The Digital Playbook for Automotive Brands

Download now to discover the biggest digital challenges facing automotive brands and how to overcome them.

The end of dealerships, online vehicle shopping, pure players, smart cars… Has the auto sector been speeding down the digital transformation highway? We quizzed two digital auto experts to find out how disruptive the auto industry is about to get…

Our first interview is with Jérôme Jean, Digital & Regional Marketing Manager of Toyota in France. Interviewed by David Robin, Associate Director of Colombus Consulting, we learned about the automotive landscape in the digital space.

Colombus Consulting: Let’s dive straight in. What does a successful customer experience (CX) in the auto sector look like?

Jérôme Jean: It’s pretty simple: it’s an experience that is completely linear — from the search engine or website all the way to the dealership visit. These last few years, Toyota has focused heavily on digital to improve the customer journey.

It was crucial for auto manufacturers, whose distribution network has not evolved in 30 years, to become more agile. The aim was to offer a renewed buying experience with a mainly digital pre-sale journey.

We thought about how we positioned our brand and our vehicles at every touchpoint. What experience do we want our customers to have in the dealership? And today we have a new challenge: customers show up very well informed and really challenge our salespeople…

Particularly nowadays, competition is so fierce…

Yes, that’s true of other manufacturers’ eCommerce platforms, but also with pure players who have a radically different approach. There is also one thing no competitor can get around: having actual dealerships so that customers can have a live experience and “feel” the product.

So does that mean the auto sector is moving from hardware to software..?

Yes, absolutely. First of all because you need to add a digital dimension to the dealership experience, which requires having one single database — in our case, Salesforce.

The software is going to continue to evolve fast with smart cars. Tomorrow, diagnosis, preventive interventions, vehicle upgrades — all of those will happen remotely. The auto sector’s approach to marketing will shift increasingly to mobile. We will be able to offer new apps and services to make our customers’ lives easier. Manufacturers will finally connect with their customers on a daily basis.

“The auto sector’s approach to marketing will shift increasingly to mobile.”

Where are we at with online sales today?

The online retail market is gaining traction. All manufacturers, especially in England and Scandinavia, have been testing online sales of new vehicles. 2020 will be a pivotal year with the emergence of online sales platforms. The real question is: what is being sold? Selling new vehicles is the Holy Grail… except that today, the used vehicle market is much more mature. But will it work? I don’t think that online sales will dominate the market or spell the end of dealerships. In my opinion, digital will be one extra sales channel that will hopefully allow us to market to a younger customer base.

Next, our own Geoffrey Vion interviewed Brice Renvoizé, Digital & Experience Manager at SEAT Groupe Volkswagen on marketing, data and CX in the automotive sector.

Contentsquare: How did SEAT restructure to meet the digital challenges of a fast-evolving sector?

Brice Renvoizé: We transformed our digital marketing strategy 2 years ago, with a restructuring of teams based on data and customer experience. Today, our Influence division is responsible for increasing brand awareness and our Digital Customer Experience division is in charge of optimizing the customer journey. The customer journey is changing fast and we’re seeing a decline in dealership visits.

Has this changed your mission at all?

Our objective today is to prove the business value of digital, and to drive more traffic to our dealerships, which is where 100% of our sales still happen. Drive to Store is our main KPI and all our digital innovation takes into account the dealerships as a key part of the buyer journey.

The SEAT ID is an example of how our digital strategy is evolving. This unique client/prospect identifier will remove all barriers between our digital interfaces, dealerships and smart cars. It guarantees a friction-free experience in both the physical and digital world — it’s the ability to keep members in our ecosystem, which includes offering new services.

New services?

Yes, third-party services (music streaming, paying for gas…) are included in a monthly payment thanks to the connectivity revolution in the auto sector.

On the product side, we’ve already disrupted the status quo by launching a “no strings attached” car. A Netflix-type subscription where you can return/exchange your car and change your mileage — all this in an easy way, with no fees. Every last obstacle in the experience has been removed! With this level of service, we’re answering the needs of the new generation, who is more interested in usage than ownership.

Will people be buying their car online anytime soon?

No, not yet. We all still need contact with a product that remains a unique type of purchase. But digital can simplify the process: online deals with financing offers, estimates for a trade-in…

So it’s not the end of dealerships just yet… But how do they connect to digital?

We can remove the barriers between the two. We measure showroom visits that come from mobile traffic. The information shared during the experience on seat.fr. makes it easier for the vendor to understand the client.

The experience both online and offline still needs to improve thanks to considerable personalization. The key to personalization will be customer ID and data.

Can you describe your data strategy?

It helps us save on acquisition and focus instead on conversions. How? By personalizing messages depending on profiles and segments, by way of optimizing touchpoints to increase conversions. Ads we will go even further with the SEAT ID and the smart car. Today, data is used for marketing, tomorrow it will be used for business and service.

Hero image credit: SergeyBitos, Adobe Stock

The Rise of Automotive UXA guest post by Lillian Xiao, a user experience designer for a large European automaker.

Automakers are designing the next generation of cars with user experience (UX) at the forefront. The merging of physical and digital—driven by electrification, connectivity, self-driving technology, and fluid ownership models—will give rise to unprecedented user experiences. The most successful automakers will bring technologies and services together in ways that are usable and delightful for the end customer.

In the future, cars will resemble our smartphones more than they’ll resemble the cars that we know today—machines composed of gears, fluids, and thousands of moving parts. Instead, cars will be connected devices on wheels, part of a large, complex network of people, devices, and infrastructure. Automakers are already bracing for this transition, where digital blends with the physical, and user experience will become increasingly important to help people navigate the world.

The physical world around us will become more digital and connected in what experts are calling the 4th industrial revolution, or industry 4.0. Cars are just one example of how this transformation is taking place. We can measure this by looking at how many lines of code cars have today. Two decades ago, cars had on average 1 million lines of code. Today, cars have 100 million lines of code. Experts predict that before long, cars will have at least 200 million lines of code.

For automakers, the increasingly digital framework poses new challenges. A major challenge for established automakers is bridging two vastly different production cycles from the automotive and software domains. Today, a car can take anywhere from 2 to 5 years to go from concept to production. However, software development cycles are fast and iterative, constantly introducing new features and replacing old features that no longer meet user needs.

The discrepancy is most obvious in today’s in-car infotainment systems. User interfaces come in and out of fashion quickly, which means that digital infotainment systems can become outdated by the time cars are introduced to market. The result is that infotainment systems are routinely ranked as the least satisfying feature for car owners. Among other things, this discrepancy reflects the challenges that large automotive companies—also known as original equipment manufacturers (OEMs)—face in transitioning to a new era of mobility.

For the automotive industry, new technology paves the way for new models of mobility. While software competence is the necessary first step, mobility will eventually be about usability, trust, and delight. UX may become the differentiating factor for cars in the future.

User experience has its origins in the software industry. At its core, UX is about designing solutions that meet human needs, often through the medium of technology. Oftentimes, technological solutions are introduced to a market, only for its creators to discover that there’s a mismatch in the market, product, or simply wrong timing.

In this way, UX provides a user-centered approach, as well as a set of practices, for automakers to test new concepts and solutions across a blend of new digital, physical, and service offerings.

How can automakers take a user-centered approach to fuel innovation in the auto industry? Below, I explore four areas of near-term growth—based largely on public discussion around these topics—and look briefly at how UX can help automakers identify opportunities for innovation.

As battery components become cheaper, electric vehicles (EVs) will become more affordable. Bloomberg predicts that in 2025, worldwide EV sales will reach 11 million, and in 2030, EV sales will reach 30 million.

The experience of driving an EV is—or perhaps should be—considerably different than driving a car with an internal combustible engine (ICE). Unlike gas-powered cars, many EVs have single-pedal driving (without the need to switch gears), faster acceleration, and simpler car maintenance (without the upkeep of a complex system of gears and moving parts).

In reality, technology never advances in isolation, which means that entire ecosystems will emerge around EVs. Vehicle charging infrastructure is just one example of this. It takes much longer to charge an EV than to fuel a gas-powered car, which creates opportunities to help drivers make use of this idle time. UX can help us understand things like where drivers prefer to charge their cars, and what drivers want to do while their cars are charging. Today, I see Tesla owners waiting in their cars at the edge of shopping mall parking lots. As EVs gain wider adopting, the experience of charging will undoubtedly improve from what it is today.

A recent consumer report revealed that drivers want their cars to provide the same communication and entertainment capabilities as their phones. Automakers are responding by introducing concepts for large touchscreens, voice recognition, gesture recognition, and heads-up displays to assist drivers in accessing content while driving.

Infotainment systems—the host of in-car features that include music, navigation, and phone integration—has a long history dating back to the first in-car radio in the 1930s. From there, navigation systems were introduced in the 1980s, and the first hard drives and Bluetooth systems were introduced in the 2000s. Recent focus has been on 5G, which many anticipate will provide high-speed mobile connectivity for networked devices in the future.

Byton Interior; Source: Sean O’Kane, The Verge

Self-driving technology is already embedded in today’s cars in the form of advanced driver assistance systems (ADAS). Features like adaptive cruise control (on freeways) and automatic parking can help drivers become more accustomed to the idea of semi-autonomous and autonomous vehicles.

Automakers can take these opportunities to educate consumers about the capabilities of autonomous technology, and to design experiences that prioritize trust and safety. A recent AAA study revealed that at least 2 out of 3 drivers using ADAS features report trusting the technology in their cars. Positive experiences can play an important cultural role in helping consumers become more comfortable with self-driving technology.

Tesla Autopilot; Source: Electrek

Car ownership has taken on many forms in recent years. Vehicle owners can make a living, or earn extra cash, by using their cars to drive people and goods around. Peer-to-peer platforms like Turo and Getaround allow car owners to rent out their vehicles, and ZipCar allows members to rent from its fleets of cars in half-hour increments. These shared mobility options help car owners and consumers determine the mobility models that work best for them in their own lives.

UX can play a central role in helping automakers understand the user journeys related to different models of shared mobility. For example, understanding a rider’s journey, from booking a ride to leaving the car, can fuel innovation at different steps along the way. With shared mobility, there’s a clear need for innovative experiences that cater to a growing demographic of people who are less interested in owning and driving a car.

If we assume that technology continues to progress in these four areas—as many automakers and experts believe today—then before we know it, the world may begin to look very different.

RethinkX, an independent think tank, predicts that by 2030, “95% of U.S. passenger miles traveled will be served by on-demand autonomous electric vehicles owned by fleets, not individuals, in a new business model called ‘transport-as-a-service’ (TaaS).”

This seems to reflect what many in the automotive industry are bracing for—conversion to an electric autonomous future. In this future scenario, it may be more practical to be driven than to drive yourself.

RethinkX analysis based on U.S. Department of Transportation data; Source: RethinkX

If these assumptions play out, then UX will play a key role in helping companies provide enjoyable, meaningful, and personalized experiences that merge the digital and physical.

Design Council, an independent charity and advisor to the UK government on design, predicts:

“There will be far more use-appropriate products as we go into the future. You will have less of the kind of car that does everything for everyone, and you’ll have more specific-use vehicles out there. Your day-to-day commute may be answered by the hire car in the city, which isn’t yours; it’s cleaned regularly, it’s there when you need it and it’s just functional. Which means that the car I choose to buy is the car that suits my other needs, whether that’s for family, recreation or holidays.”

The further we look into the future, the more difficult it is to predict user needs. However, it’s clear that UX will become increasingly important for the auto industry moving forward.

If you want to learn more about building future-proof digital experiences for the auto sector, click here.

To drive a higher conversion rate automotive industry needs to focus on digital experiencesEfrat David, former CMO at Contentsquare, explains why focusing on improving digital experiences is critical to driving a higher conversion rate in the automotive industry.

A business school professor of mine once referenced “buying a car from a dealership” as one of Americans’ top ten fears. And while the nation’s anxieties have evolved since my MBA years, shopping for a vehicle remains a significant pain for many consumers today.1

The automotive industry has long had an unfortunate reputation in the collective unconscious, what with:

And even if you’re not swayed by pop culture stereotypes of car dealers, the amount of confusing information that gets thrown at you when shopping for a vehicle is overwhelming at the best of times.

Like many parents, I spend a significant amount of time driving my kids from one after-school activity to another. But while I may be a veteran carpooler, a Formula 1 driver I am not.

The Digital Playbook for Automotive Brands Download now to discover the biggest digital challenges facing automotive brands and how to overcome them.

I’m not particularly interested in acceleration stats, high-fangled engine specs or rustproofing. Nor do I want to spend forever negotiating on special features I don’t need or get into lengthy discussions about warranties.

When it comes to picking out a car, my checklist is fairly simple: I’m looking for good mileage, reliable safety ratings and comfort on the road.

My main priorities: An easy buying experience and simple, fast delivery

So when it was finally time for me to get a new car, I decided to go online in order to bypass those long, confusing showroom conversations I’ve grown to dread. I made a short list of my top three car manufacturers and checked out each of their sites. My main priorities: an easy buying experience and simple, fast delivery.

In the end, my online experience was far from seamless, and I had to request assistance from a customer service representative. I did end up buying a vehicle online, but the process was complex enough that it did make me wonder, “Do car manufacturers actually design their sites with the intention of selling online..?”

Or is it high time that the automotive industry embraced conversion rate optimization?

While buying a car online might seem daunting to a lot of people, more and more big purchases and transactions are shifting to the digital sphere. There is a tremendous opportunity for the automotive industry to build up its digital audience by investing in successful online experiences that remove the friction associated with showroom visits. But creating successful journeys online means more than transposing the dealership sales model to digital platforms.

Creating successful journeys online means more than transposing the dealership model to digital platforms.

Disruptors like Airbnb and Amazon have understood that today’s consumers want seamless digital experiences that strike the right balance of giving you the facts upfront and at the same time not overloading you with information.

A brand like Tesla (I did not buy a Tesla) delivers on these points, keeping the process of buying a vehicle as simple and transparent as possible, with a manageable amount of choice for the consumer. Their car configurator is user-friendly, pre-selecting standard models and clearly labelling the value of each added feature for a quick and painless overview of upgrades.

Understanding what consumers are looking for in a digital experience is the first step towards creating journeys that speak to their expectations and are convenient from start to finish. This becomes particularly important when it comes to major transactions like acquiring a vehicle, which is slightly more involved than many of the “one-click purchases” we complete from day to day.

Developing these seamless journeys means knowing which steps and elements cause users to stall or hesitate, or become frustrated. Thanks to AI, analytics today can pinpoint where these obstacles lie so you can focus on fixing the User Experience (UX) elements that still make consumers reluctant to convert online when it comes to cars.

Automotive brands that harness digital experience analytics to understand site visitor behavior and optimize conversion rates will turn their digital platforms into the ideal showroom, keeping up with the digital appetite of today’s consumers and shift more and more of their vehicle sales to the online space.

Just take a look at French car dealership BYmyCAR, who used Contentsquare to optimize its customer journey, increase inbound leads and exceed its goal of doubling its conversion rate.

To find out more about how the automotive industry can drive better conversion rates through digital experiences and overcome the digital challenges facing the industry, read our automotive playbook.

The Digital Playbook for Automotive Brands Download now to discover the biggest digital challenges facing automotive brands and how to overcome them.

Digital Transformation for the Automotive Industry

In 2010, Ford announced that it would start selling its cars online. According to their research at the time, 4 in 10 buyers were ready to buy their next car on the internet.

Seven years later, most automotive manufacturers and dealers are still far from being ready to sell cars online, not to mention consumer expectations which are at an all time high. Yet despite massive investments in digital technology by all the players, there is still little to no understanding of exactly what customers are looking for online.

In our new study dedicated to car manufacturer’s e-commerce, we set out to solve the automotive industry’s online challenges by driving transformation in user experience. A great digital experience will convert more visitors online and help sales managers build lasting relations with customers, both online and offline.

OVER THE LAST SIX MONTHS, INTERNET TRAFFIC FOR NEW CAR TECHNOLOGIES HAS SHOT UP BY 127%!

Today, most customers start their car-buying journey online by researching new car technologies. In fact, over the last six months, internet traffic for new car technologies has shot up by 127%. Yet despite this increase in traffic, only 1% of visitors will actually fill in a form or leave contact details. So why are 99% of online visitors not satisfied enough to leave their details? Classic analytics don’t give you any information on why visitors do what they do. You need the behavioral data, or visitor’s interactions, in order to start making decisions that will move your customer down the sales path.

By uncovering the customer’s journey online, you can begin to understand what they are doing, and how you can help move them down the sales cycle, and bring them closer to your online objectives. These interactions will let you know how the buyer feels on your website, or what the actual user experience is. Hesitation metrics can signal frustration, and waiting a long time before the first click can mean confusion.

OUR STUDY SHOWS THAT 65% OF TRAFFIC IS STILL FROM DESKTOPS.

Our study shows that 65% of traffic is still from desktops. You can imagine a visitor comfortably seated at the computer and wanting to have a look at some new car models. What would make navigation easy for them? Since most visitors know exactly what they are looking for, try playing with the navigation to focus on showcasing vehicles and their features, making it easy for them to progress from the home page to product pages, until they reach the contact form.

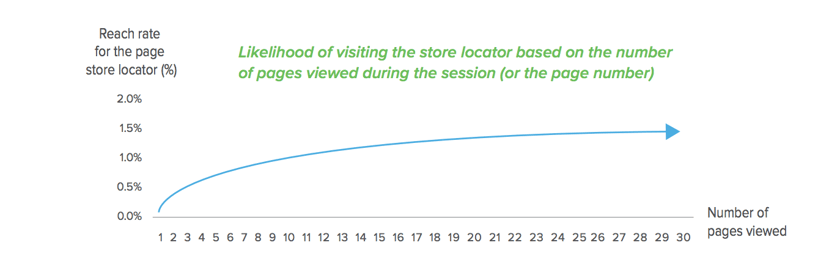

A picture, of course, is worth a thousand words. Here too, you can use the power of images to create a good user experience and increase the likelihood of submitting a form by a sizable 134%. On the other hand, be wary of too much scrolling. Your visitors are looking for very specific information, and they will not scroll through the entire page to track it down. If your bounce rates are high, look at the scroll rate and adjust the location of information on the page. If they do find what they are looking for, that is good news for the site. Our study showed that after the 30th page read, the likelihood of visiting the store locator increases by 35%.

While new car sales still happen mainly in the showroom, there is a clear indication that most people are starting their buying journeys online with research and information gathering. The experience you give your customer on the first page visit will set the stage for the entire customer relationship. Make sure it is a positive one by optimizing your website with a great user experience.