traffic to online grocery stores has exploded in the UK since the onset of the crisis, with supermarkets recording a +225% increase in visits (almost five times more the increase observed in the US). Transactions however are down -61%. In comparison, global supermarket transactions are up +39%.

It appears that stores in the UK have been struggling to keep up with demand and have been running out of delivery slots. Some chains, like Iceland, temporary suspended their online delivery service to anyone but the elderly and most vulnerable, although delivery appears to be back to normal as of 3/26. Others are prioritizing deliveries for those most at risk and leveraging data to reserve slots for those who need them most.

Cans & Booze in France, Soap & Cleaning Supplies in the UK and US

A deep dive into most popular supermarket items revealed that consumers in France are shopping for the long term, with canned goods at the top of their most reached pages list. UK consumers are heading primarily to pages featuring hand soap, while consumers in the US are browsing en masse for cleaning products.

Pages featuring alcoholic beverages recorded a much higher reach rate in France than in any other country we analyzed, seeming to confirm the age old stereotype that wine is a staple of any French meal, even during a quarantine. Meanwhile, the chance of UK and US consumers reaching alcohol category pages was lower than average, suggesting perhaps that drinking is much more of a social affair in these countries.

For a free walkthrough of the latest data, sign up for our upcoming webinar on March 31st, 1pm.

Impact of Coronavirus on eCommerce: Consumers Settle Into Quarantine (Update 4)To provide understanding during this uncertain time, we are closely monitoring the impact of coronavirus on online consumer behaviors. Find all the latest insights on our Covid-19 eCommerce Impact data hub.

As more and more cities and regions across the world adopt lockdown and shelter-in-place measures, digital consumer patterns are once again shifting to reflect new needs and ways to adjust to an altered reality.

We’ve been analyzing billions of user sessions every day to bring you week-by-week updates on global browsing behaviors across industries. We have broadened our approach to include more than 4.8 billion sessions and 23 billion page views over the last 12 weeks of 2020, from January 6th 2020 to March 23rd 2020. To understand how the fast-evolving situation has impacted global eCommerce, we’ve compared recent weeks to the period immediately preceding the global reporting of the outbreak (or, the first 6 weeks of the year which we call the reference period).

In last week’s update, we referenced American psychologist’s Abraham Maslow’s hierarchy of needs, illustrated as a pyramid, with the lower tiers covering the most basic of needs, including food, safety, social needs etc. What we observed this week is that, after focusing their efforts on securing the most basic of needs such as groceries, health products and financing, consumers have been shifting their online activity to focus on items and services that will help get them through an extended period of isolation.

Online Grocery Stores Struggling To Keep Up With Demand

Traffic to online grocery stores shot up +84% in the last week, contributing to an overall +161% increase in visits since February16. The number of transactions, however, was down -15% last week, in stark difference to the 32% increase recorded the week before. We have observed that in many countries, as consumers increasingly turn to online supermarkets to keep their pantries stocked, delivery slots are running low and some products are unavailable, resulting in a higher number of abandoned carts. At the extreme, in the UK, supermarket chain Iceland has restricted online shopping to “over state pension age, self-isolating and other vulnerable people.”

Retail healthcare clocked in a steady number of visits in the last week but significantly fewer transactions (down -35%), suggesting consumers may have already stocked up on essential medical supplies, vitamins, etc. to last them for the weeks to come.

As some grocery and retail healthcare players experience supply chain issues, it is worth noting that transactions on cosmetics websites were up last week by +33% from zero the previous week. Many beauty players have indeed decided to refocus their offering, with much success, on necessities such as soap and hand cleaning products.

Consumers Get Equipped To Stay Indoors

With a huge part of the workforce now officially in WFH mode, and a great number of children switching to e-learning, many consumers spent some time this week upgrading their hardware. Tech retail sites recorded a +20% increase in traffic in the last week — higher than the total jump in visits since February16 (+15%). The sector also recorded a higher number of purchases than any other week we analyzed, with a +30% increase in transactions. As a comparison point, the week immediately preceding this one had shown no change in the number of transactions.

Visits to sites specializing in books and toys increased +25% in the same period — double the total increase since the start of the outbreak. As parents everywhere contemplated weeks of homeschooling and indoor play, the number of transactions followed suit, with a +140% increase in the last week only.

And despite a -2% dip in the number of visits, sports retailers saw a +30% increase in the number of transactions this past week, a significant increase compared to the changes recorded in previous weeks. As social distancing measures limit people’s ability to go to the gym or take part in group sports, consumers are making sure they have the right equipment to keep up with their fitness regime at home. This is true in particular in the US with more than 60M American members of a gym club now in need to work out from home!

Traffic to Media and Streaming Sites Peaks

Visits to TV/streaming sites went up +34% in the last week — almost three times the increase recorded during the previous week, and +43% since the start of the outbreak. Transactions for the sector doubled week on week, with a +108% increase over the previous seven days.

Media sites continue to record a weekly traffic increase (+24% this week), steadily adding up to a +80% increase since the start of reporting.

Connectivity has taken on a whole new importance in people’s lives over the last few weeks and the telecom sector is continuing to see its traffic grow. The +7% increase in visits to telecom sites this last week is half the spike in traffic observed three weeks ago, implying many customers have now made sure they are properly connected to weather the next few weeks or months.

Tourism and Real Estate Continue to Suffer

Following three weeks of relative stability and a slight dip two weeks ago, the real estate sector recorded a huge dip in traffic this past week — -46% compared to -52% since the beginning of the outbreak.

The travel and hospitality sector continues to experience a slowdown in traffic, which was down – 44% last week. Transactions were also down -67%, contributing to a decrease of -81% since the start of the crisis. Luggage sites followed suit, with a -42% decrease in visits — the biggest drop since we started our analysis.

Meanwhile, visits to fashion and luxury sites were down approximately -15% this past week, and apparel sites in particular saw a -8% decrease in transactions.

For a free walkthrough of the latest data, sign up for our upcoming webinar on March 31st, 1pm. Our CMO Aimee Stone Munsell will be sharing fresh verticalized insights in an effort to help experience stakeholders make sense of the impact we are all experiencing.

NEWS: 2020 Digital Experience Benchmark Finds Two Thirds of Web Content Goes Unseen by Customers

NEW YORK, NY 10 MARCH 2020 — Over two thirds (69%) of all web content published by brands still goes “unseen” by consumers. This is just one of the findings revealed in a new global study from Contentsquare, the leading provider of digital experience analytics. Of all the sectors analyzed, banking has the highest amount of unseen content (75%), closely followed by beauty websites, where 74% of content is rarely being accessed by visitors. The research reveals that home and technology brands are the most effective content marketers, with 40% of their content viewed by users.

The ‘2020 Digital Experience Benchmark’ incorporates global Contentsquare session data from some of the world’s biggest brands. The anonymized data set includes over 7 billion web sessions from over 400 websites around the world, providing unparalleled insight into previously misunderstood user behaviors.

Mobile continues to be the context for most new site visits. 55% of visitors get to a site using their mobile phone, with luxury topping the mobile traffic table (67%). The energy sector, which has been lagging in the smartphone traffic boom, recorded an 11% increase in mobile traffic since 2019, and travel saw a 5% increase. Mobile experience is now a critical battleground in every industry, regardless of its typical purchase size, frequency or cycle time.

Visitors require 3 sessions on average to convert, but with only 55% of users returning visitors, there is a tremendous opportunity for brands to harness great customer experiences to encourage return visits and maximize retention.

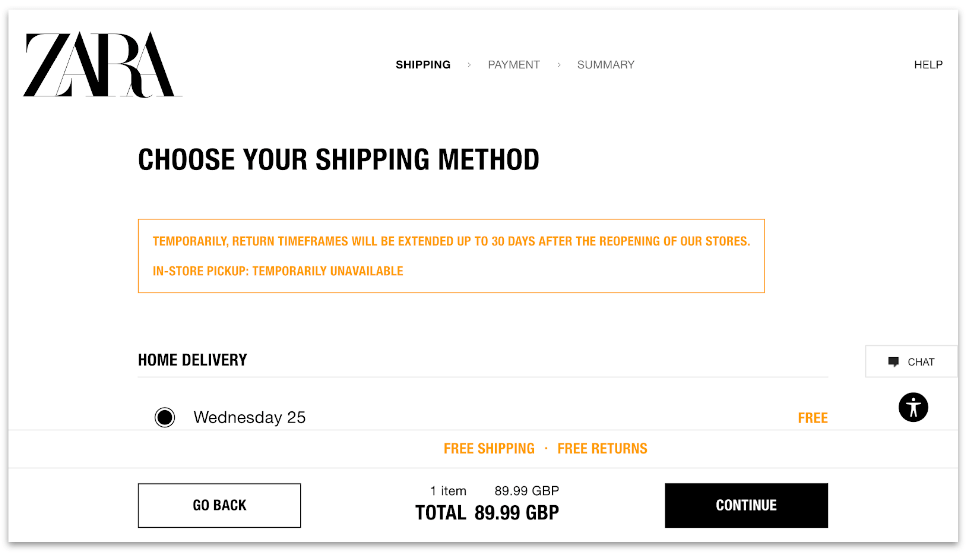

44% of visitors who reach the payment page on a site will not complete their transaction, and 56% of visitors who reach the shipping/billing page won’t convert, highlighting the critical importance of optimizing the checkout process.

Commenting on the findings, Aimee Stone Munsell, CMO at Contentsquare said, “The window of opportunity for brands who haven’t turned digital experience into a competitive advantage is rapidly shrinking. The good news is today, we’re able to locate with precision the stumbling blocks along the customer journey. Marketers and UX teams who have a granular understanding of customer behavior can uncover simple improvements that shrink the experience gap and multiply their conversions.”

“Being able to visualize customer journeys and uncover user behavior presents an opportunity to understand and optimize content placement and sequence to increase the ROI of what you produce. That’s why experience analytics is so valuable. Just as we’ve done with this study, brands can use experience analytics to uncover hidden behaviors and to create better digital experiences for maximum impact in the shortest space of time.”

Contentsquare’s full Digital Experience Benchmark is now available online. Contentsquare also analyzes trends in shopping behaviors in line with e-commerce trends and current affairs such as the Coronavirus.

Methodology

Research based on 12 months of Contentsquare data from 400 websites in 9 different verticals from 13 countries including US, UK, France, Germany, Spain, Netherlands, Sweden, Denmark, Japan, China and Canada. “Unseen” content metrics are calculated by comparing the total number of pages on a site with the pages viewed by 95% of traffic.

Not to be outdone by the wordsmiths of this world, the retail industry recently came up with its own neologism, coining the term “phygital” to describe a new form of commerce — one that blends the best of offline and online experiences for an elevated customer experience (CX).

It may be early days in the world of phygital CX, but brands are experimenting away, and coming up with innovative solutions to fit the needs of today’s omnichannel customer.

But how do you build links between a digital platform and physical store? What experience transfers are already proving successful in terms of engagement and conversions? And how do you make digital features work in the physical world, and vice versa?

What’s certain is that the line between eCommerce and brick-and-mortar is more blurry than ever. The reality is that digital has transformed everyday life. Many of our daily activities — work, communication and of course, consumption — play out in the digital realm.

In fact, we have fully become phygital beings, and retailers are racing to adapt the customer experience to reflect our evolving needs and expectations.

THE CUSTOMER IS KING

Consumers today expect seamless omnichannel journeys. But that’s not all they are looking for — they also want choice, and they want to feel special. And VIPs love nothing more than customized product or services!

Digital has unlocked new opportunities for retailers, but has also made things slightly more complicated. Consumers are no longer looking for the cheapest product or best customer assistance — they seek excellence throughout the customer experience.

“Today we’re seeing a real convergence between online and offline, with many advantages for consumers,” explains Jérôme Malzac, Innovation Officer at Wide Agency.

“On the eCommerce front: easy search, time-saving, the ability to order wherever, whenever… When it comes to local shopping, the human and physical dimensions are incredibly important, as well as contact between the retailer and the customer — advice, service, getting more info on a product and how quickly it can be purchased.”

LEVERAGING CUSTOMER INTELLIGENCE FOR A SUPERIOR CX

One of the main challenges for brands today is delivering intelligent customer journeys that are adapted to every customer. Collecting and aggregating customer behavior data can help brands identify pain points along the customer journey (both online and offline). But it doesn’t stop there, as a granular data collection allows brands to effectively personalize the experience and services.

“Thanks to data, we can follow our customers along their journey both on and offline, and suggest relevant products to them. For example, a woman who has just purchased newborn clothes will get suggestions for baby shoes,” explains Vanessa Guignoux, head of digital and eCommerce at Gémo.

Integrating mobile app localization can also help brands deliver useful information to customers at the right time, and make their store visit more efficient. Brands can optimize a store visit based on a digital shopping list, for example. And understanding app behavior allows teams to maximize the role of smartphones in facilitating a great CX at every touchpoint.

“Digital makes omnichannel possible, and allows access to things that were only possible in the physical world, removing obstacles to purchase, understanding, sharing and knowledge. In the other direction, from digital to physical, we see gains on the human, emotional front,” explains Yann Carré, head of the marketing communication cycle for Decathlon.

“But you need to maximize this potential. The most important thing is to have a completely responsive website, one that can be browsed and visited from any device, be it desktop, tablet or smartphone. To illustrate this, for over a year now, more people visit the Decathlon site on a smartphone than a desktop. All of our content (image, text, video, comparison tools, 3D) are conceived to be accessible digitally and to complete the offline and in-store experience.”

With consumer needs and expectations evolving fast, agility and continuous monitoring of customer behavior have never been more important. Digital teams need to analyze the way customers interact with their digital properties as part of their daily workflow. And adopting a design thinking approach and test & learn strategy allows teams to react quickly and keep up with customer expectations.

THE BEST OF BOTH WORLDS

Armed with a better understanding of their customers, digital retailers and brick-and-mortar stores have started to adopt a phygital CX strategy. Drive-throughs, in-store lockers, click & collect and online reservation are just some of the ways brands have integrated offline and online to improve omnichannel CX.

Brands have also been exploring the benefits of expanding the reliance on digital in-store, removing typical customer frustrations prevalent in physical stores such as: low inventory, or a certain size not being available. Sales assistants now use tablets to help customers complete an in-store purchase online. Some brands even mix in-store help with added online services to offer product personalization, for example.

“Our sales assistants and department managers have access to the same information as our customers via smartphone, tablet or interactive in-store touch-screens. But they’re also able to analyze buyer behavior from a mobile number or email address. By checking their information system, they can view the purchase history and searches, and engage Mr. D with advice, product suggestions, etc,” said Yann Carré.

“And each department manager also has all the information that will allow them to make pricing, inventory and merchandising decisions. For example, if a competitor is offering a more competitive price on a particular item, they are empowered to change the price of this particular model to match or to offer a more competitive price. They can predict how this will impact sales either positively or negatively. They have all the intelligence they need to make important decisions completely autonomously.”

Phygital logic also drives a store’s merchandising strategy. For example, if an item gets anything less than a 3 out of 5 customer score, it is removed from both the online and offline store in order to be improved.

There are many other innovations on the horizon. Monoprix, for example, is hoping to speed up in-store checkout with its Monop’Easy solution. It’s simple: customers scan their items via the mobile app, pay, and receive their receipt by email.

Sephora also offers a mobile app that blends digital and physical realities, allowing users to test out makeup thanks to AR, and delivering info and advice to in-store customers as they are browsing the physical aisles. And beauty brand Passion Beauté has been inviting social media influencers into their stores.

Pure players have also been playing the phygital game, coming up with concept stores that allow them to get closer to their customers. In New York, you can rent pajamas and a book a bed for a 45-minute nap at Casper’s Dreamery.

Sezane, which started off as a pure player, has opened showrooms it calls “apartments,” where shoppers can browse exclusive designs and new releases in a cozy, trendy setting.

Brands are constantly coming up with unique ways to explore the transitions between digital and physical, and elevate the click-and-mortar experience. “We want to be (to sports) what Airbnb is to accommodation and travel,” says Yann Carré. “We want to offer more than just the value of the product and create value around sports, too.

The more people do sports, the more opportunities there will be for us to connect with them, and sometimes, even if not always, that will transform into a purchase.”

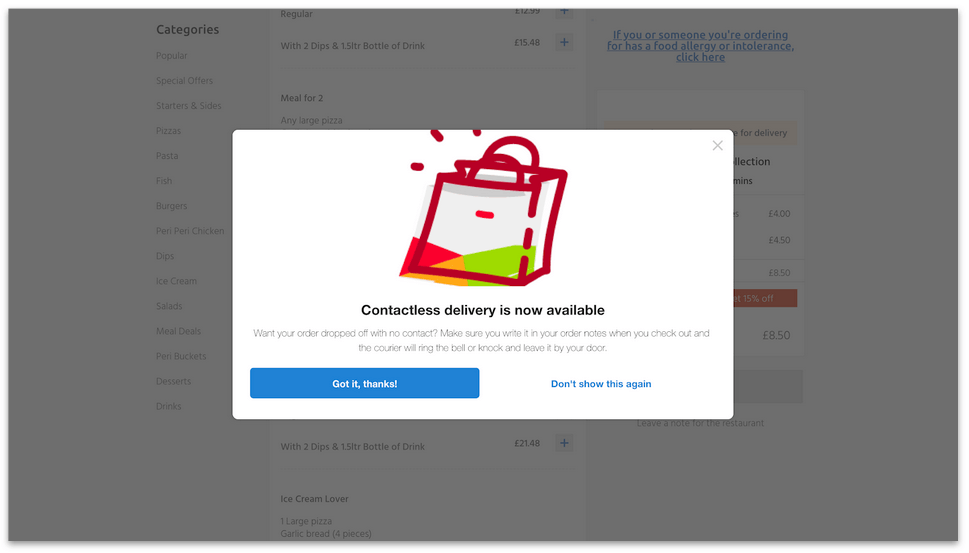

These are just a few examples of some of the measures implemented overnight by brands across the globe. And as businesses set together the new standards of customer-centricity, it will be interesting to see which of these services and changes are here to stay.

In uncertain times, a lack of clarity in the visitor journey and insufficient guarantees are a surefire way to lose customers.

These are just a few examples of some of the measures implemented overnight by brands across the globe. And as businesses set together the new standards of customer-centricity, it will be interesting to see which of these services and changes are here to stay.

In uncertain times, a lack of clarity in the visitor journey and insufficient guarantees are a surefire way to lose customers.