Impact of Coronavirus on eCommerce: Store Reopenings Slow Down Online Surge And Local Tourism Sees A Resurgence (Update 12)

Many consumers in the world are entering a second week of relaxed restrictions, with non-essential businesses tentatively opening their doors again to the public. Stores, restaurants, bars, hair salons and gyms are open for business in many US states and in Europe, albeit at reduced capacity, and consumers are starting to engage once again with physical shops and services.

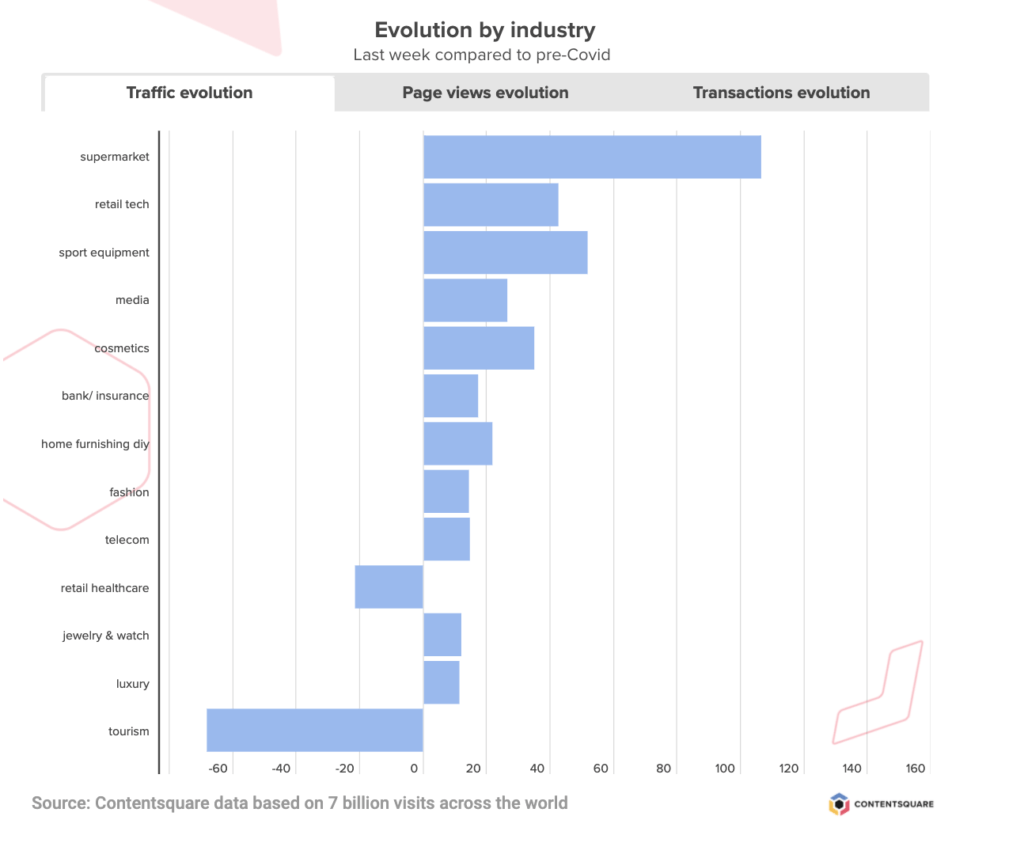

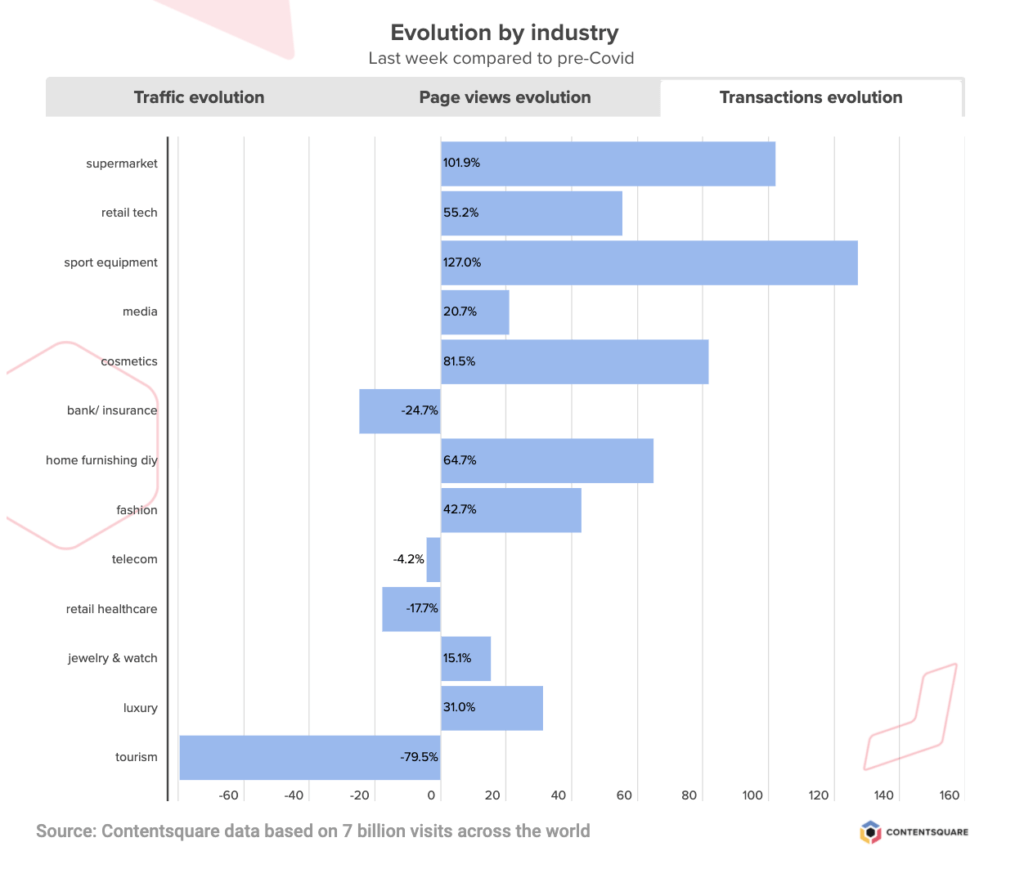

We’ve been analyzing digital consumer behavior for 13 weeks now to get a sense of how the unfolding crisis is reshaping the way people browse and connect with businesses digitally. To really gauge the impact of Coronavirus on eCommerce globally, we’ve been comparing key metrics every week (traffic, transactions, and engagement) with data from the period immediately preceding the introduction of quarantine measures in the West (or, the first 6 weeks of the year, which we call the reference period).

Here are some of the insights we surfaced this week:

Digital Traffic Flatlines But Visits And Transactions Still Up From Pre-Quarantine Levels

Traffic has been stable for two weeks, as businesses start to reopen in some regions of the world. Transactions globally were down for the second week in a row, dropping by -2.6% from the previous week. And yet despite this recent slowdown, digital traffic is still +30% higher than pre-quarantine levels, with transactions across industries increasing by +40% over the same period.

After a four-week slump starting mid-February and spikes in late March and mid-April, customer engagement (time/session) has been dropping fast since late April and is now -6% below ‘normal’ levels. Meanwhile, the conversion rate across industries is climbing steadily, and is +10% higher today than it was before stores closed their doors.

Camping Vacations Get Big Boost As Travel Sector Records Third Week of Double Digit Growth

This week’s biggest growth was recorded by the travel industry, which saw a +21% increase in the volume of visits this past week. Transactions were also up +40%, slightly accelerating four weeks of improvement for the industry. The volume of transactions remains 75% below pre-quarantine level, but there seems to be a clear trend toward recovery. Engagement has also been climbing steadily since the first week of April, as restrictions ease and consumers’ thoughts turn once again to summer plans.

Our breakdown into sub-industries shows camping vacations are doing particularly well, boasting the highest volume of traffic of all travel sectors (including air and train travel, hotels, package vacations etc). In fact, camping vacation sites are now seeing just over half the traffic they enjoyed pre-quarantine (54%), up from 31% the previous week. Today these sites are seeing 57% of the number of transactions they were recording before the introduction of lockdown measures — a huge surge from the 17% observed in the previous week. With a lot of remaining uncertainty over risk and restrictions, consumers appear much less willing to commit to air travel and are favoring domestic destinations.

With many hotels closed and social distancing still in place all over the world, camping stands out as the most convenient as well as safe solution, offering more possibilities for isolation than many other types of trip.

Unsurprisingly, car rental and train travel sites are also doing much better than air travel and cruise sites in terms of actual sales, although the increase of traffic to air travel sites, which now stands at 50% the pre-quarantine level, (versus 41% the previous week) suggests consumers are dreaming of escape.

Traffic Down In Grocery Sector But Up For Sports Retailers

Global traffic to grocery sites was down -18% from the previous week, although a closer look at specific geos tells two different stories. In the UK and the US, visits were slightly up, while France saw a significant slump in traffic, going from +244% of regular traffic volume back down to +162%. The relaxing of lockdown measures over the past ten days means French residents no longer need a special permit to leave the house and car journeys up to 60 miles are now allowed, making a dent in consumers’ reliance on digital services to get their grocery shopping done.

This staggered return to activities outside the home perhaps explains the higher number of consumers browsing sports gear. Transactions on sporting goods sites didn’t budge much from the previous week (+1%) although traffic was up +7%, as warmer days and fewer rules on venturing out come into play.

We’re investing to accelerate the world’s digital transformation — read about our recent news to find out how we plan to do that.

Keep Reading...