Impact of Coronavirus on eCommerce: Telco & Consumer Electronics Sectors Experience Strong Digital Growth

As we turn to digital to complete all the tasks that once upon a time required venturing out into the world, going into the office, or heading to the stores, digital has become a cornerstone of the new quarantine lifestyle and economy.

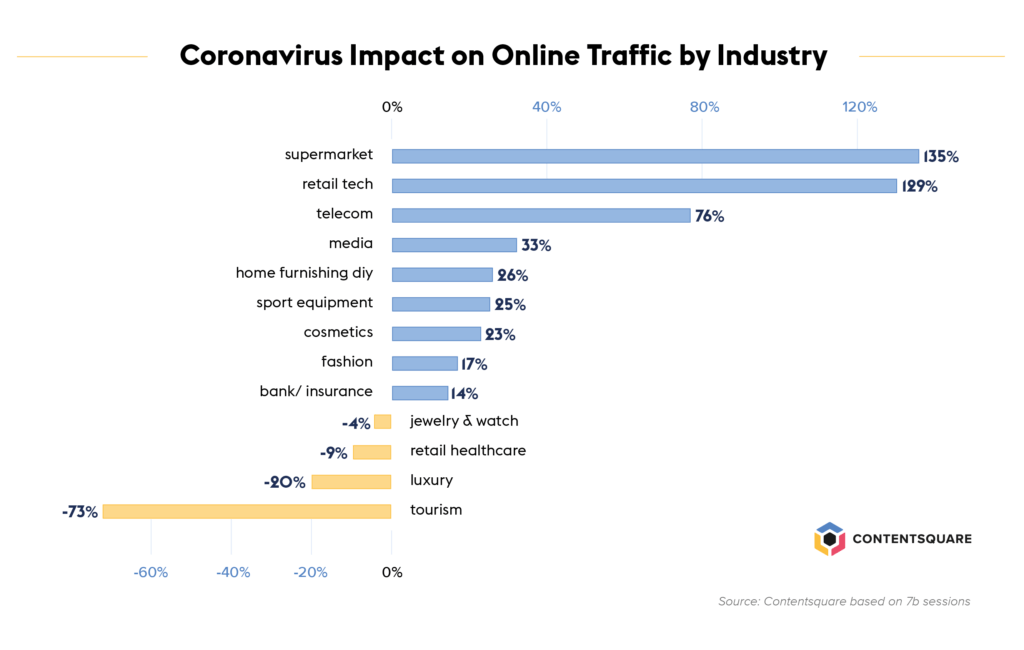

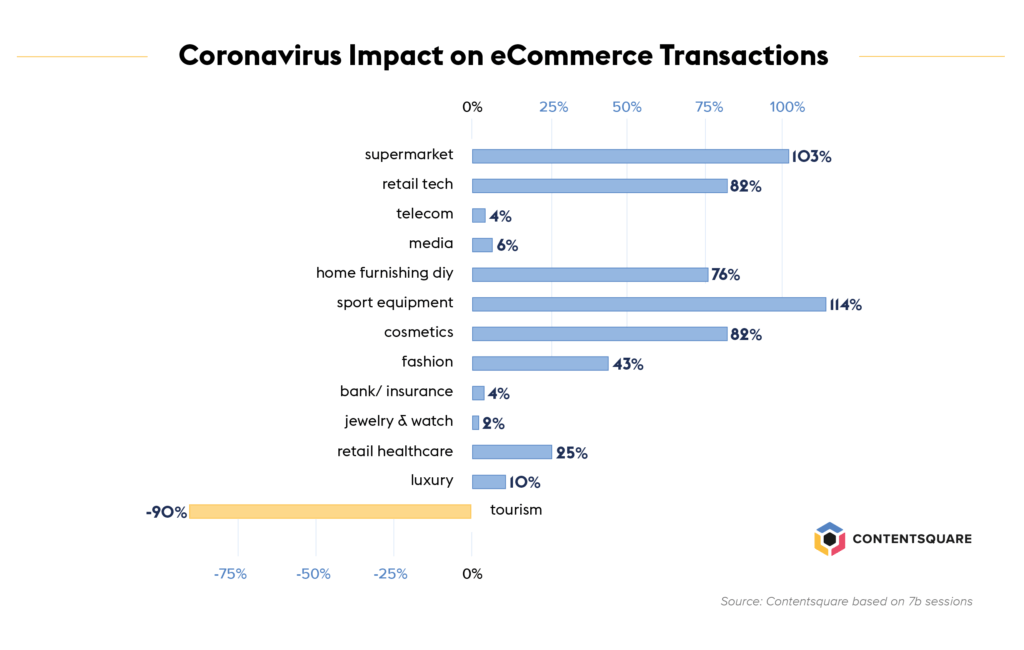

We’ve captured and analyzed 7.3 billion actual digital user sessions since the first stay-at-home orders in the West to understand how Covid-19 is impacting various industries and reshaping digital customer behaviors. To do this, we tracked visits across 37 billion site pages, on more than 900 websites in 26 countries.

To understand the impact of the crisis on several key KPIs (traffic, transactions, pageviews, and more), we’ve compared data from the past week to the period immediately preceding the global reporting of the outbreak (or, the first 6 weeks of the year, which we call the reference period).

Here are some of this week’s findings:

Telco Sector Tops Traffic Increase Table This Week

Telecommunications companies are at the heart of the shift to remote, and this past week saw a massive +32% increase in traffic from the previous week. This latest week of growth means the sector is today seeing +76% more visits than it was pre-pandemic.

The latest data shows that traffic to sites selling general telco products such as contracts and phone devices are up +40% above normal traffic. However, transactions have not budged much since March. Hardware vendors and other specialists (second hand, devices and phone cases) have seen less traffic than before the start of quarantine in the West, but a doubling of the volume of transactions.

Consumer Electronics Brands Record Biggest Traffic And Purchase Increases In The US

Consumer electronics sites have recorded strong, steady growth since the start of the crisis. Traffic today is more than double the pre-crisis level, and visitors are consuming twice as many pages. Just this week, the sector recorded a +15% increase in the volume of traffic, contributing to a hefty +128% surge in visits since the onset of the outbreak.

These companies are doing well globally, with the DACH region leading both in traffic (x2.4 the pre-outbreak average) and transactions (x3.5). Transactions almost doubled in France, and increased by x1.5 in the US and x1.3 in the UK. In fact, the volume of purchases globally has almost doubled in the past month, although it appears to have peaked and stabilized last week.

Traffic has grown faster than transactions, though, and despite a spike in late March, the conversion rate has dropped to 15-20% below the pre-Coronavirus average, suggesting many consumers are window-shopping only.

If we look at the breakdown of product categories, we see that video games and consoles are the most popular items in the US, UK and France, with refrigerators in second place in the US and UK. And while UK and US consumers may be looking for additional room to stockpile all those extra groceries, consumers in France put tablets in 2nd place, and audio equipment in 3rd. Tablets are the 3rd most popular product category browsed by consumers in the US, while UK shoppers prefer to look at laptops.

Another thing we noticed when analyzing traffic patterns is that businesses with brick-and-mortar stores are getting more traffic surge than pure-play brands — although the gap in transactions is not as wide. It shows that many consumers who used to shop in store are now browsing these big box websites but perhaps not converting as much as they would offline.

Conversely, pure players have not experienced such traffic growth but conversion rates have increased more, showing these brands are winning market shares from closed stores. Players selling new products exclusively are enjoying a higher surge in traffic than second-hand specialists, but are only doing slightly better when it comes to transactions.

Online Grocery And Healthcare Sectors Are Seeing A Surge In Transactions

This past week saw significant increases in the volume of purchases on grocery and healthcare sites — up +19% and +22% respectively. With traffic slightly down for both sectors this week, it could be that retailers have ironed out supply chain issues, leading to improvement in conversion rates.

Online grocery has topped the industry chart from the very beginning of the crisis, recording a +135% increase in the global volume of visits and +103% more transactions. This surge is most noticeable in the UK, where traffic is up +199% and transactions have increased by +136%. In comparison, US consumers have clocked in +40% more visits and made +59% more purchases. And in Germany, transactions have only increased by +13% since stay-at-home orders were implemented in Europe.

Join us for our upcoming webinar on Getting Digital Right Today, on Wednesday April 29th, 12pm. We’ll be joined by CX-perts from Monetate, Botify and Medallia for an insights and advice-packed session on all things digital customer experience.

Keep Reading...