This holiday shopping season is gearing up to be quite different from past years. As COVID-19 cases continue to surge across the country, many retailers aren’t sure if their brick-and-mortar locations will even be able to remain open during the holiday shopping season. And, even if they do open their doors, many customers still feel un-easy shopping in-stores.

The silver lining for brands? Digital transactions continue to soar and businesses don’t have to worry about websites and mobile apps closing down due to COVID. Plus, this year’s holiday season is expected to be a record-breaking period for eCommerce, with analysts expecting online sales to grow by 18%.

Even amid all the uncertainty, brands are doing their best to meet changing customer needs and capitalize on this new surge of digital traffic. We sat down with digital experience experts from e.l.f cosmetics, Dell, T. Mobile, Orvis, and VF Corporation to hear how they’re preparing for this untraditional holiday shopping season.

Here’s what they had to share:

1. Digital Activations with e.l.f. Cosmetics

“We take holidays, just like every retailer, very seriously. What’s really different about this year is that we were able to learn so much about our customers because of the pandemic. That’s going to inform the content we produce and how quickly we put it out there. I don’t think people will be comfortable walking into stores until the end of the year, so we’ll be focusing on bringing more products to our augmented reality experience, attracting new consumers, and figuring out how to engage and educate them on how our different products come together.

We’ll be focusing on bringing more products to our augmented reality experience.

In a way, our preparation is no different than last year, but this year, we’re going to be adapting more quickly and focusing more on digital activations. People are not going to be comfortable walking into stores so bringing even more activations online will be the key.”

— Etka Chopra, VP of Digital at e.l.f. Cosmetics

2. Year-Round Preparation with Dell

“I think the holiday season itself has been evolving a lot over the last several years. Once upon a time, it was all about Black Friday, then we had Cyber Monday, then there was Green Monday. Holiday transformed from a single day event into a whole season of holiday shopping. And it’s no longer restricted to the period after Thanksgiving anymore. You have Black Friday in July, Amazon Prime Day, Dads & Grads, Back to School, and at Dell, we do things like Ten Days of Deals. It’s always ongoing.

At Dell, we start holiday prep as soon as one holiday season ends. You must have a detailed plan from a merchandising, procurement, and fulfillment standpoint to assure that you have the right assortment of products that your customers are looking for next year. We were already deep into holiday season planning for Q4 when COVID started.

You must have a detailed plan from a merchandising, procurement, and fulfillment standpoint

Today, it’s hard to imagine a scenario where there will be long lines in physical stores and that again brings more focus to digital. Our focus is to make sure that we allow customers to be able to transact with us and find exactly what they’re looking for on our digital properties. We’re making sure deals.Dell.com is ready to go, which we actually use year-round. We’re always testing new ideas, seeing what is working, learning how customers interact with our site, and figuring out how we can impact their customer journey in a positive way.

For us, there’s never really downtime when it comes to prepping for the holidays because the sales cycle goes on all year long. The holiday calendar has transformed from that two-three week time period to being essentially all year long.”

— Vab Dwivedi, Director of Digital Customer Experiences at Dell

3. Finalizing Holiday Offers with T. Mobile

“Typically, we start our holiday planning process right about now. We decide what offers we’re going to have and what phones will be on sale. We always have to wait until the Apple Special Events, where they announce their new product releases, which happen in September/October. From there, we fly right from there into holiday preparation. That’s when we decide what phones we’ll have deals on and determine whether we focus on upgrades, prospects, a mix of both, etc.

Over the last few years, the whole idea of Black Friday and Cyber Monday has gone out the window.

Over the last few years, the whole idea of Black Friday and Cyber Monday has gone out the window. Last year, we started doing holiday messaging and offers a week before Black Friday then we change offers that run up until Christmas so as people are making last-minute decisions there are still great offers for them. It’s not just a weekend anymore. It’s almost a full month.”

— Kerry Sikora, Sr. Manager, Business and Performance Analytics at T-Mobile

4. Adopting a New Content Strategy with Orvis

“From a creative perspective, the majority of our holiday season assets are being produced now. We’re hypothesizing what the social climate will look like in November and beyond, and shifting our storytelling to incorporate those predictions. We’re focusing on ways to change the dialogue on what the season is going to be.

We’re hypothesizing what the social climate will look like in November and beyond, and shifting our storytelling to incorporate those predictions.

Orvis, being a family-owned company, takes a lot of pride in family gatherings. This year, we probably won’t see the large 20+ person gatherings around a large dinner table. The holidays will probably be more intimate and you might just be celebrating with the five people you’re closest with. This year, we’ve been leveraging the Perkins family, the family owners of Orvis, more and more. They live the brand and are Orvis in and out. We’re trying to capture the spirit of coming together with those who mean the most to you, and highlight the small things you can do to put a spin on your traditions and still make the holidays meaningful.”

— Dan Corby, Sr. UX Design Manager at Orvis

Want a more in-depth look at how the Orvis team is prepping for the holiday shopping season? Click here to hear more about their 2020 holiday strategy and website design overhaul.

5. Enhanced Product Imagery with VF Corporation

“We’ve started to push out more 3D product photography. One of the best things about offline shopping is that you can touch the product, see it, try it one, and hold it next to you. People value being able to spin a product, open a suitcase, and see what’s in it. We also have a separate experience that lets you view a product’s size in comparison to a Nalgene, an iPad, and other tangible everyday items. There’s nothing worse than getting a backpack, realizing it’s smaller than you need it to be, and having to go through the hassle of returning it and waiting for a new one.

Eagle Creek is really where we’re pushing 3D product imagery hard. Our luggage pieces have a lot of really cool features that you can’t really portray with just flat product images. A 3D product image lets customers spin the product around on their screen, click on it, and discover a cool locking feature or something else. People are visual—we could put the words on the page, but people don’t always read them.

People like to see what a product looks like in the real world and on other people, especially if they can’t see it in a store.

The other thing we’re prioritizing is user-generated content. People like to see what a product looks like in the real world and on other people, especially if they can’t see it in a store. We’re putting a lot more emphasis on lifestyle product shoots so we can show products in a tangible experience even though it’s on their computer screen.”

— Ashley Peterson, eCommerce Analyst with VF Corporation, the parent company of JanSport and Eagle Creek

Interested in hearing how more retail brands are preparing for this year’s holiday season? Check out our Holiday Readiness Hub for brand success stories, interviews with digital experts, helpful UX/UI tips, actionable workshops, and more.

How Top Retailers Are Preparing for Peak Season amid a PandemicThis holiday shopping season is gearing up to be quite different from past years. As COVID-19 cases continue to surge, many retailers aren’t sure if their brick-and-mortar locations will even be able to remain open during the holiday shopping season. And, even if they do open their doors, many customers still feel un-easy shopping in-stores.

The silver lining for brands? Digital transactions continue to soar and businesses don’t have to worry about websites and mobile apps closing down due to COVID. Plus, this year’s holiday season is expected to be a record-breaking period for eCommerce, with analysts expecting online sales to grow by 18%.

Even amid all the uncertainty, brands are doing their best to meet changing customer needs and capitalize on this new surge of digital traffic. We sat down with digital experience experts from e.l.f cosmetics, Dell, T. Mobile, Orvis, and VF Corporation to hear how they’re preparing for this untraditional holiday shopping season.

Here’s what they had to share:

1. Digital Activations with e.l.f. Cosmetics

“We take holidays, just like every retailer, very seriously. What’s really different about this year is that we were able to learn so much about our customers because of the pandemic. That’s going to inform the content we produce and how quickly we put it out there. I don’t think people will be comfortable walking into stores until the end of the year, so we’ll be focusing on bringing more products to our augmented reality experience, attracting new consumers, and figuring out how to engage and educate them on how our different products come together.

We’ll be focusing on bringing more products to our augmented reality experience.

In a way, our preparation is no different than last year, but this year, we’re going to be adapting more quickly and focusing more on digital activations. People are not going to be comfortable walking into stores so bringing even more activations online will be the key.”

— Etka Chopra, VP of Digital at e.l.f. Cosmetics

2. Year-Round Preparation with Dell

“I think the holiday season itself has been evolving a lot over the last several years. Once upon a time, it was all about Black Friday, then we had Cyber Monday, then there was Green Monday. Holiday transformed from a single day event into a whole season of holiday shopping. And it’s no longer restricted to the period after Thanksgiving anymore. You have Black Friday in July, Amazon Prime Day, Dads & Grads, Back to School, and at Dell, we do things like Ten Days of Deals. It’s always ongoing.

At Dell, we start holiday prep as soon as one holiday season ends. You must have a detailed plan from a merchandising, procurement, and fulfillment standpoint to assure that you have the right assortment of products that your customers are looking for next year. We were already deep into holiday season planning for Q4 when COVID started.

You must have a detailed plan from a merchandising, procurement, and fulfillment standpoint

Today, it’s hard to imagine a scenario where there will be long lines in physical stores and that again brings more focus to digital. Our focus is to make sure that we allow customers to be able to transact with us and find exactly what they’re looking for on our digital properties. We’re making sure deals.Dell.com is ready to go, which we actually use year-round. We’re always testing new ideas, seeing what is working, learning how customers interact with our site, and figuring out how we can impact their customer journey in a positive way.

For us, there’s never really downtime when it comes to prepping for the holidays because the sales cycle goes on all year long. The holiday calendar has transformed from that two-three week time period to being essentially all year long.”

— Vab Dwivedi, Director of Digital Customer Experiences at Dell

3. Finalising Holiday Offers with T. Mobile

“Typically, we start our holiday planning process right about now. We decide what offers we’re going to have and what phones will be on sale. We always have to wait until the Apple Special Events, where they announce their new product releases, which happen in September/October. From there, we fly right from there into holiday preparation. That’s when we decide what phones we’ll have deals on and determine whether we focus on upgrades, prospects, a mix of both, etc.

Over the last few years, the whole idea of Black Friday and Cyber Monday has gone out the window.

Over the last few years, the whole idea of Black Friday and Cyber Monday has gone out the window. Last year, we started doing holiday messaging and offers a week before Black Friday then we change offers that run up until Christmas so as people are making last-minute decisions there are still great offers for them. It’s not just a weekend anymore. It’s almost a full month.”

— Kerry Sikora, Sr. Manager, Business and Performance Analytics at T-Mobile

4. Adopting a New Content Strategy with Orvis

“From a creative perspective, the majority of our holiday season assets are being produced now. We’re hypothesizing what the social climate will look like in November and beyond, and shifting our storytelling to incorporate those predictions. We’re focusing on ways to change the dialogue on what the season is going to be.

We’re hypothesizing what the social climate will look like in November and beyond, and shifting our storytelling to incorporate those predictions.

Orvis, being a family-owned company, takes a lot of pride in family gatherings. This year, we probably won’t see the large 20+ person gatherings around a large dinner table. The holidays will probably be more intimate and you might just be celebrating with the five people you’re closest with. This year, we’ve been leveraging the Perkins family, the family owners of Orvis, more and more. They live the brand and are Orvis in and out. We’re trying to capture the spirit of coming together with those who mean the most to you, and highlight the small things you can do to put a spin on your traditions and still make the holidays meaningful.”

— Dan Corby, Sr. UX Design Manager at Orvis

Want a more in-depth look at how the Orvis team is prepping for the holiday shopping season? Click here to hear more about their 2020 holiday strategy and website design overhaul.

5. Enhanced Product Imagery with VF Corporation

“We’ve started to push out more 3D product photography. One of the best things about offline shopping is that you can touch the product, see it, try it one, and hold it next to you. People value being able to spin a product, open a suitcase, and see what’s in it. We also have a separate experience that lets you view a product’s size in comparison to a Nalgene, an iPad, and other tangible everyday items. There’s nothing worse than getting a backpack, realizing it’s smaller than you need it to be, and having to go through the hassle of returning it and waiting for a new one.

Eagle Creek is really where we’re pushing 3D product imagery hard. Our luggage pieces have a lot of really cool features that you can’t really portray with just flat product images. A 3D product image lets customers spin the product around on their screen, click on it, and discover a cool locking feature or something else. People are visual—we could put the words on the page, but people don’t always read them.

People like to see what a product looks like in the real world and on other people, especially if they can’t see it in a store.

The other thing we’re prioritising is user-generated content. People like to see what a product looks like in the real world and on other people, especially if they can’t see it in a store. We’re putting a lot more emphasis on lifestyle product shoots so we can show products in a tangible experience even though it’s on their computer screen.”

— Ashley Peterson, eCommerce Analyst with VF Corporation, the parent company of JanSport and Eagle Creek

Interested in hearing how more retail brands are preparing for this year’s holiday season? Check out our Preparing for Peak Hub for brand success stories, interviews with digital experts, helpful UX/UI tips, actionable workshops, and more.

Why 88% of US Shoppers Will Avoid Stores on Black FridayWe’re entering the most hectic time of the year again — and it’s not even (officially) the holiday season. That’s because the holiday season doesn’t formally start until the holy grail of retail events. We’re of course alluding to Black Friday, the crème de la crème for boosting revenue.

Our globally-extracted data attests to the weight this pre-holiday season event holds. (Have you seen the stampedes and clashes over commonplace items on this day?) With strong expectations of drawing in higher volumes of customers who purchase, now is the time to make sure your digital CX is spot on.

We analyzed 110 million visitor sessions and inspected the performance of 600 million pages during the 2018 Black Friday season, stretching from November 11th to November 27th.

Our data validates the expectations of higher sales and shopping carts surrounding these retail affairs (in most cases). There was also less site abandonment — in some countries. Let’s look at some of the key insights we gleaned from those numbers.

Big Wins in the USA — Cyber Monday Rules

Black Friday — historically a brick-and-mortar affair — is today a major digital sales event. In 2018, Black Friday digital sales reached record highs, generating $6.22 billion in revenue. Cyber Monday, as its name suggests, has always been about promotions in the digital space, i.e, eCommerce.

The United States followed this rationale, as its largest sales were chalked up to Cyber Monday last year. Black Friday sales saw a 17% hike in conversions, but Cyber Monday sales trounced these, with conversion increases of 60%.

And conversions weren’t the only thing on the rise — in the US, average carts increased during Black Friday by 12%.

These heightened conversions were made possible owing to the checkout in particular. This was the case for not solely the US, but also in the UK. Let’s look at the stats we crunched on the checkout portion of the customer journey.

Adobe Stock, via Ivan

The Checkout: Higher Conversions, Lower Bounce Rates & Less Logins

The conversion rate among visitors who reached the checkout funnel was 25% higher during both Black Friday and Cyber Monday. Pre-holiday shoppers who reached the checkout appeared to be more inclined to go through all the steps necessary to complete their purchase, from selecting a product to entering their shipping address.

The checkout page spurred lower bounce rates in both the US and UK. In the US, the checkout bounce rate went down by 28.3%, and in the UK, it decreased by 32%.

In the US, the checkout bounce rate went slightly up again on Cyber Monday, but was still lower than the bounce rate in the lead-up to the holiday shopping weekend.

Despite the good performance of the checkout page, it also incurred some engagement issues. Retailers in the UK saw half the checkout logins during Black Friday, and in the US, the logging in rate was 61% lower.

It could be that Black Friday and Cyber Monday shoppers are in a rush to complete their purchase, or that they are already logged into their account.

In any case, optimizing the checkout step with a quick and easy login process (think one-click, social login, etc) will only encourage more sign-ins. Encouraging guest users to create an account after they convert is another long term marketing opportunity.

Adobe Stock, Via AlexanderNovikov

The Search Bar & Category Pages: Higher Global Usage, Yet Higher Frustration

In all the countries we analyzed, search bar usage saw a stark increase on both Black Friday and Cyber Monday. US shoppers browsing retail tech sites drove a 31% increase to the click rate on the search bar.

In the UK, specifically in the retail apparel sector, the search bar garnered a 3.16% click rate increase on Black Friday alone. The click rate rose to 10.01% on Cyber Monday.

Visitors also browsed fewer category pages in general — 5% fewer in the US and 27% fewer in the UK — confirming the theory that, by the time Black Friday rolls around, shoppers have a good idea of what they’re looking for.

The kickoff to holiday shopping season isn’t a time for idle window shopping, so brands should put their best offers on display well in advance of the big day.

Despite the seemingly good engagement coming from the click rate of the search bar, it can also be a source of frustration, as it drew in higher click recurrences across the board.

With an average of 2 clicks on the homepage search bar during Black Friday, the US felt the most acute wrath in high click recurrence. The UK followed suit, particularly in the fashion sector, where the search bar sustained a monumental 2,000% rise in click recurrence, from 0.08 to 1.78 clicks.

So while the search bar is a necessary element for possible conversions, it may not be very intuitive. It could be drawing up the wrong results or not pulling in products close to what users are typing in automatically.

Bad UX on the Add to Cart Button Globally

The search bar wasn’t the only element to incur a high click recurrence, as the add to cart button was racked by a similar fate.

In France, particularly in the apparel sector, the add to cart button suffered a click recurrence increase of 5.85%.

It was slightly bigger in the UK apparel sector, having risen by 8%. Most notably, in the UK tech sector, it shot up by 62%.

The US was dealt the biggest blow on add to cart buttons, as they racked up a heaping 50% in click recurrence increases.

The root of this international UX trouble-maker could be error messages springing up when users clicked on the button, either due to a technical error or issues with inventory.

The lessons to glean from this is to optimize the add to cart button and make sure you don’t run out of products. Pay special attention to best sellers and other popular items.

An Eclectic Set of Acquisition Sources

Traffic from emails was higher by a hulking 79% during Black Friday and Cyber Monday, compared with the prior period.

Contrary to the US, UK brands received a higher-than-average visitor flow during this season. On Black Friday, organic traffic, or traffic from SEO, was 33% higher, and direct traffic also increased by 24%.

Cyber Monday did not follow suit in the UK. Instead, brands piqued the interest of incoming visitors through paid sources and CRM. Email-based traffic was 160% higher, while social media garnered a king-size 310% increase in traffic.

Whether your brand uses paid sources or goes the organic route, make sure your copy is compelling. Add your best deals to captivate more interest.

And when creating SEA or paid social ads, make sure your landing pages are consistent with the messaging and offers mentioned in your ads.

Capitalizing on Black Friday & Cyber Monday in 2019 & Beyond

As the drivers of major retail events, it is incumbent upon brands to create good experiences — digital and otherwise — to attract customers’ attention and most importantly, retain them. As our data shows, Black Friday and Cyber Monday are key forces for higher revenue streams and fewer bounces. However, there is plenty brands can do to improve the UX, reduce frustration, and engage higher add to carts.

For example, product and CTA findability carries a great deal of weight in user experience. As do elements that appear to be clickable, but turn out not to be.

Read more about how The North Face leveraged granular customer data to optimize their gift guide.

Luckily, you can refer to a slew of hard data, including industry benchmarks and see how to improve your digital experience for this year’s Black Friday and Cyber Monday. But it doesn’t end here.

You’ll need a continuous stream of data to refer to — and we’re not only referencing industry criteria. You’ll need to have a sturdy set of data on your customers’ behavior. That way, you can determine where customers are struggling and where they’re having a good UX. Once you’re equipped with this data, you can proactively make optimizations so that for your customers, Black Friday and the holiday season will truly be times of giving, i.e., buying.

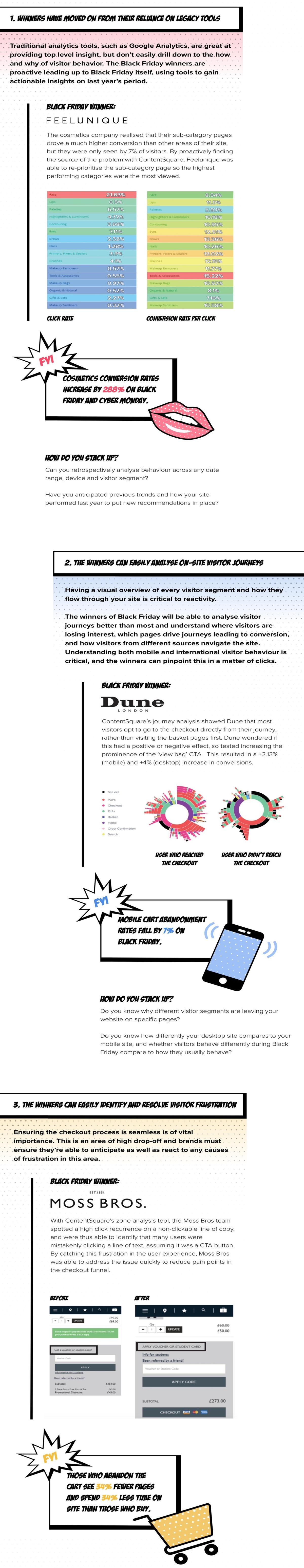

How Brands Win Black Friday: Tips To Optimize Your Site For The Holiday Shopping Season KickoffBrace yourselves, Black Friday is coming. This infographic will break down three reasons why certain brands lead the pack during this period, and explore how three ContentSquare clients have harnessed the power of granular data to improve their site’s performance. See how they did it, and what tips you can follow to make sure you have the right tools to make the most of the holiday shopping season.

The winners of Black Friday will apply the lessons here year-round, maximizing their returns at every opportunity. Advanced technologies like UX analytics are crucial to empowering teams to work faster, smarter, and more efficiently. Are you ready to become a Black Friday winner?

For more insights and examples of how brands have leveraged behavioral analytics to optimize the customer journey and boost ROI, download our Black Friday report today.

What 48 Million User Sessions Tell Us About Singles Day 2018 – The World’s Biggest Digital Spending SpreeSingles Day 2018 — also known as 11/11 — concluded on a high note for Chinese eCommerce giant Alibaba, after the group announced a record-breaking $30.8 billion worth of sales in just 24 hours. Alibaba is not the only brand to see sales rocket during this one-day self-gifting extravaganza — a ContentSquare analysis of 48 million user sessions showed a spike in conversion rates and an increase in customer engagement during this highly commercialized day.

Not surprisingly, the biggest leap in conversions is observed in China, where the average conversion rate across a sample of luxury and travel sites increased by 94% on desktop and by a spectacular 344% on mobile over the previous day. The ripples from the event can also be felt in the US, where desktop sales increased by 50% and mobile sales by 58% between 11/10 and 11/11. In both regions, brands appear to be maximising mobile to unleash their flash sales. The average mobile conversion rate increase in France (+13%) and in the UK (+11%) show that smartphone users from these regions are not falling for the converting frenzy of Singles Day as enthusiastically as consumers in China and the US.

Singles Day 2018 driving online engagement

One thing that is true across the board is that luxury and travel brands are definitely capturing their audience’s attention on 11/11. Mobile bounce rates in the US drop by almost 10% during the event, and smartphone users also consume more content than on average, viewing 14.50% more pages and increasing their average session time by 13%. In China, brands are driving a particularly high level of consumer engagement, with mobile users viewing 39% more pages than they did on 11/10, and extending their browsing sessions by 83%. The mobile bounce rate for shoppers in China drops by 23% — an interesting statistic when you consider that mobile traffic also drops by 6% during Singles Day. The opposite trend is observed in France, the US and in the UK, which boasts the highest mobile traffic increase of all four countries (+9.5%).

With content consumption peaking around annual shopping events like Singles Day, Black Friday or Cyber Monday, brands need to make sure they are delivering the experiences that will keep their audience rapt all the way to conversion. And with these publicized spending sprees driving a greater share of mobile traffic than usual, it is vital to make sure customer paths are optimized for the small screen. We compiled a report packed with advice on how brands can leverage a greater understanding of their customers’ behavior to achieve greater ROI during the holiday shopping season.

How Well Do You Know Your Holiday Shoppers? – esYou think you know your holiday shopping? Take this quiz to test your seasonal savvy and see how much you really know!

Now it’s time to roast some chestnuts and check out the 10 Commandments of Holiday Shopping!