Coronavirus and the Travel Sector: Industry Experiences First Growth In Weeks

It’s no surprise then that the industry bearing the brunt of the coronavirus outbreak is the travel and tourism sector. After coping with a wave of cancelations that initially kept traffic steady, the sector began to suffer as governments announced travel restrictions and even border closures. The cruise industry took its own hit as ships became the sites of Covid-19 outbreaks, with passengers stranded at sea and lacking information.

But while the travel industry is predicted to suffer an -81% drop in revenue in the months to come, there was a glimmer of hope for hotel, airline and train sites this week, as renewed interest in travel drove the first traffic increase in weeks.

First Signs Of Growth In Weeks As Consumers Look To Summer And Beyond

After two months of plunging traffic and transactions, our research (based on billions of actual visits) shows that for the first time in weeks, global travel sites are seeing an increase in the volume of traffic, and reassuringly, a significant boost in transactions from the previous week. Visits to the sites included in our broad worldwide sample grew by +8% over the past week, while conversions grew by +24%.

And while these positive numbers may not make much immediate difference to an industry that has seen visits decline by -70% since the onset of the outbreak, and transactions, drop by -90%, the shift in behaviors suggests many people are feeling optimistic about the possibility of travel in the not-so-distant future.

Consumers in the US lead the pack when it comes to transactions, with a +40% week-on-week increase in transactions this past week. Germany comes in second, with a +35% increase, followed by France and the UK (both +27%). In fact, of all the countries we analyzed, the US has experienced the least decline in traffic and transactions since the beginning of the outbreak.

Digital Travel Industry: Customer Behavior Breakdown

The last eight weeks have not only shown dropping traffic and sales, but also dwindling customer engagement, as consumers focused on procuring essentials — scrambling for grocery delivery slots and equipping themselves to work from home effectively.

Pageviews are down -75% since the onset of the oubreak in the West, although last week did see a hopeful +16% increase in the number of pages browsed by visitors.

Region by region, US sites seem to be weathering the storm a little better than their counterparts in Europe, with the volume of traffic only halved since the start of quarantine. In comparison, France has lost -78% of its pre-Coronavirus traffic.

And even though transactions are down by -82%, the US is still faring slightly better than the UK, where travel site conversions have dipped -93%.

Paradoxically, the early wave of cancellations or checking on the status of trips means traffic was up for hotel and air travel sites at the start of quarantine. For these reasons, airline and cruise sites experienced a lower drop in traffic (-51%) than hotel and experience gift box sites (-76%) or train travel (-83%).

In terms of sales, experience gift box sites and holiday parks fared better than other sectors, with a -71% decrease in the volume of transactions compared to a -95% decrease for train/camping and trip planner sites. It could be that, while would-be travelers are weary of booking holidays, they might still be gifting experiences, or stays, which can be booked at any time.

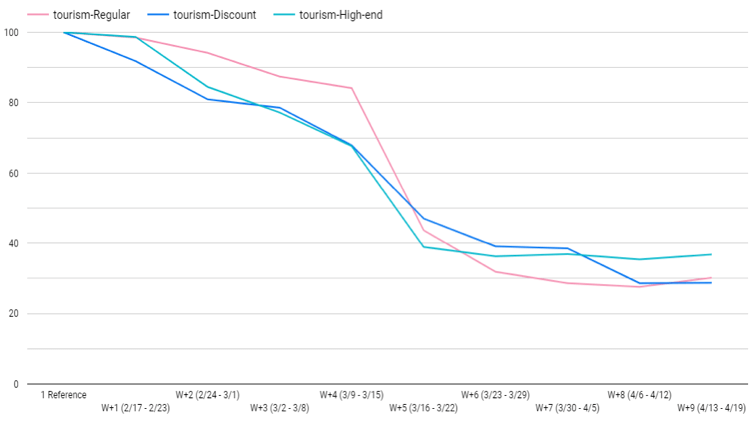

Evolution of traffic by price point

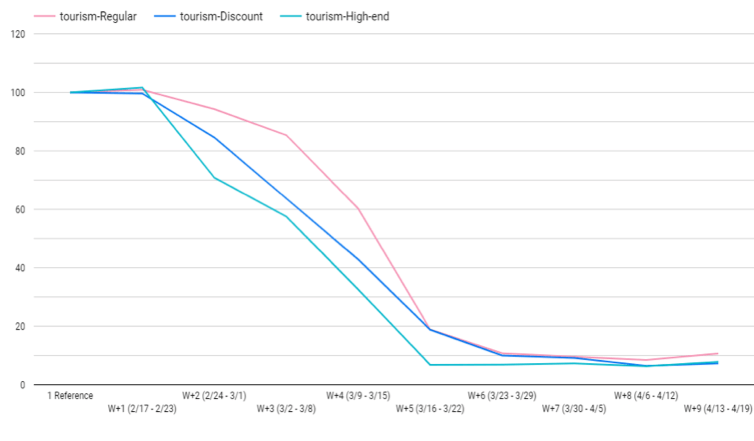

Evolution of transactions by price point

High-end tourism players saw a slightly lower drop in traffic than those offering lower price point travel (-63% compared to -70%). But High-end travel transactions went down much faster in early March, before other price point travel caught up fast to reach currently all similar low levels.

Pure consumer focus players struggled much more at beginning of the crisis but have since stabilized at -64% on traffic and -82% on transactions. Meanwhile, sites with both business and consumer focus dropped less fast but fell significantly behind.

How The Travel Industry Reinvented Itself Overnight

Travel brands have been leading efforts when it comes to innovating themselves out of a crisis, with many players re-aligning their offering with their customers’ immediate needs. Luxury resort brands Leading Hotels Of The World has launched a Coloring The World project, and shared a coloring book with its customers, inviting them to get creative with destinations they can’t visit in person right now.

True to its DNA, Club Med is offering a full program of activities on its site and through its newsletter, bringing its family fun ethos into people’s homes during the quarantine.

Sykes Cottages in the UK is going the opposite way of the last-minute vacation and offering trips two years in advance. The Landmark Trust — a British website advertising heritage properties for stays — has also refocused its messaging on future travel.

And French railway company SNCF has changed its regular schedule to accommodate the needs of essential workers and is offering free travel to all hospital personnel.

We’re publishing fresh data on how the Coronavirus is impacting eCommerce every week on our eCommerce data hub.

Also, join us for our upcoming webinar on Getting Digital Right Today, on Wednesday April 29th, 12pm. We’ll be joined by CX-perts from Monetate, Botify and Medallia for an insights and advice-packed session on all things digital customer experience.

Keep Reading...